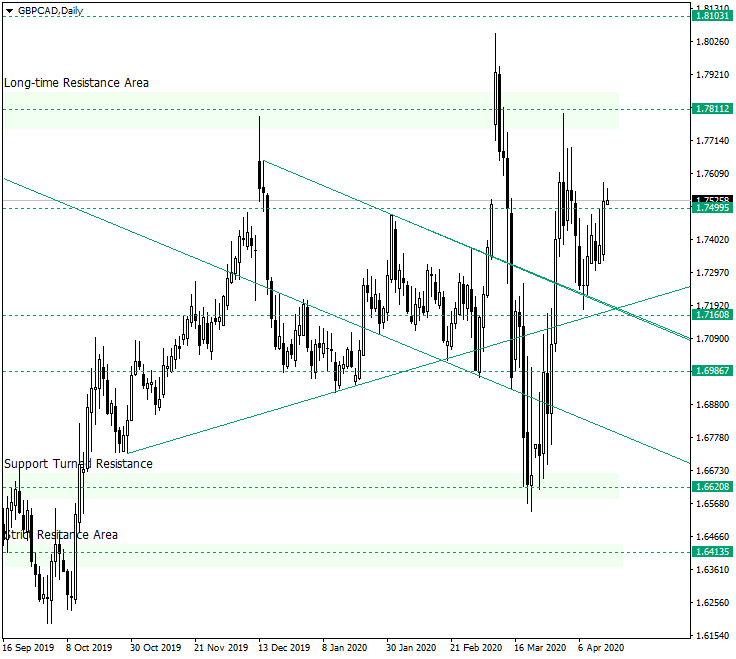

The Great Britain pound versus the Canadian dollar currency pair does seem that it is hard to sell. Long-term perspective The appreciation from the 1.6620 level extended to the resistance area defined by the 1.7811 resistance level. The price then head towards the, now, triple support area made possible by the 1.7160 level, the ascending trendline, and the upper line of the descending channel, respectively. After the confirmation, the price had some trouble passing … “GBP/CAD Continues Aiming for 1.7811”

Month: April 2020

Euro Rallies as Some EU Countries Reopen Businesses and Schools

The euro today rallied higher against the US dollar as some European countries announced new measures to ease some of the restrictions put in place to fight the coronavirus. The EUR/USD currency pair reversed yesterday’s downtrend and rallied higher today driven by investor optimism about a return to normalcy across the eurozone. The currency pair rallied from a low of 1.0915 in the early European session to a high of 1.0983 in the American session but was off these highs … “Euro Rallies as Some EU Countries Reopen Businesses and Schools”

Chinese Yuan Flat As Imports, Exports Beat Bearish Estimates

The Chinese yuan is flat on Tuesday after new trade data came in better than what the experts had projected. A couple of economic reports from China are highlighting that the situation is not as grim as what many investors first thought. Is the economic fallout from the coronavirus pandemic proving to be a case of hope for the best and expect the worst? Last month, imports fell 0.9% year-on-year to $165.25 billion, led … “Chinese Yuan Flat As Imports, Exports Beat Bearish Estimates”

Australian Business Confidence at Record Low, Aussie Struggles to Keep Gains

The Australian dollar was rising at the start of Tuesday’s session but has reversed movement and is now trading below the opening level against most major currencies, though currently, it has managed to rise against the US dollar a bit. The Aussie performed better against its commodity-linked counterparts. According to the Business Confidence Survey released by National Australia Bank today, the confidence index dropped to the lowest level on record. The report said: … “Australian Business Confidence at Record Low, Aussie Struggles to Keep Gains”

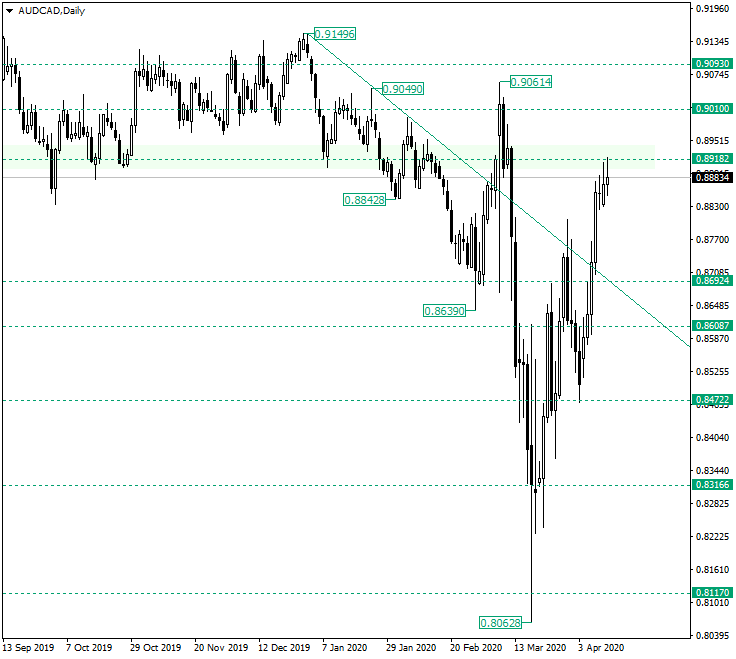

Bulls Tired at 0.8918 on AUD/CAD?

The Australian dollar versus the Canadian dollar currency pair seems to have some trouble passing the 0.8918 level. Are the bears planning something? Long-term perspective The appreciation that started at the low of 0.8062 managed to find its way to the old support area defined by 0.8918. The rally from 0.8472 succeed in passing the double resistance made possible by the level of 0.8692 and the trendline that starts from the high of 0.9149, but as it approached the old … “Bulls Tired at 0.8918 on AUD/CAD?”

Australian Dollar Forecast for April 13-17, 2020

The Australian dollar was demonstrating an impressive performance so far in April. But can the currency maintain its upward momentum this week? Market analysts have doubts about that. The Aussie looked surprisingly resilient considering that the coronavirus pandemic rages on, making safe options more appealing to investors than riskier ones. But the currency of Australia managed to log sharp gains last week despite that. Experts … “Australian Dollar Forecast for April 13-17, 2020”

Chinese Yuan Weakens As Bank Loans Top $1 Trillion in Q1

The Chinese yuan is weakening against its major currency competitors to kick off the trading week. The yuan is trending downward on foreign exchange markets on new data that shows the central bank pumped $1.01 trillion into the worldâs second-largest economy in the first quarter. The Peopleâs Bank of China (PBoC) also generated headlines for raising its stake in the nationâs largest mortgage lender. Is the stimulus peanuts, or will Beijing place … “Chinese Yuan Weakens As Bank Loans Top $1 Trillion in Q1”

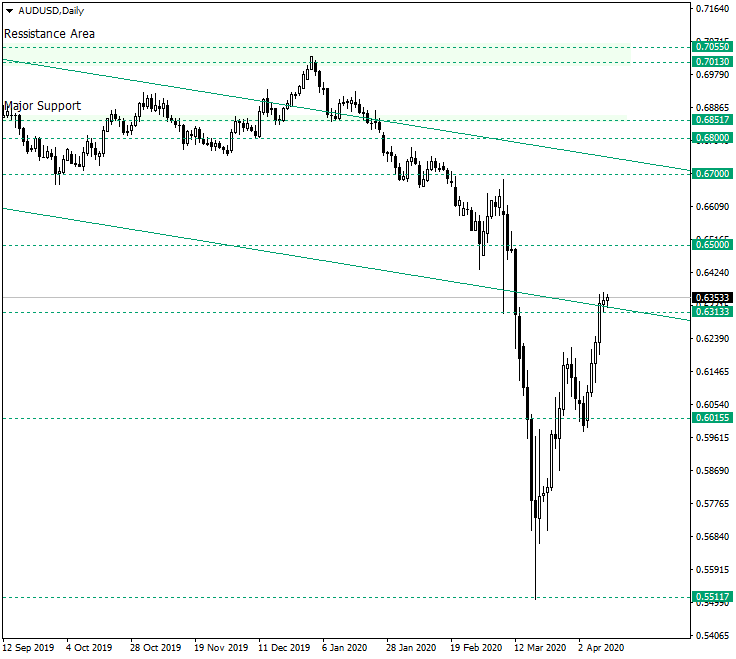

AUD/USD Back Above 0.6313

The Australian dollar versus the US dollar currency pair succeeded in getting back above the important level of 0.6313. Could the bears be just around the corner? Long-term perspective After the retracement form the 0.5911 level, the price went past the 0.6015 level, extending two thirds between 0.6015 and 0.6313. After that, a correction came into being, one that found support at 0.6015. This confirmation led to an appreciation that managed, … “AUD/USD Back Above 0.6313”

Pound Inches Higher on Good Friday as Markets Remain Closed

The pound today inched higher against the US dollar as most global equity markets remained closed due to the Good Friday holiday celebrations. The GBP/USD currency pair posted gains as investors celebrated the fact that Boris Johnson, the UK Prime Minister, was out of the intensive care unit. The GBP/USD currency pair today rallied from … “Pound Inches Higher on Good Friday as Markets Remain Closed”

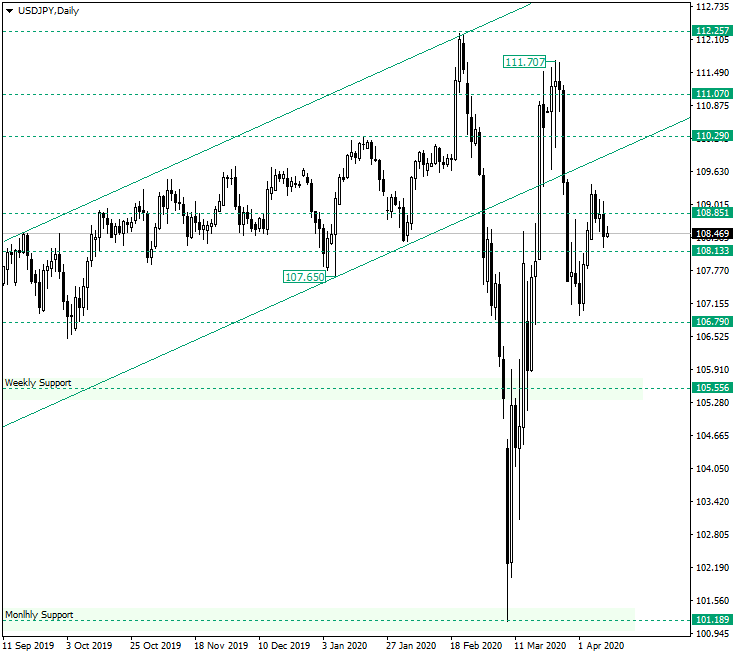

Bears Taking Control from 108.85

The US dollar versus the Japanese yen currency pair may have failed to win the bulls, after all? Long-term perspective The appreciation that started after the confirmation of the 101.18 monthly support reached the 111.70 high. After that, a sharp decline almost touched the 106.79 support level, and then rallied again. But the price was not able to sustain the gains above the 108.85 level. In this case, the bears are expected to keep … “Bears Taking Control from 108.85”