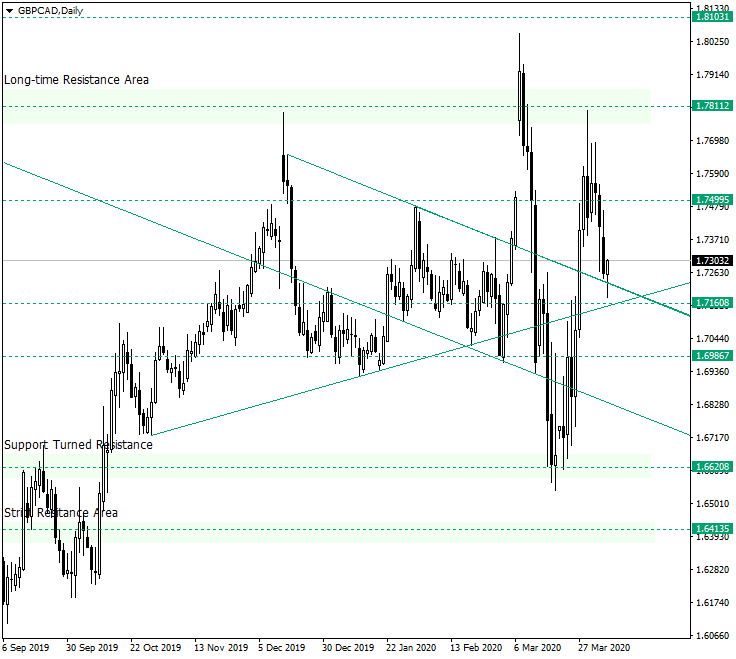

The Great Britain pound versus the Canadian dollar currency pair sits in an interesting zone. Is this area a good starting ground for the bulls, or is it already too late for them? Long-term perspective The appreciation that started at the 1.6620 level extended all the way to the long-time resistance area of 1.7811. But it retraced from there, slipping under the intermediary level of 1.7499. The price is now sitting just above the possible … “Bulls Still Aiming for 1.7811 on GBP/CAD?”

Month: April 2020

Japanese Yen Weakens As Abe Unveils $1 Trillion Stimulus Package

The Japanese yen is losing against multiple currency pairs to start the trading week, prompted by Tokyo unveiling a massive $1 trillion stimulus package to curb the economic fallout from COVID-19. While Japan has refused to institute a nationwide lockdown, Prime Minister Japanese yen declared a state of emergency to prevent coronavirus infections â domestic cases have topped 4,000. Can the worldâs third-largest economy come out of the public health … “Japanese Yen Weakens As Abe Unveils $1 Trillion Stimulus Package”

Chinese Yuan Flat As PBoC Pumps $56 Billion Liquidity for SMEs

The Chinese yuan is trading relatively flat to kick off the holiday-shortened trading week. China continued to employ monetary policy measures to resuscitate the worldâs second-largest economy in the coronavirus fallout. One mechanism Beijing is utilizing to spur business activity is bank lending, offering credit to businesses â large and small. Will it be enough … “Chinese Yuan Flat As PBoC Pumps $56 Billion Liquidity for SMEs”

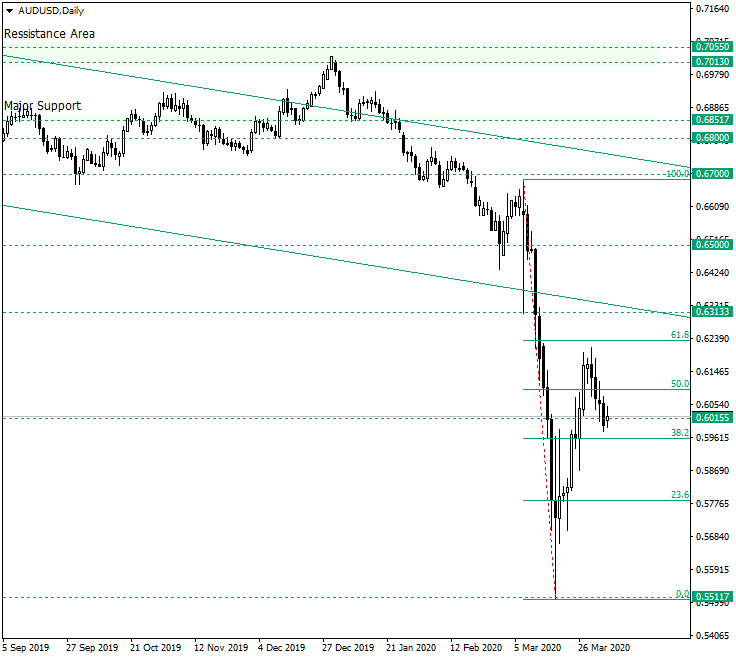

Wedge Chart Pattern on AUD/USD Played Out?

The Australian dollar versus the United States dollar currency pair seems to have failed in any further appreciation attempts. Is this the entire story? Long-term perspective After confirming the resistance area defined by the 0.7055 and 0.7013 levels, the price began a depreciation that unleashed until the 0.5511 support level. From there, the price retraced above the 0.6015 level and extended two thirds away from the possible double resistance area made … “Wedge Chart Pattern on AUD/USD Played Out?”

Australian Dollar Forecast for April 6-10, 2020

The Australian dollar has experienced strong volatile moves lately. The currency tanked in the first half of March, recovered a bit in the second half only to move down again in April. While it is hard to predict price movements during such volatile time, let’s see what factors will be affecting the Aussie this week and how the currency can react to them. The week will start with somewhat less important … “Australian Dollar Forecast for April 6-10, 2020”

US Dollar Mixed As Coronavirus Slaughters 701k Jobs in March

The US dollar is mixed against several major currency competitors at the end of the trading week, driven by a grim portrait of the American labor market last month. Although it was a devastating jobs report, experts say that the worst is still to come as more states institute stay-at-home orders. Will the buck remain the top currency in todayâs chaotic financial market? According to the Bureau of Labor Statistics (BLS), the US economy lost … “US Dollar Mixed As Coronavirus Slaughters 701k Jobs in March”

Canadian Dollar Rallies on Higher Oil Prices and Weak US Jobs Data

The Canadian dollar today rallied against its US counterpart as oil prices pressed higher for the third consecutive session boosting the commodity-linked loonie. The USD/CAD currency pair fell from its intra-day highs as the loonie strengthened amid rumours that OPEC and its allies would agree to drastic oil supply cuts to boost oil prices. The USD/CAD currency pair today fell from a high … “Canadian Dollar Rallies on Higher Oil Prices and Weak US Jobs Data”

AUD/USD set for another plunge down under as coronavirus carnage spreads

AUD/USD has been dropping as coronavirus spreads and amid a worsening market mood. The RBA decision, disease updates, and US jobless claims are eyed in the week leading to Easter. Early April’s daily chart is showing that bears are in control. The FX Poll is pointing to long-term gains. The thrill is gone – AIUD/USD’s … “AUD/USD set for another plunge down under as coronavirus carnage spreads”

GBP/USD: Coronavirus, Death cross pattern, and other factors pointing down

GBP/USD has rocked and rolled as coronavirus continues spreading. Additional disease-related updates, consumer data, and the Fed minutes are eyed. Early April’s daily chart is showing the death cross pattern. The FX Poll is pointing to falls in the short and medium terms, with a recovery afterward. Pound/dollar volatility is at Brexit levels – not … “GBP/USD: Coronavirus, Death cross pattern, and other factors pointing down”

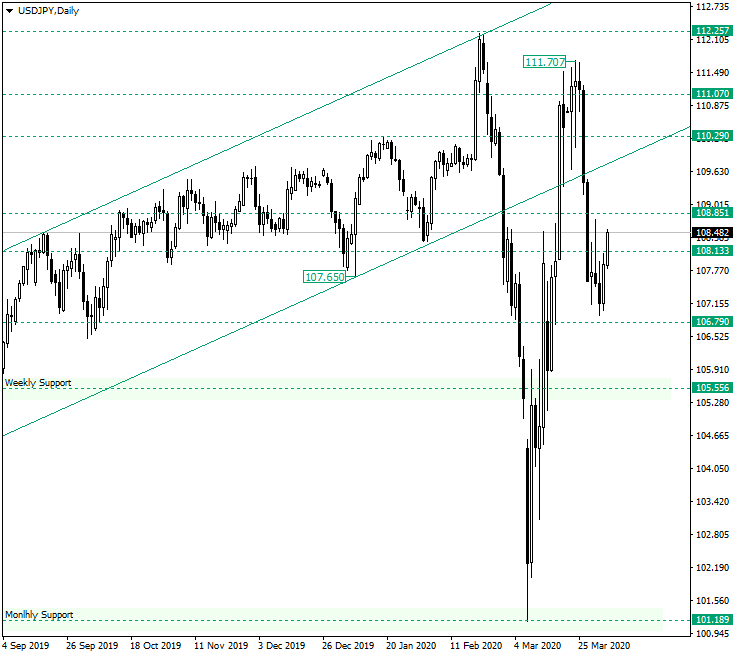

Bulls Back on USD/JPY from 107.06

The United States dollar versus the Japanese yen currency pair seems to be delaying further advancement towards the south. Is this really a delay or the bulls took control? Long-term perspective The depreciation that started from the high of 111.70 almost touched the technical support level of 106.79, stopping in the psychological 107.00. Although the fact that the price got under the area defined by the levels of 108.85 and 108.13, respectively, was welcomed by the bears, the bulls … “Bulls Back on USD/JPY from 107.06”