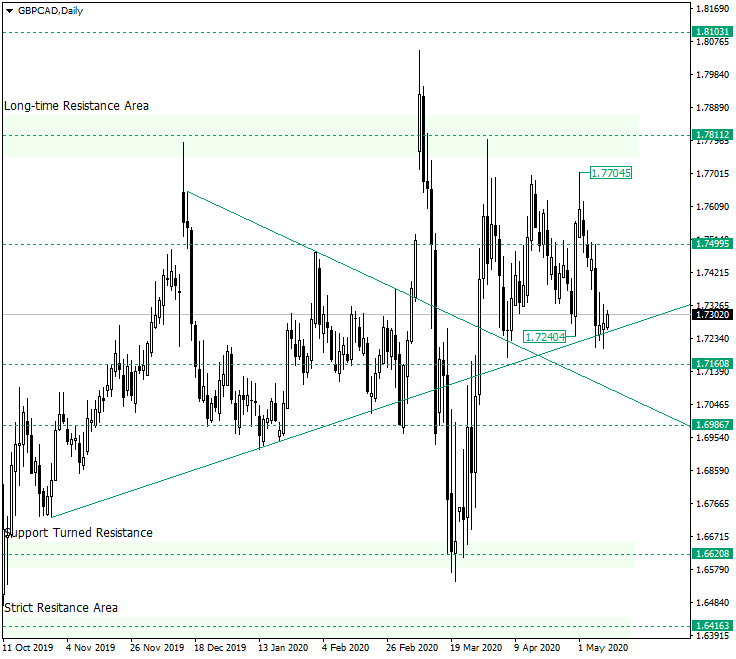

The Great Britain pound versus the Canadian dollar currency pair is back at the ascending trendline. Could the bears spell further movement to the downside?

Long-term perspective

After the appreciation that started from 1.6620, the bulls met the long-time resistance area of 0.7811. The price retraced drastically from this area, ingraining a high that would serve as a reference point for the next — at least for now — two confirmations, and that matches to the 0.7700 psychological level — not marked on that chart, corresponding to the peak of 0.7704, and that serves as resistance.

On the other side, the support of the last two months’ oscillations is represented by the confluence area of the 1.7160 level, and the descending and ascending, respectively, trendlines.

So, it may be considered that the rally from 1.6620 level gave way to a range limited by the two above mentioned boundaries, and since such unfoldings end up as a continuation of the initial movement, the bulls are entitled to believe that they are still in charge.

As a consequence, as long as the price develops above the triple support area, the market can record a new movement towards the north. Therefore, the first bullish target is defined by the 1.7499 level. The high of 1.7704 passes as their next purpose — from where they could extend and rechallenge the 1.7811 level.

The bears may join the market only if the triple support is invalidated. Hence, if 1.7160 turns resistance, then 1.6986 may very well serve as a bearish destination.

Short-term perspective

From the high of 1.7698, the market evolved in a descending channel that lasted until the confirmation of 1.7288 as support. As that happened, the bulls drove the price beyond the double resistance established by the upper line of the channel and the 1.7481 level.

However, the price peaked at 1.7704, which is very close to the previous high — at 1.7698. If the fact that the price rapidly retracted under the 1.7609 resistance level is taken into consideration, the conclusion would be that the bears were willing to make their presence felt. And they sure did, as the price dipped under the level of 1.7383 and back into the descending channel.

But their last attempt to push the price lower seems to have failed, as it is highlighted by the retracement that halted the slip which came after confirmation of the double resistance designated by the level of 1.7288 and the upper line of the descending channel, respectively.

So, if the price confirms 1.7383 as support, then the buyers could hope for 1.7481 and 1.7609 to be their profit booking areas. On the flip side, if the sellers manage to instill a second drip from 1.7288, then they can set 1.7130 as an objective.

Levels to keep an eye on:

D1: 1.7160 1.7499 1.7811 1.6986 and the peak of 1.7704

H4: 1.7383 1.7481 1.7609 1.7130

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.