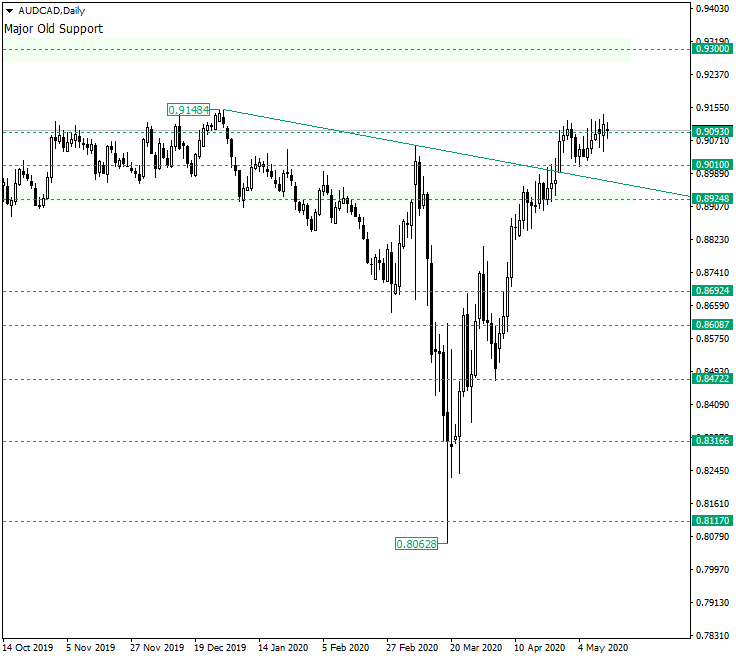

The Australian dollar versus the Canadian dollar currency pair seems to be willing to still think where to go next. But does the market offer some guides?

Long-term perspective

After stamping the low of 0.8062, the surge that took place from the 0.8117 level brought the price above the double resistance area created by the 0.8924 level and the trendline.

Once here, the bears tried to put pressure to send the price back, just as it did in November and December 2019, and in March 2020, respectively. Only this time, the effects of their intervention were limited by the 0.9010 level turning support.

Although this development shows that the bulls are more firm than in the previous instants, they should be mindful of the fact that the more they delay further advancement, the lesser the chances for the climb to be a sustainable one, or to happen at all. In other words, even if they have the advantage of the price not being, yet again, sharply turned around from this area, prolonging the current consolidation might be perceived as a lack of power from their side to push the price towards higher values. Of course, this could lead to the price tuning back beneath 0.8924.

So, if the bulls achieve in conquering 0.9093, then they could start a rally full on. In this case, their primary objective is the major old support of 0.9300.

On the other hand, if the price drops, then the bulls could use the 0.9010 level for a second run, even if, in this scenario, they would have already lost ground.

If the bears become optimistic at 0.9010, then they could bring the price back beneath 0.8924, which then paves the way to 0.8692.

Short-term perspective

The price is still in the ascending trend that started after the confirmation of 0.8872 as support.

As the bulls tried to bring the price above 0.9105, the bears repelled them. However, the bulls regrouped at the double support cast by the level of 0.9075 and the trendline.

As long as the trendline continues to be validated, the bulls are on schedule for their advancement towards 0.9153 and, later on, 0.9204. Of course, the confirmation of 0.9105 aids in their purpose.

But if the trendline gets pierced, then 0.9041 could be the first bearish target, followed by 0.8985.

Levels to keep an eye on:

D1: 0.9093 0.9300 0.9010 0.8924 0.8692

H4: 0.9105 0.9153 0.9204 0.9041 0.8985

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.