The Australian dollar versus the New Zealand dollar currency pair climbed above an important support level. Will it be able to take this chance to further appreciate?

Long-term perspective

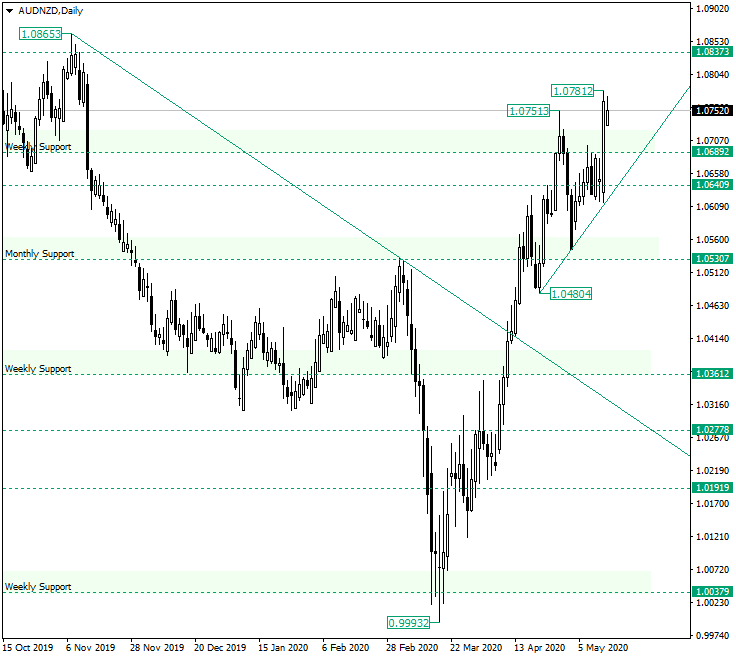

The surge that started from the weekly support of 1.0037 managed to cross the double resistance crafted by the descending trendline starting from the 1.0865 high and the old weekly support of 1.0361.

After that, the price searched further for a support level to continue its climb. The former monthly support of 1.0530 was found to be the perfect match for this purpose, as from there progress towards the north continued.

The first reaction when the significant 1.0698 level was reached was a bearish one, as they heavily defended it, sending the price a hair away from 1.0530. But the bulls countered these actions and sent the price just under 1.0689. From there, on 13 May, a strong bullish candle formed, one that departed enough from the level to take out the previous high at 1.0751.

This the mark of the bullish dominance, so the next movement is expected to be a bullish one. However, after such rally, a correction — or at least a consolidation is needed.

So, the first bullish scenario is the one in which the price throws back to confirm the double support defined by the ascending trendline starting from the 1.0480 low and the 1.0689 weekly support.

The second bullish scenario can take the shape of a consolidation that unfolds around the high of 1.0751. This can end up being a flag or a pennant.

So, as long as the ascending trendline remains valid, the bulls are in charge, targeting the 1.0837 level.

On the other hand, if the bulls lose their edge, then the bears could send the price slumping towards 1.0530.

Short-term perspective

The price is at mid-distance between 1.0709 and 1.0807, the former serving as a target that may happen after the latter was pierced in a very convincing manner.

If the price retraces towards 1.0709, then it may end up forming an angled rectangle or wedge (both pointing to the downside), which, because they are continuation patterns, could fuel the next leap to 1.0807.

On the other hand, if a range forms, one that continues the current consolidation, then the bulls may extend quicker to the 1.0807 level.

Only the price getting back beneath 1.0709 could send the price to 1.0635.

Levels to keep an eye on:

D1: 1.0689 1.0837 1.0530

H4: 1.0709 1.0807 1.0635

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.