AUD/USD has been extending its uptrend as Australia is winning against coronavirus. The RBA decision, US Non-Farm Payrolls, and the next steps regarding lockdowns are eyed. Early May’s daily chart is showing an uptrend channel. The FX Poll points to falls in the medium and long-terms. The Aussie has continued flying like a rugby ball – … “AUD/USD : Defeating coronavirus may be insuficient, RBA, NFP eyed”

Month: May 2020

GBP/USD: Ongoing UK lockdown, BOE, and NFP to determine next moves

GBP/USD has been rising amid dollar weakness and PM Johnson’s return. The next move in the UK lockdown, the BOE’s decision, and US Non-Farm Payrolls stand out. Early May’s daily chart is pointing to gains. The FX Poll is pointing to lower targets in all timeframes. Pound/dollar has moved higher in a week that saw … “GBP/USD: Ongoing UK lockdown, BOE, and NFP to determine next moves”

Euro Rallies Despite Gloomy News From Across the Euro Area

The euro today rallied higher against the US dollar despite the mostly negative news coming out of the eurozone earlier today amid empty economic dockets. The EUR/USD currency pair inched higher as European countries moved closer to reopening their economies despite the significant risk of a second wave of COVID-19 infections. The EUR/USD currency pair … “Euro Rallies Despite Gloomy News From Across the Euro Area”

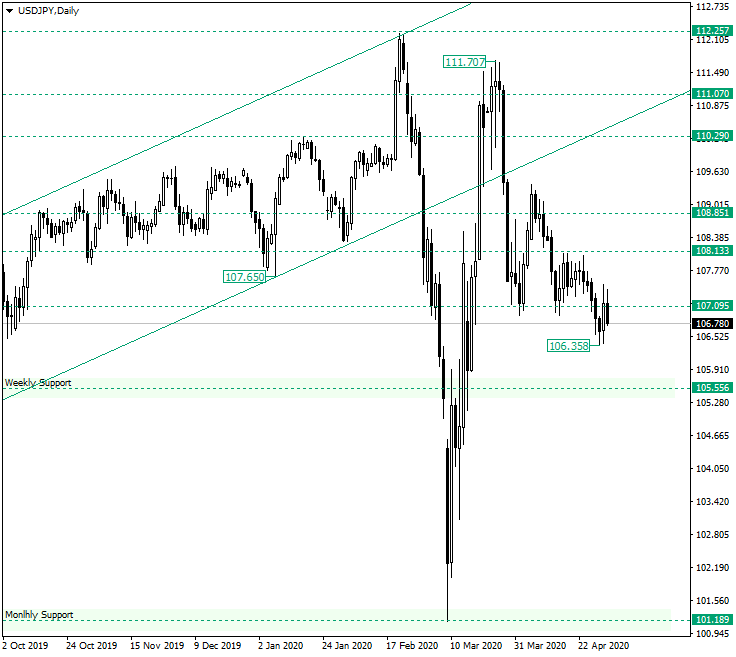

The Bears Try to Confirm 107.05 on USD/JPY

The US dollar versus the Japanese yen currency pair seems to be willing to continue the decline. Do the bulls still have any options left? Long-term perspective The decline that started from the high of 111.70 found support at 107.05, which is the technical correspondent of the 107.00 psychological level. From there, an appreciation commenced, but it did not manage to conquer the 108.85 level, thus, confirming it as a resistance. This lead … “The Bears Try to Confirm 107.05 on USD/JPY”

Great Britain Pound Soft After Economic Data, PM Statement

The Great Britain pound rallied against the very weak commodity currencies but fell against majors today. The sterling was under pressure from extremely poor domestic macroeconomic data and Brexit worries but had some support from hopes for an end of the quarantine period. The Nationwide House Price Index rose 0.7% in April on a seasonally adjusted basis. The positive result surprised experts as they were counting on a drop of 0.3%. Furthermore, … “Great Britain Pound Soft After Economic Data, PM Statement”

Australian Dollar Weakest After Manufacturing PMI Logs Record Drop

The Australian dollar was the weakest currency on the Forex market today, falling against all other most-traded rivals, even its commodity counterparts. The Aussie has started to decline yesterday and accelerated the drop after the manufacturing index demonstrated a record slump. The Australian Industry Group Australian Performance of Manufacturing Index plunged from 53.7 in March to 35.8 in April. The extremely low figure indicates that the industry was contracting with the fastest pace … “Australian Dollar Weakest After Manufacturing PMI Logs Record Drop”

Yen Gains on Commodity Currencies, Reverses Losses vs. Others

Commodity currencies were generally weak today, allowing the Japanese yen to gain on them. The yen also rose versus the Great Britain pound. Initially, the Japanese currency was flat against the US dollar and fell versus the euro and the Swiss franc but currently the yen rebounded, rising against the dollar and the euro while being about flat against the franc. Japan released a bunch of macroeconomic indicators today, and unsurprisingly, they were rather … “Yen Gains on Commodity Currencies, Reverses Losses vs. Others”