Trading platforms offer dozens of tools for traders to analyze the charts and consequently conduct a more thorough analysis. The Equidistant channel is one of such tools which can be very handy with working with charts. The channel itself is formed by two parallel lines that maintain the same distance between them.

Traders use this tool to identify both short and long term trends. This can certainly give some valuable clues to those market participants, who are employing trend following strategies. However, the use of this tool is not strictly limited to those methods. In fact, the price breaking out of the Equidistant channel can be an important sign of trend reversal.

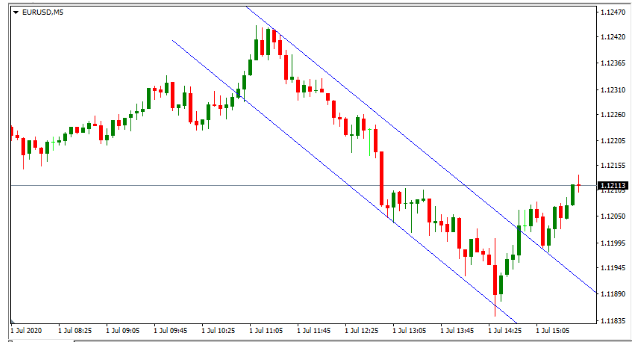

In order to better visualize how this tool works, let us take a look at this 5-minute EUR/USD chart:

As we can see from the above diagram, the EUR/USD pair was engaged in a downtrend channel for around 4 hours of trading. As a result, the Euro has declined from $1.1242 level to $1.1189. However, this development was followed by four green candles, as a result of which the price broke above the downward channel and have kept appreciating until the pair reached $1.1211.

This type of analysis is available for both MetaTrader 4 and MetaTrader 5. Traders interested in using this tool for their trading experience can register with Axiory and try it out on a demo or real trading account. In fact, here traders will be able to draw Equidistant channels on historical Forex charts, in order to test the effectiveness of their strategies.

While there are many people in favor of the Equidistant Channel Drawing Tool, there are also quite a few seasoned traders that are strongly against using it. In fact, it is important to say that using the tool may not be a good addition to every strategy or every trader’s approach, this is why we strongly recommend reading a guide on how to back test MT4 and then backtest the tool on the historic data to understand how adding this indicator to your strategy would actually impact your past trading.

Traders can also make use of Axiory Academy to come up with new trading strategies which they might utilize in their daily trading experience. After choosing those methods, market participants can then backtest those for their effectiveness. If a given Forex trading strategy works well with the past historical charts, then traders can have a reasonable expectation that it might help them to improve the ratio of the winning trades.

Forecasting Exchange Rates with Equidistant Channels

At the stage, the obvious question would be: what does the price action tell us about the future possible direction of the EUR/USD exchange rates? Well, it seems quite clear that the price has recently broker decisively above its downward channel. This is a bullish sign for the Euro and can be a sign of further potential appreciation of the single currency.

This might be even more likely considering the latest trends with the US dollar and the Euro. According to Bloomberg, after years of the dollar rally, a new USD depreciation cycle may have already begun. At the same time, as the sources from CNBC suggest that the single currency is on track to achieve the longest winning streak against USD for the first time since 2013.

Therefore all those developments suggest that the end of this very short term bear market for the Euro might be over and the single currency might be well-positioned to make some significant gains going forward.

This expectation is further strengthened by the fact that according to the latest Purchasing Power Parity measures, published by the Organization for Economic Cooperation and Development (OECD), at current prices, the Euro is still significantly undervalued. In fact, as OECD data suggests, the single currency has to rise by more than 25% in order to reach its fair valuations.

Alternative View

Here it is worth noting that not all financial experts and media outlets agree with those forecasts. In fact, the famous British financial magazine, the Economist published an article, according to which, the US dollar is still in high demand and is prone to sharp appreciation.

The reasoning behind this argument is the fact that global economic uncertainty is still present in the market. Some people expect the 2nd wave of COVID-19 pandemic, while some economists are openly discussing the possibility of a sharp economic downturn. The US dollar is still the world’s number one reserve currency, making up more than 60% of global currency reserves. Consequently, USD typically tends to benefit from the economic uncertainty in the world.

Actually there is another possible reason why the US dollar might maintain its straight through 2020. Obviously, the current Federal Funds Rate, which stands between 0 to 0.25% range does not offer a very attractive rate of return for investors and savers. However, when it comes to the Eurozone, the situation is even worse. The European Central Bank (ECB) is already keeping rates at 0% for more than 4 years, with its deposit facility already at -0.5% mark.

Here it is helpful to remember that the ECB has a single mandate of maintaining price stability. The European Central Bank policymakers define this term as ‘keeping inflation below, but close to 2% in the medium term’.

The latest flash estimate for Harmonize Index of Consumer Prices (HICP) suggests that the annual Eurozone inflation is at 0.3%. It goes without saying that HICP is far below the ECB target. If this state of affairs persists, then one can not rule out that the European policymakers might decide to take additional easing measures.

In this case, the ECB might decide to increase its stimulus considerably. Or alternatively, the ECB board members might take an example from the Swiss National Bank and resort to negative nominal interest rates. At this stage, it is very difficult to make accurate predictions. However, it is obvious that taking any of those measures can certainly weaken the Euro exchange rate and consequently push the EUR/USD pair much lower. So as we can see we have some valid arguments on both sides of the debate.

Get the 5 most predictable currency pairs

How Traders Can Make Use of the Equidistant Channel Drawing Tool?