The Great Britain pound versus the Canadian dollar currency pair looks to be determined to go to higher prices. Does it have a chance or the bears are preparing their next movement?

Long-term perspective

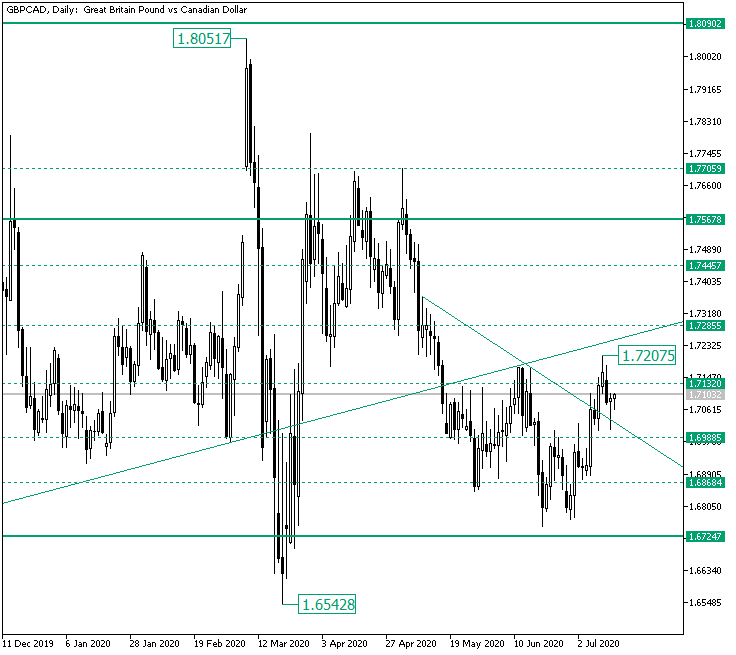

The depreciation that started after the three failed attempts to conquer the solid resistance level of 1.7567 extended a hair away from the 1.6724 firm support area.

In the process, a descending trend — highlighted by the descending line — took shape, which ended as the double bottom chart pattern formed towards the end of June.

The rally that followed pierced both the resistance trendline and 1.7132 intermediary level, printing the 1.7207 high. Afterward, the price retraced back under the just pierced level. However, the bearish hopes for a false break of the 1.7132 level may be in vain because the 1.7207 is a higher high — compared to the previous, which sits at the conjunction of the two trendlines — and the candle on July 17 confirmed the descending trendline as support. Moreover, it did so by noting a bullish pin bar on the chart.

Considering the presented aspects, it seems that the bulls are the ones in control. But even if they proved it, by validating the trendline as support, they are just about to take another test, the intermediary level of 1.7132 being the one to give it. In other words, for the movement towards the north to continue, the bulls must conquer and confirm the 1.7132 level. If they manage to, then the double resistance crafted by the ascending trendline and the 1.7285 intermediary level serves as their first profit booking area.

On the flip side, if 1.7132 holds as resistance, then 1.6988 could be paid a visit, opening the door to 1.6868.

Short-term perspective

From the 1.6769 low, the price is in an ascending trend. As of writing, the bulls are attempting to confirm the double support made possible by the trendline and the 1.7094 intermediary level.

If they pull it off, then the robust resistance level of 1.7244 is their next target. But if the price drops under the potential double support, then the bears could drive the price back to the 1.6965 support level.

But even if this happens, as long as 1.6965 is validated by the bulls, they still have other shots to send the price to higher values. Only falling beneath 1.6965 may send the price to 1.6842.

Levels to keep an eye on:

D1: 1.7132 1.7285 1.6988 1.6868

H4: 1.7094 1.7244 1.6965 1.6842

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.