Dear Traders,

Do you sometimes enter a trade in the ‘middle of nowhere’ with no clear bounce or break spot on the chart?

Traders are often tempted to trade spontaneously when they price action moving quickly. But an unplanned trade often creates trouble…

This guide explains how traders can plan their trade setups and entries with more calm, precision, and focus. Our approach is called the ‘triangle of entries’ and is based on finding decision zones, triggers, and entries.

Triangle of Entries

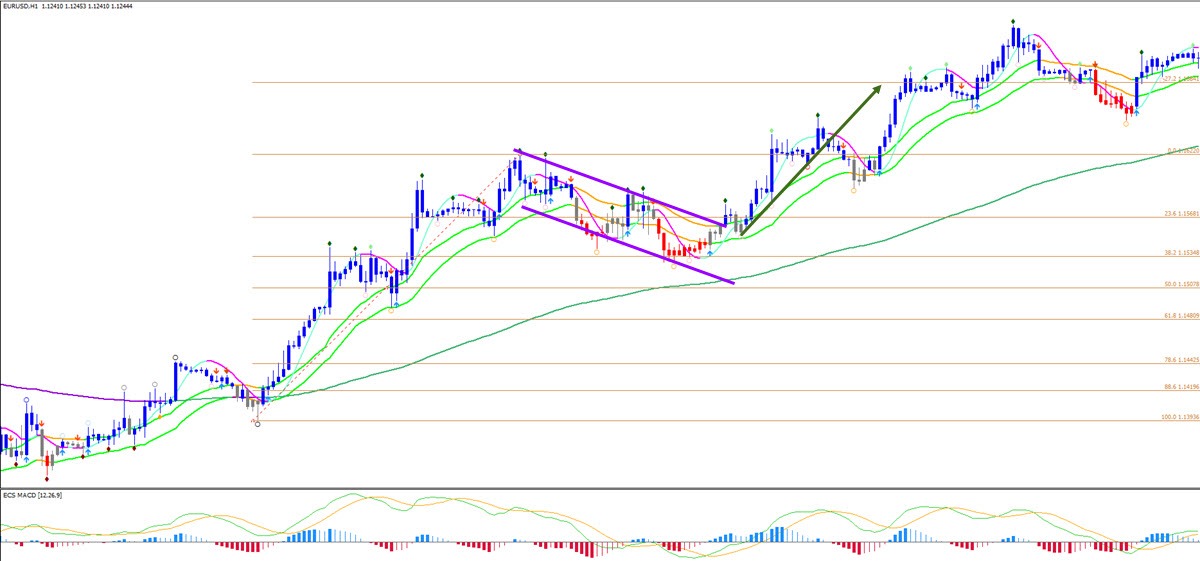

The ‘triangle of entries’ can be used regardless of the strategy, whether it is my ecs.SWAT method, Nenad’s ecs.CAMMACD method, or your own.

The triangle of entries is based on these 3 aspects:

This is how we use it.

This is how we use it.

- Determine zones of interest.

- Take and exit trade setups.

Let’s first review decision zones, triggers, and entries.

Decision Zones Explained

A decision zone is like a point of confluence or point of control (POC), which indicates that there are multiple factors that indicate the importance of a price zone.

POCs are often used to indicate that there are multiple support or resistance (S&R) levels at one price zone, which makes that particular S&R more important.

Decision zones often have POCs as well but they are even more important because there are usually other factors that play a role such as key price patterns, momentum and trend. A decision zone is therefore more critical than a POC and it is the place on the chart where price must show its true intent of moving lower or higher.

Decision zones often have POCs as well but they are even more important because there are usually other factors that play a role such as key price patterns, momentum and trend. A decision zone is therefore more critical than a POC and it is the place on the chart where price must show its true intent of moving lower or higher.

Why are decision zones important? Traders want to take trades at decision zones and avoid spots which are in the ‘middle of nowhere’ because:

Many trades take place in the middle of nowhere because traders enter too soon (jump in early) or enter too late (chasing the trade) due to their own trading psychology such as fear of missing a setup.

Let’s give an example. Based on your analysis, you expect price to …. Entering now would be in the middle of nowhere. It is better to wait for the price to reach the decision zone.

How do you decide what is a decision zone? This is fully based on your triangle of analysis. Here is the sequence of steps:

If you have identified a key resistance zone in a strong downtrend, then this could be marked as your decision zone. You want the price to return to this decision zone before you trade it and you will not want to trade this instrument before it reaches this decision zone.

Once price is in the decision zone, then based on your triangle of analysis you might decide that you are looking to trade only a short setup once a bearish bounce at the resistance zone is confirmed. You would skip a bullish breakout at the decision zone (point 5).In other cases, there could be decisions where you might be willing to trade in both directions.

To help determine your trades, we recommend using Forex wave analysis for finding the right direction and right type of setup (break, bounce, pullback, etc).

Trigger and Entry

Once you have established a decision zone and a directional bias, then it is to think about the next steps, which are trigger and entry.

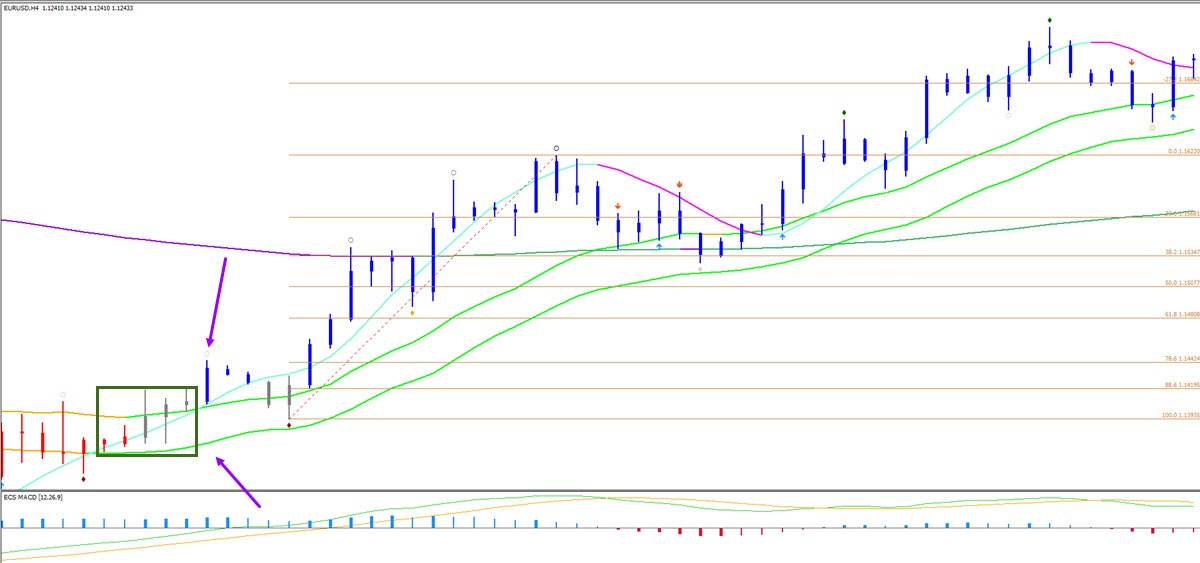

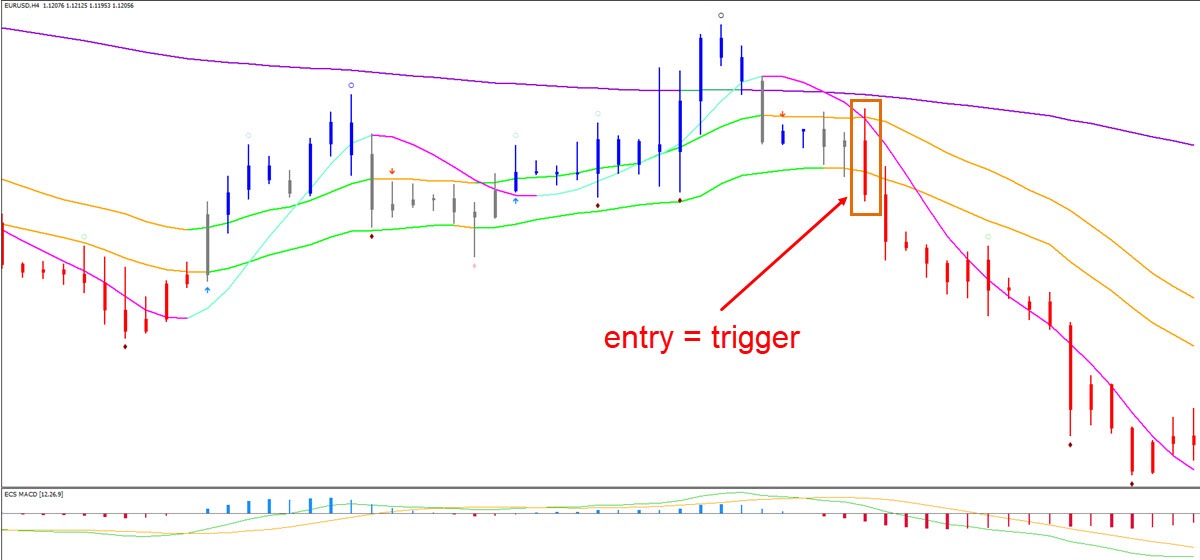

The trigger is the confirmation that you expect in a decision zone. For instance, if you are looking for a bullish bounce at the support zone, then examples of a trigger could be a bullish candlestick pattern or support fractal in the expected price zone or a swat.CANDLE below the support trend line and 21 ema zone (see image below).

The advantage of the trigger is that you wait for price action to confirm your analysis. If you assume that your analysis is correct and you do not want to wait for the market to confirm it, then you could see the price simply push through your zone and invalidate your analysis.

The best trading is done by following the market movements closely rather than trying to outguess or second guess the market. Many traders try to anticipate the market’s movement and then hope that the market will follow their lead. Wise traders always let the market move first, and they follow their lead. Many traders tend to say this: “markets should speak, traders should listen”. Or an example that I often use is a comparison with dancing. The market is the leader dancer and traders should be following the footsteps and rhythm of the market.

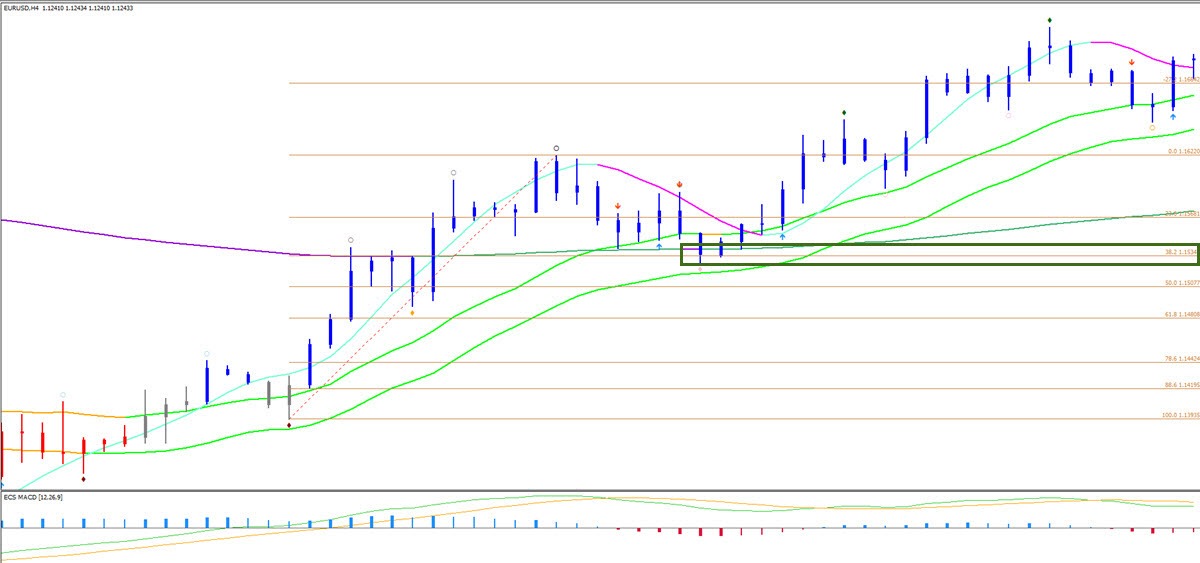

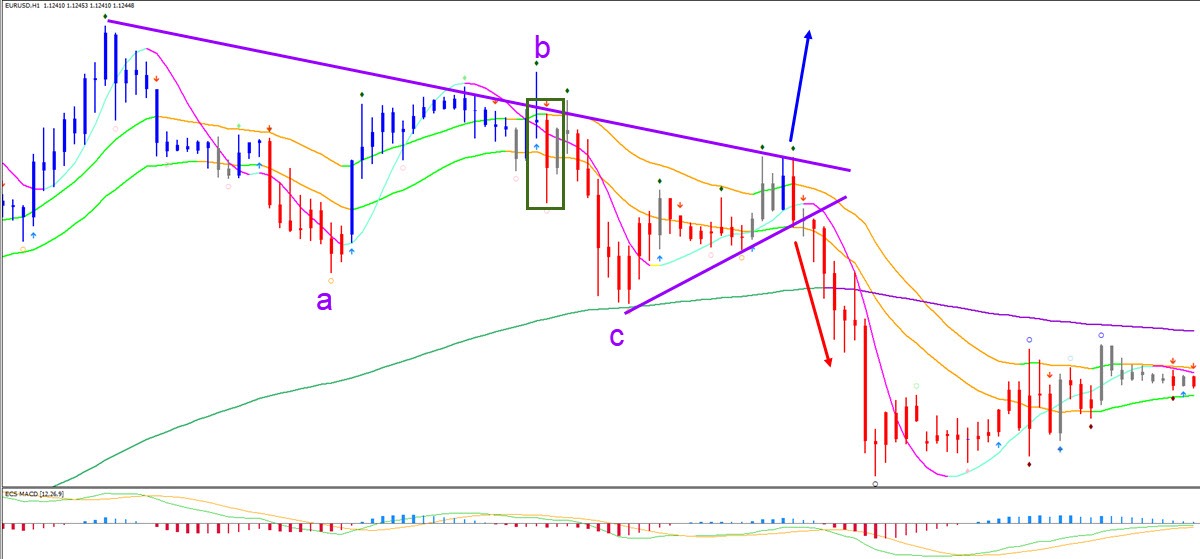

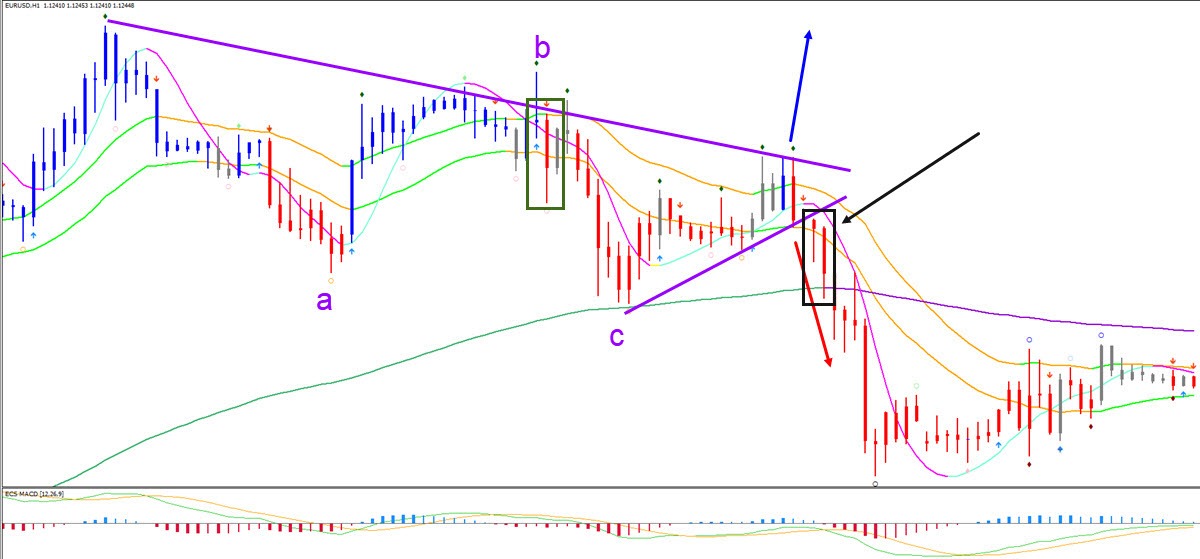

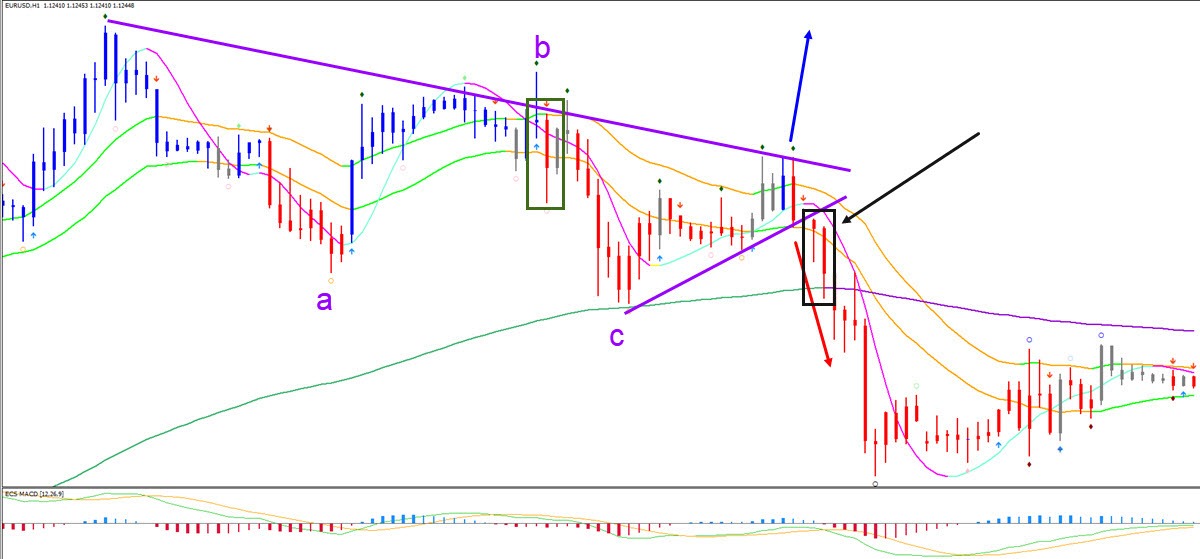

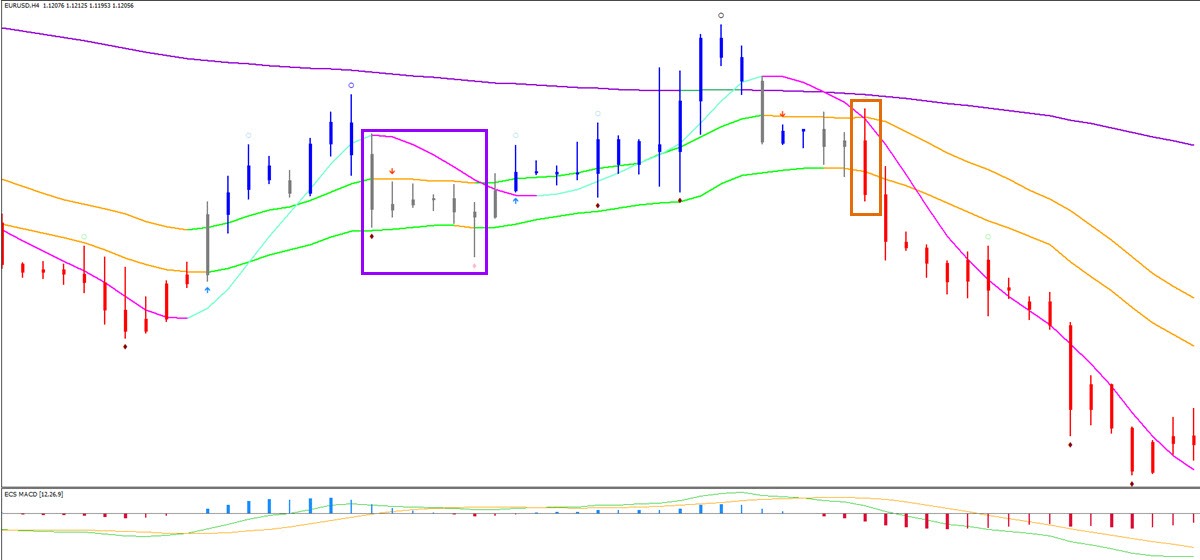

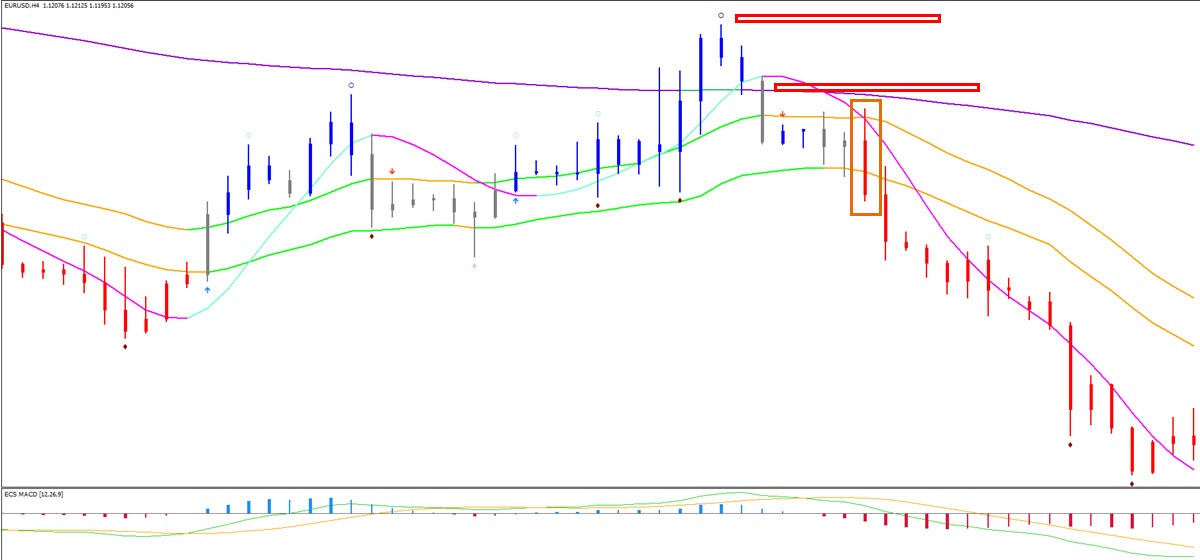

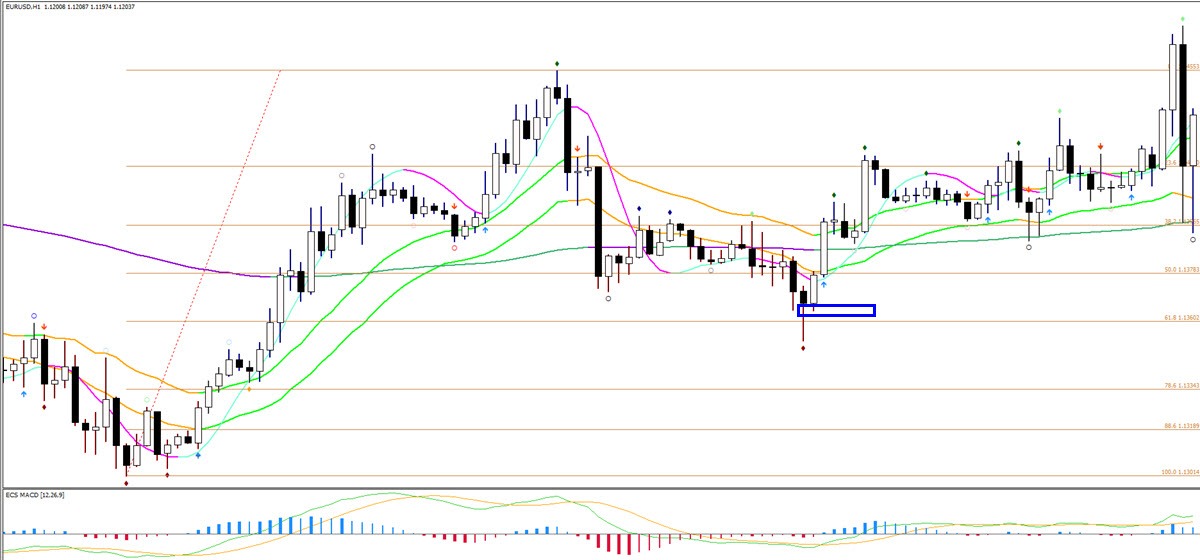

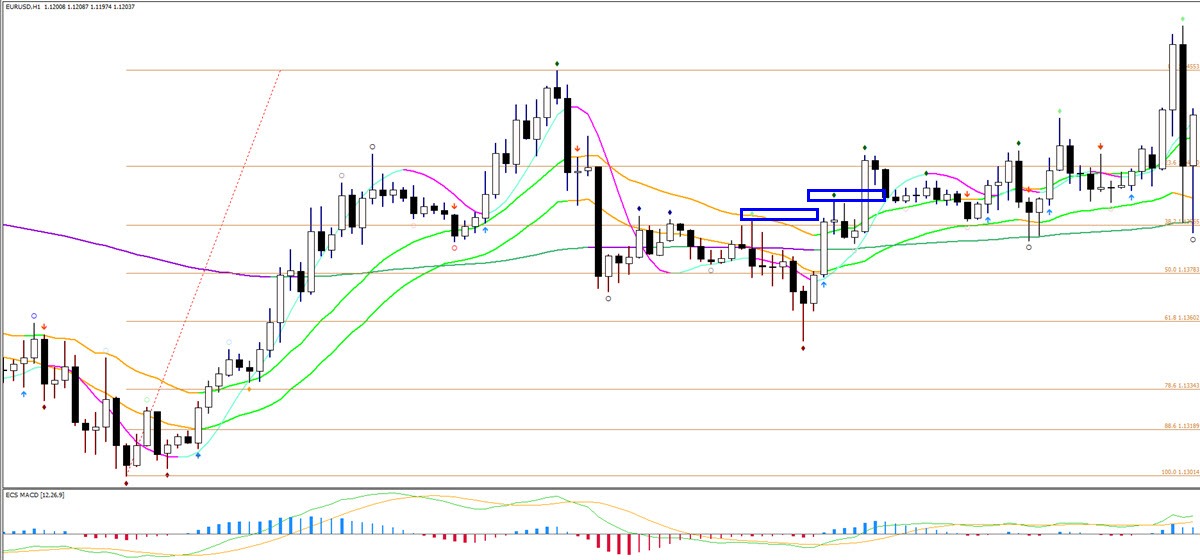

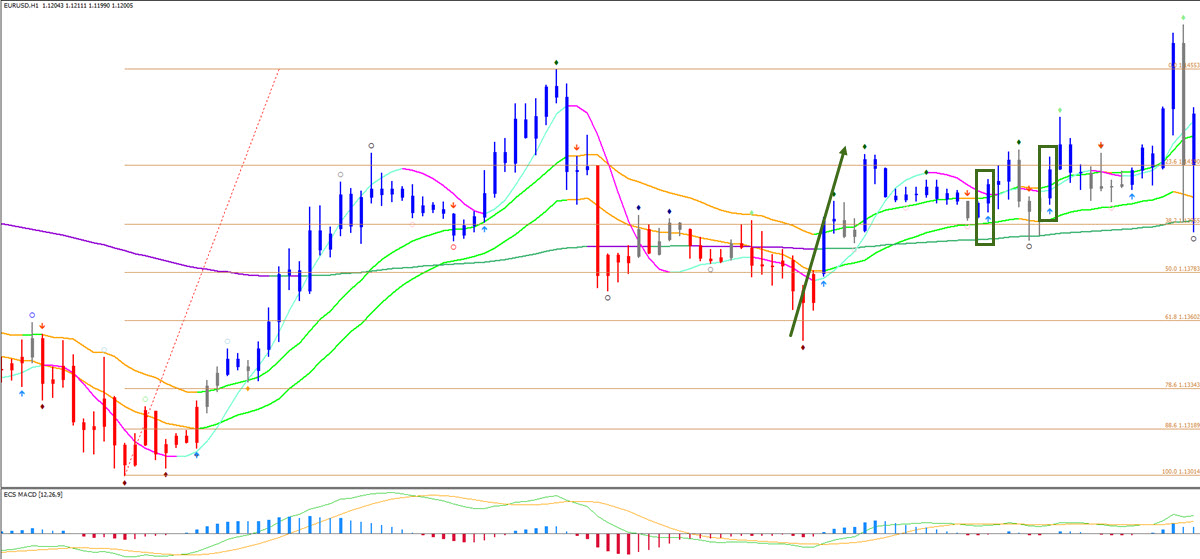

In the image below, a trader might hope for a bullish market (black box) but they are better advised to wait for the break above the 21 ema zone and 144 ema close so that the chart confirms the breakout. Even if your analysis is incorrect, then you avoid losing this trade as the market never confirmed the setup. In fact, new swat.CANDLES arrived just a little later (orange box), which makes a short setup more interesting and logical. The best approach is always to follow the market’s lead rather than trying to anticipate its direction.

Traders can best achieve this by waiting for triggers at decision zones. The advantage of trading without the trigger is that traders can get a better entry but often it is difficult to find a proper place for a stop loss. Or the stop loss size is quite wide. It could be tempting to trade right at the decision zone and assume / hope that your analysis is correct, but a trigger at the decision will often provide a couple of benefits:

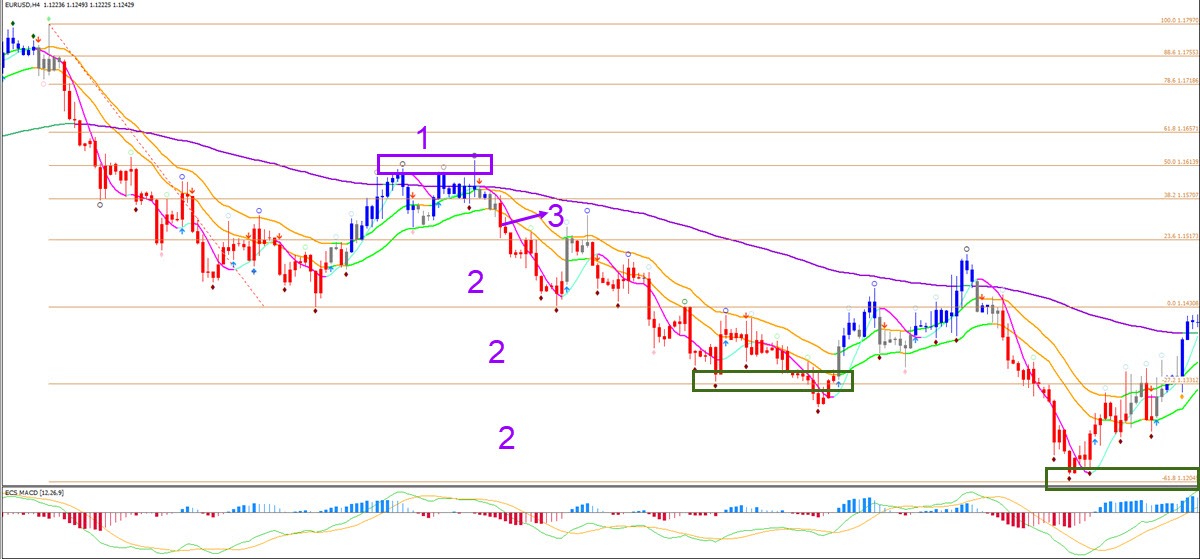

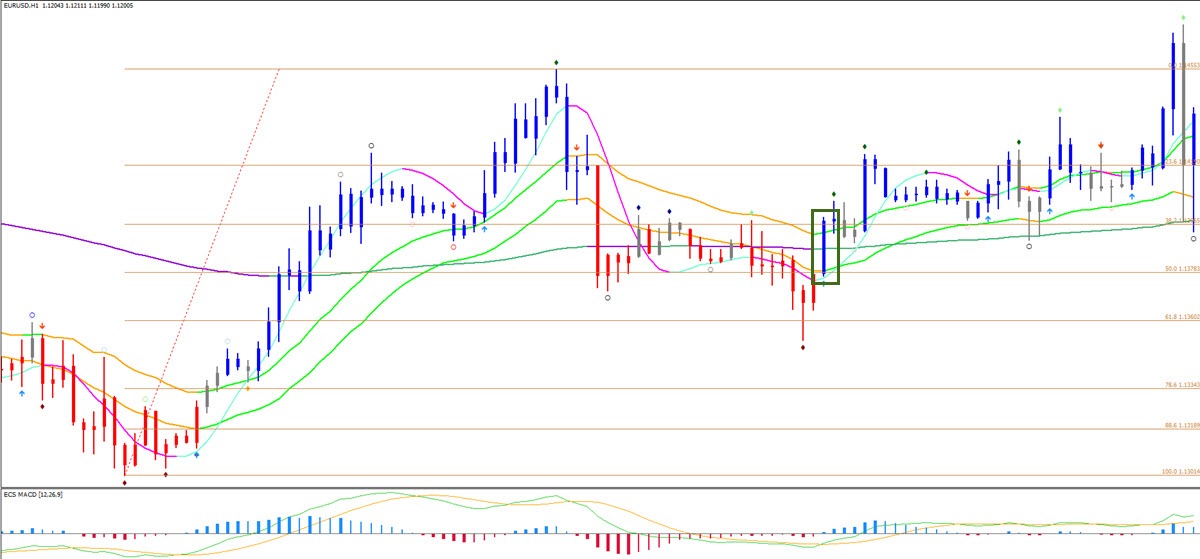

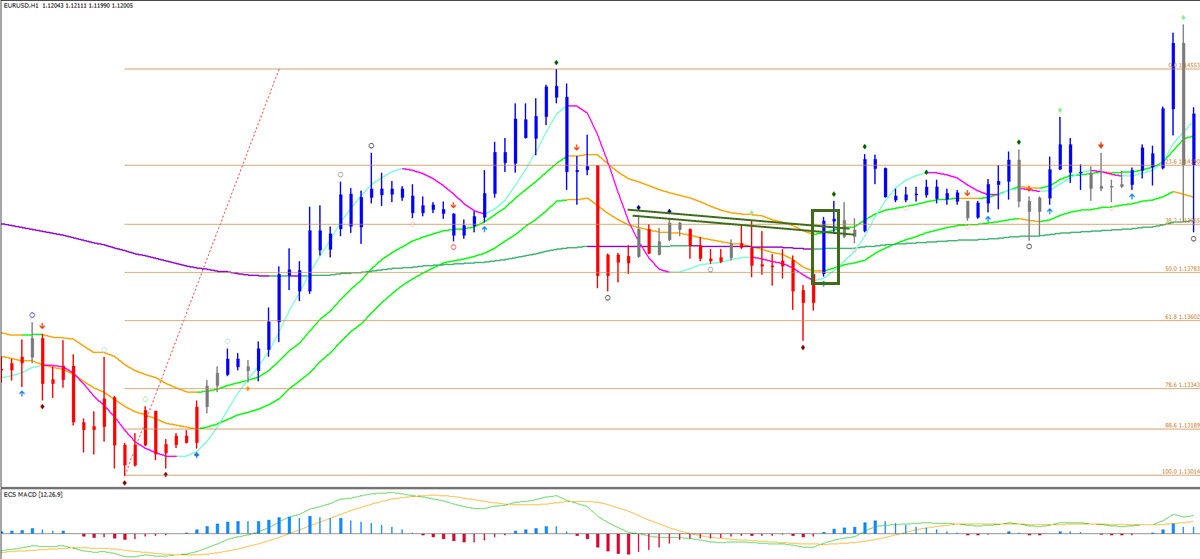

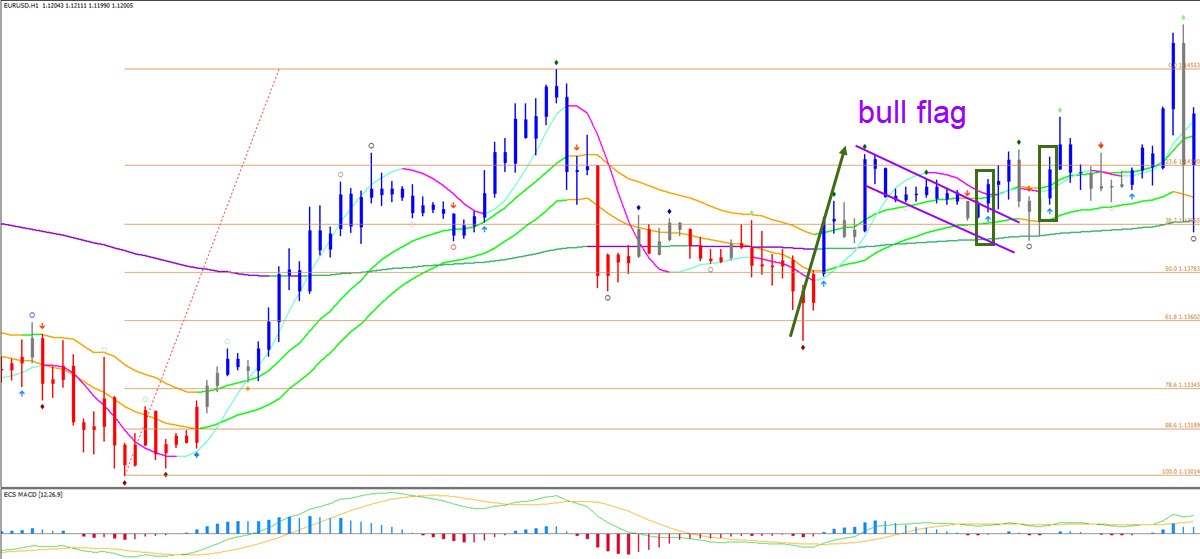

1 A clear response and reaction at the decision zone (as you expect) will increase the chance of the trade working out well. The image below shows how price tried to break below the 21 ema zone (purple box) but ultimately failed to confirm the breakout with swat.CANDLE. The next breakout attempt however did see a candle close below the 21 ema and also saw a confirmation of a red swat.CANDLE appearing (with a clear down move after that).

2 The opposite reaction at the decision zone means that you avoided trading in the wrong direction and a potential loss.

3 Using a stop loss after a reaction at the decision zone makes it easier to find a correct place (technical spot) for the stop loss.

4 Placing a stop loss above or below the reaction at the decision zone keeps the stop loss small.

Once a trigger is visible in the decision and in the expected direction that you want to trade, then traders can think about looking for entries. There are two options:

1 The entry can be the same as the trigger.

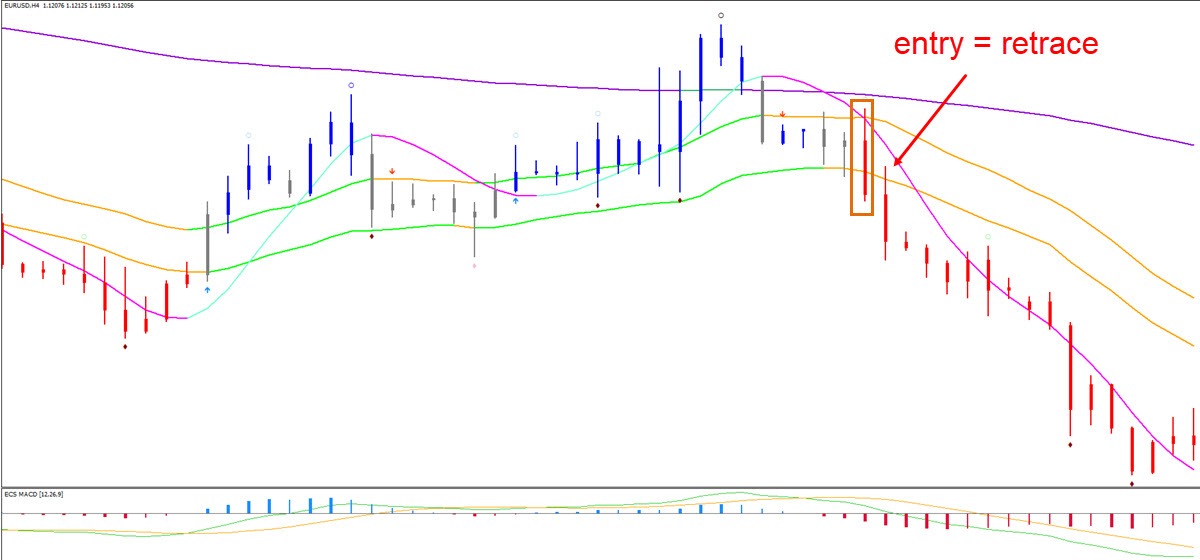

2 The entry can be determined after the trigger is confirmed.

If a trader really likes a particular chart, then it could be best to enter the market as soon as the trigger is confirmed. Waiting for a better entry could mean that you miss the trade setup.

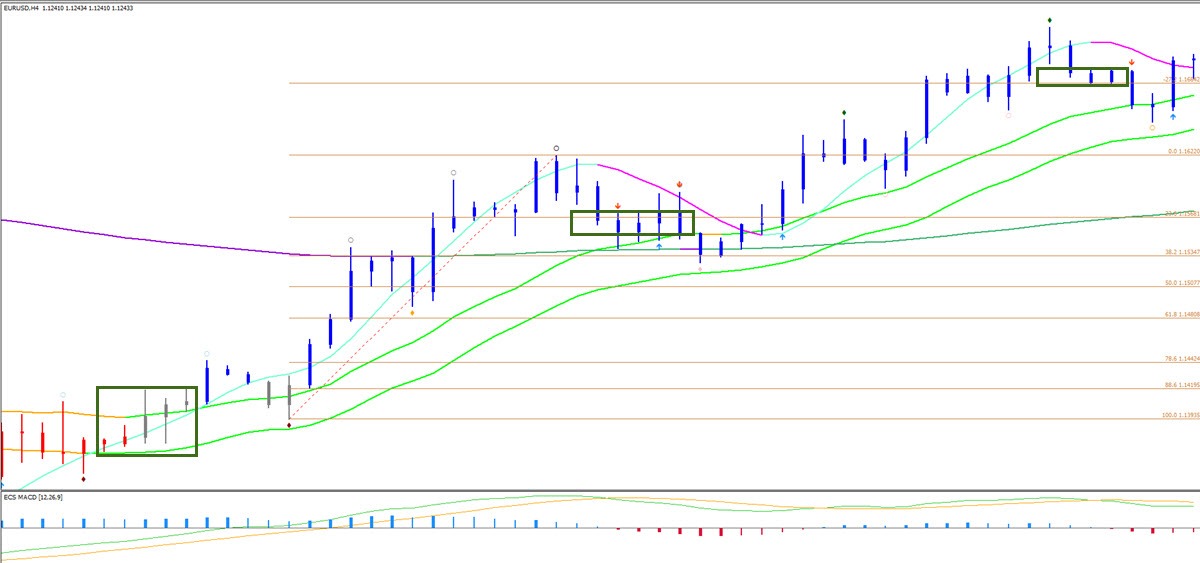

If however, you think that trigger has provided you with an entry spot which is much worse, then there are ways to look for a better entry. An often-used concept is BPC: break, pullback, continuation either on the same time frame, a lower time frame, or even a higher time frame. The image below shows potential entries on the 15-minute chart after the trigger was confirmed on the 1-hour chart (see image above).

Whether the price is expected to break or bounce at the decision zone, traders can use BPC in both cases. On top of that, there are really dozens of options when using various tools and time frames:

All of this is explained in Forex wave analysis

But let’s continue with some examples. Let’s say that you are looking for a trigger at… Fibonacci level. You could enter at different spots on the same time frame or a lower time frame:

This is a bullish example but of course, the same methods work for the bears as well.

The BPC concept is a strong concept because it allows traders to look around for better entries. Of course, there is always the risk that a setup might be missed. For instance, if you expect a pullback on an H4 time frame but the price, in fact, decides to move ahead in one direction without any substantial retracement. That is why using the right time frame is key too. A pullback often happens on a lower time frame.

Whether you trade the break, pullback or continuation depends on your trading strategy and your analysis. Most traders will naturally gravitate towards one or two of the three styles.

Once again, all of these tools could be used for 2 or 3-time frames: the entry time frame, and one or two time frames lower.

Here is a summary:

- Identify ‘decision zones’ on the chart within that path of least resistance.

- Understand whether a break or bounce is more likely and desirable for trading within that path of least resistance.

- Measure whether a break or bounce is taking place at the decision zone.

- Find the best way to enter.

- If a trade is entered, then to monitor and manage the setup till the exit.

The entry should also take into account any upcoming major news that could impact your trade setup. Trading a 15-minute setup just 30 minutes before an interest rate decision from the US is not a good practice because the charts will respond massively to the news event and not to your technical trade.

Besides news events, also keep in mind that the volatility will differ depending on the currency pair and time of day. The EUR/USD usually does not move that much during the Asian trading session but an AUD/USD or EUR/JPY will move more because of the AUD and JPY pair from countries where the market is open.

The least price movement is seen at the beginning and end of each trading week, month, and also a year.

For more information, free analysis, webinars, videos, tools, systems, and methods for trading stocks, cryptos, Forex and options, please check out my website www.EliteCurrenSea.com.

Wish you good trading,

Chris Svorcik

Get the 5 most predictable currency pairs