What cannot advance on upbeat news is exposing its weakness. Upbeat UK and US data were insufficient to send sterling higher. UK retail sales, US coronavirus cases, and other developments are eyed, with the pound poised to plummet.

This week in GBP/USD: Good data is not good enough

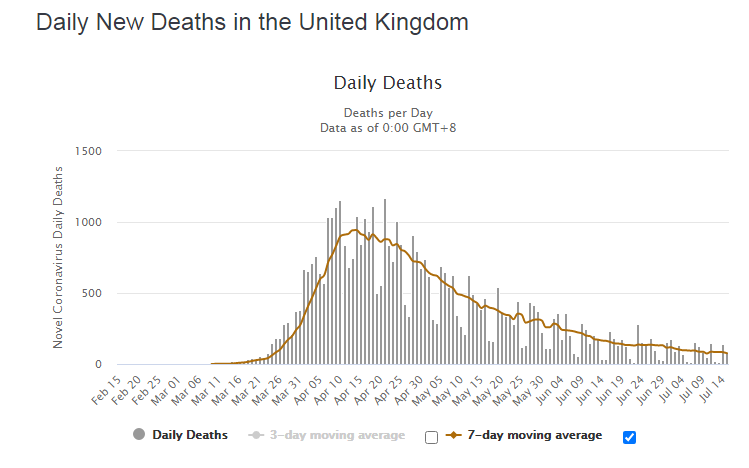

UK coronavirus cases continued dropping, supporting the gradual reopening. The pick up in activity began in May and extended to June – even helping inflation stabilize and edge 0.1% higher. More importantly, British jobless claims surprised with a drop of around 28,100 in June – turning the tide. The unemployment rate provided good news for another month by remaining at only 3.9%.

Source: WorldInfoMeter

Nevertheless, upbeat economic figures failed to push the pound higher. The lack of movement may be attributed to several misses. Monthly Gross Domestic Product rose by only 1.8% in May, below forecasts and annual wage growth turned negative in that month – albeit the 0.3% was above estimates.

Another potential culprit on the UK side is Andrew Bailey, Governor of the Bank of England. He told MPs that interest rates will likely remain at low levels for at least two years – yet that was no shocker to market participants.

Two other downbeat – yet known – factors are the lack of progress in Brexit talks and concerns that the government’s fiscal stimulus package is insufficient.

Overall, the pound struggled to rise, perhaps finally succumbing to previous concerns.

On the other side of the pond, data was more nuanced, with retail sales surging by another 7.5% in June and pointing to a comeback – but jobless claims remaining stubbornly high at 1.3 million.

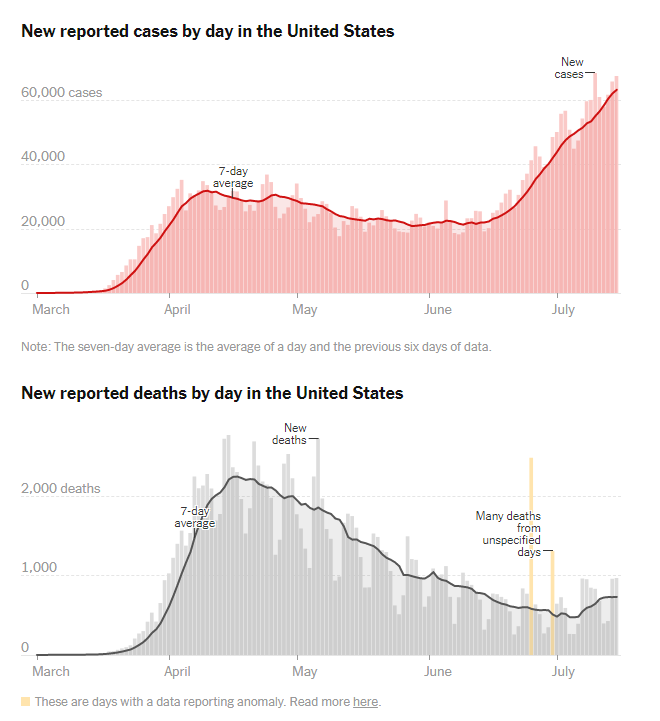

America’s coronavirus cases began rising in mid-June, making some of the data stale. The increase continued through mid-July with several states hitting record numbers of cases. Moreover, the mortality curve remains on the rise, adding to worries.

On the other hand, both Moderna and AstraZeneca announced progress in developing a COVID-19 vaccine, and that helped send stocks higher – yet once again, GBP/USD failed to capitalize on the safe-haven dollar’s weakness.

Source: New York Times

Sino-American relations continued deteriorating as the world’s largest economies continue tussling over Hong Kong, Huawei, and the blame for coronavirus. The administration idea of banning the entry of Chinese Communist Party members – all 90 million of them – to the US, dampened sentiment.

UK events: Ongoing reopening, retail sales, and PMIs

With low expectations for any progress in Brexit talks, the UK’s gradual reopening of the economy is of higher interest. Easing restrictions depends on coronavirus statistics, which are falling. Any flareups – such as in Leicester – could weigh on the pound.

The debate about the fiscal stimulus plan may continue. If doubts creep in, the government may bring forward additional measures and that could support sterling.

June’s retail sales report stands out, with economists expecting another considerable bounce in monthly consumption – but still leaving a substantial yearly drop that may even deepen. The recovery is far from bringing the British economy back to pre-pandemic levels.

Markit’s preliminary Purchasing Managers’ Indexes for July are also likely to move the pound. These forward-looking gauges showed that manufacturing barely returned to growth while the services sector is still contracting. The same trends are set to continue in mid-summer, yet surprises are always possible.

Here is the list of UK events from the FXStreet calendar:

US events: Coronavirus and its impact on the consumer

How bad is the pandemic in the US? That is the main question for markets, and daily statistics, coming early from Florida and concluding California are eyed. Apart from cases, investors are eying the positive-test rate, Intensive Care Utilization, and deaths. Apart from rising statistics, reports about new restrictions or easing them may also have an impact:

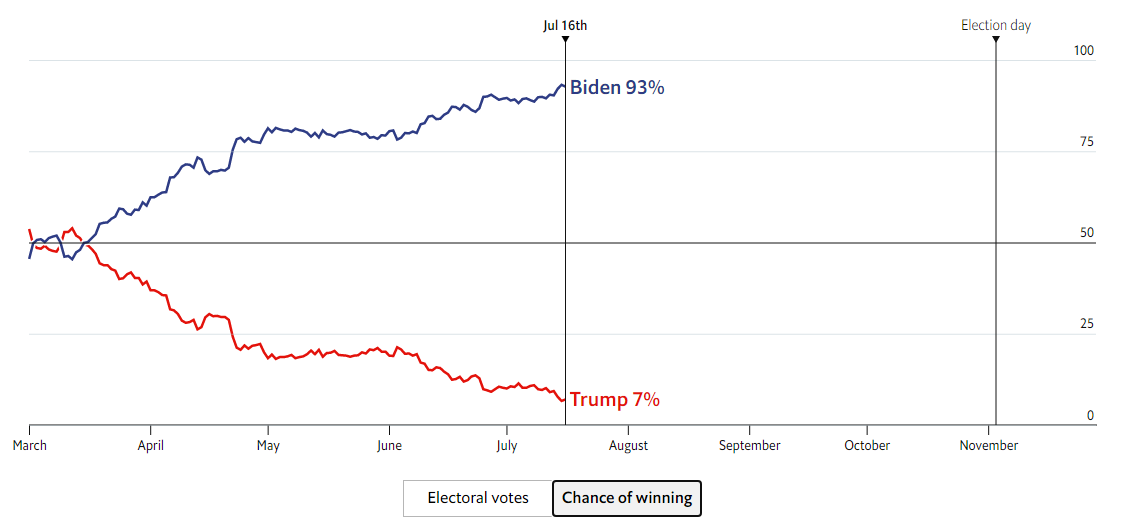

US politics have had a marginal impact on markets so far, but any change in opinion polls may have an impact. With Biden having a substantial lead against Trump, perhaps the focus will shift to the Senate. Polls on tight races may provide some clarity if Democrats have a chance for taking a clean sweep or not.

According to the Economist’s model, Biden has a 93% chance of winning at the time of writing:

Source: The Economist

Investors are following Sino-American relations but as long as the trade deal remains intact, heightened rhetoric will likely be disregarded.

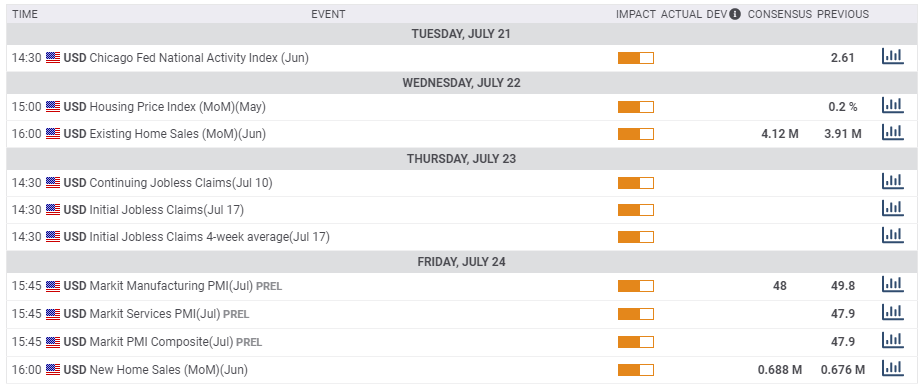

The economic calendar kicks off with several housing figures that will likely show ongoing stability in the sector – which has been surprisingly unscathed by the crisis so far.

Initial jobless claims are of higher interest amid the rise in coronavirus cases and also due to the timing – the figures are for the week including the July 12, when the Non-Farm Payrolls are held. If applications rise once again, markets may worry and the safe-haven dollar could suffer.

Markit’s preliminary Purchasing Managers’ Indexes for July may show if the recovery toward a return to expansion has reached a halt.

Here the upcoming top US events this week:

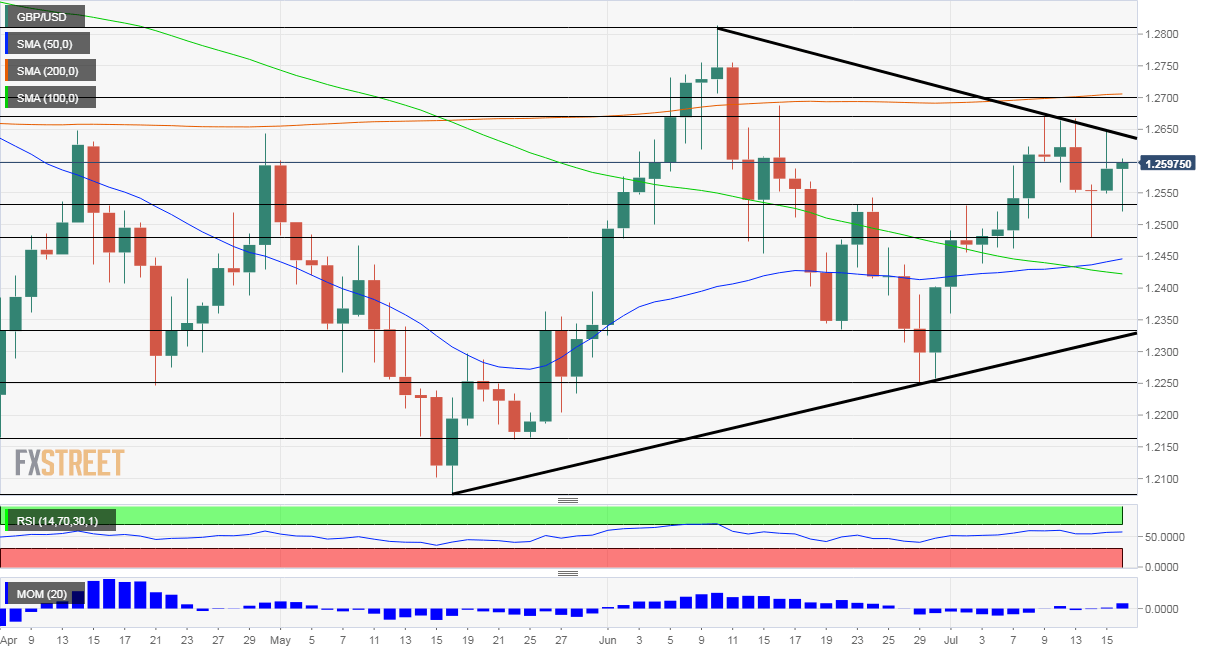

GBP/USD Technical Analysis

Pound/dollar continues trading within a narrowing triangle, or wedge. It is edging closer to the downtrend resistance line and has been unable to break higher for now. Momentum on the daily chart remains positive, and GBP/USD is holding above the 50 and 100 Simple Moving Averages but remains capped by the 200-day SMA.

Support awaits at 1.2535, a swing high in early July. It is followed by 1.2475, which was a low point in mid-July. The next noteworthy support line is only at 1.2340, a support line in mid-June and then 1.2250, the late July low.

Resistance is at 1.2670, a stubborn cap during July. The next level to watch is 1.27, a round number that nearly converges with the 200-day SMA. Further above, 1.2815 is the peak in June.

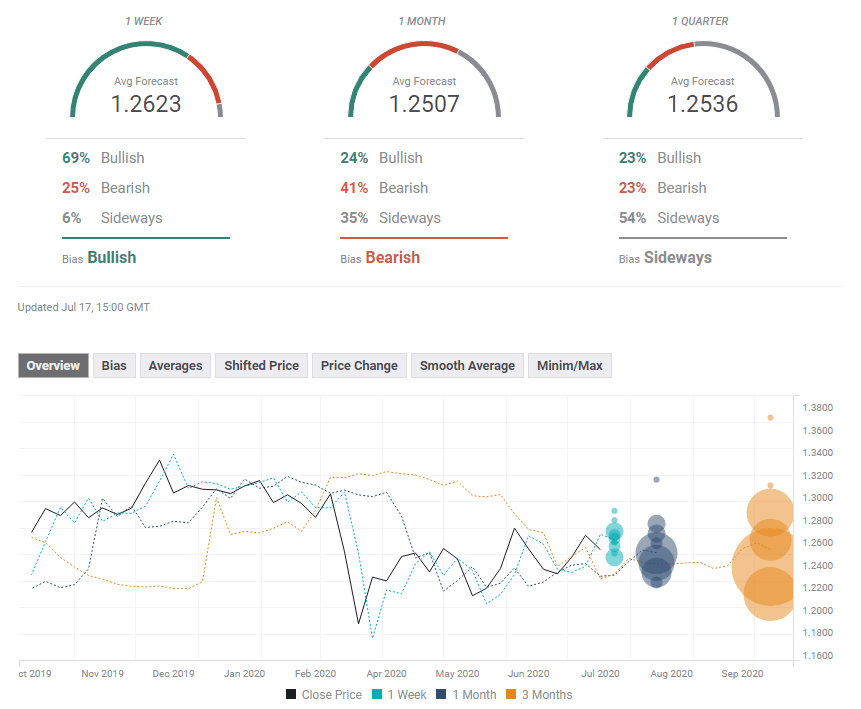

GBP/USD Sentiment

While technicals are relatively balanced and even positive, fundamentals and the failure to move higher may result in a retreat for GBP/USD.

The FXStreet Forecast Poll is showing that experts have marginally downgraded the average forecast and see different moves for every timeframe – rises initially, falls afterward, and a rise in the long term.

Related Reads

Get the 5 most predictable currency pairs