The Australian versus the New Zealand dollar currency pair seems to be in bullish hands. Do the bears still have a chance?

Long-term perspective

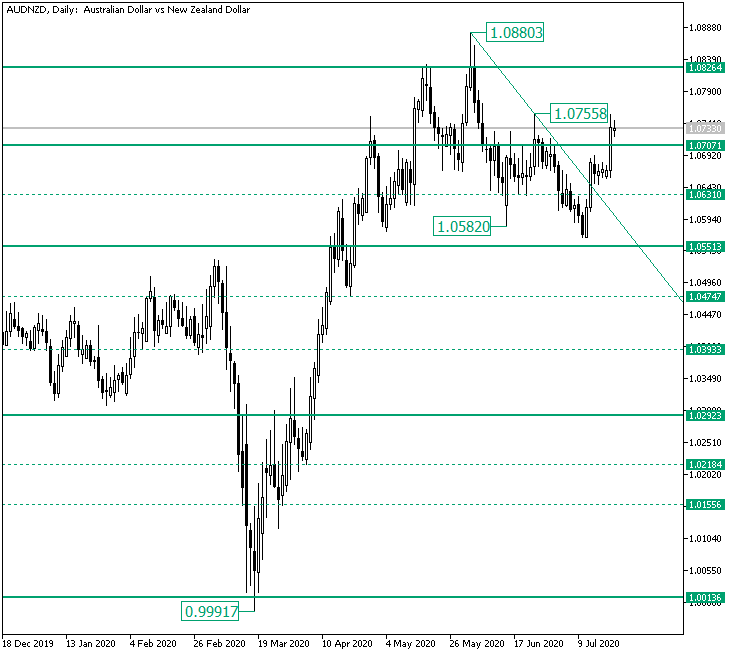

The rally that started from the 0.9991 low extended to as high as 1.0880. From there, a strong drop came about, bringing the price under the firm 1.0707 level and printing the low of 1.0582.

Even after their first run, the bulls were only able to etch the 1.0755 high, which made the descending line possible. On their second attempt — when they stalled the depreciation before 1.0551 by defining a bullish engulfing on July 13 — they managed to gather enough steam to pierce the resistance trendline.

After a short consolidation period that validated the piercing, the bulls started another rally, one that managed to puncture and close the day of July 21, above the major 1.0707 level.

In this context, as long as 1.0707 keeps its role as support, the appreciation can continue. It might come after a throwback towards 1.0707 or as a short-lived consolidation phase, such as a flag or pennant. As long as one of these scenarios materializes, the bulls are targeting 1.0826.

On the flip side, if 1.0707 gives way, then the intermediary level of 1.0631 would serve as the first stop for the bears.

Short-term perspective

From the 1.0565 low, the price is in an ascending trend. Until the 1.0692 high, the price crafted the first impulsive wave, which led to a consolidation that unfolded just under the 1.0681 intermediary level.

Afterward, the price pierced 1.0681 and almost jumped to the next resistance, the 1.0741, an intermediary level as well.

In the current state of events, one possibility is to see a retracement that confirms the ascending trendline as support, followed by the piercing of 1.0741, and another “jump” to the next level, 1.0778, in this case.

Another scenario vouches for the piercing of 1.0741 with the subsequent development of a consolidative phase just above it, targeting, of course, the same 1.0778.

Only if the potential double support defined by the ascending trendline and the 1.0681 level is invalidated, then the bears could extend their movement until 1.0621.

Levels to keep an eye on:

D1: 1.0707 1.0826 1.0631

H4: 1.0741 1.0778 1.0681 1.0621

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.