The Great Britain pound versus the Canadian dollar currency pair printed a strong rally. Could the bears invalidate it?

Long-term perspective

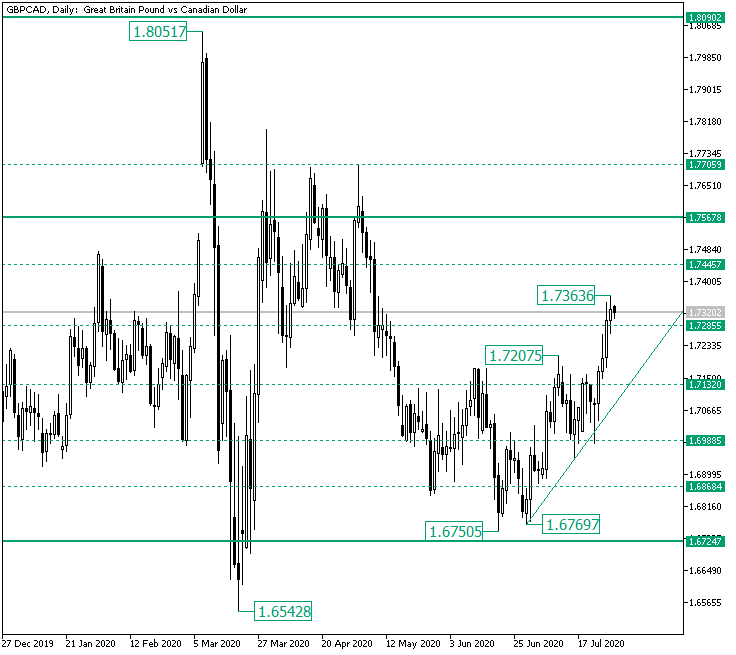

After the three failed attempts to conquer the strict 1.7567 resistance level, the bulls let the bears do what they know best. As a result, the price got brought around the 1.6724 major support level, where the first bullish opposition towards the continuation of the fall noted the 1.6750 low. Even if the bears believed that by confirming the 1.6988 as resistance, they would be able to continue, the bulls defined a new low at 1.6769.

As a result, a double bottom got set in place, and he bulls used it to their advantage. This aided the materialization of a new high — 1.7207 — which shifted the situation in favor of the bulls.

As a consequence, even if the bears attempted to limit any bullish advancements by defending the 1.7132 intermediary level, the force of the trend overwhelmed them. The outcome was the price confirming the double support — made possible by the ascending trend and the 1.6988 level — and starting a strong rise that — as of writing — printed the 1.7363 high and set the oscillation of the price above 1.7285.

As long as the price oscillates above 1.7285, the bulls have the path to 1.7445 and 1.7567 open. But even if the price falls under 1.7285, as long as the ascending trendline is validated, the march towards the north is just a matter of time.

On the flip side, if the price falls under the ascending trendline, and most probable under 1.7132 as well, then the bears would be able to bring the price back to 1.6988.

Short-term perspective

The appreciation that started form the 1.6769 low, and ultimately printed a symmetrical triangle — a continuation chart pattern — with its base limited by the 1.6875 low and the 1.7207 high, managed to get above the firm 1.7244 level.

Moreover, it extended until the next resistance, the 1.7337 intermediary level. If 1.7337 gets conquered as well, then the current movement could very well continue until 1.7487.

Or course, another possibility is for a consolidation — limited by 1.7337 as resistance and 1.7244 as support — to take place, which would also target the same 1.7487.

Only if 1.7244 gives way, then the price may fall towards the double support defined by the resistance of the triangle — the trendline starting from 1.7207 — and the 1.7094 intermediary level.

Levels to keep an eye on:

D1: 1.7285 1.7445 1.7567 1.7132 1.6988

H4: 1.7337 1.7487 1.7244 1.7094

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.