The Sterling pound today traded sideways against the US dollar despite the release of multiple positive macro prints from the UK docket in the London session. The GBP/USD currency pair traded in a tight range as investors worried about the prospect of a no-deal Brexit and the high chance of the second wave of coronavirus … “Sterling Range-Bound Despite Upbeat UK Retail Sales and PMI Data”

Month: July 2020

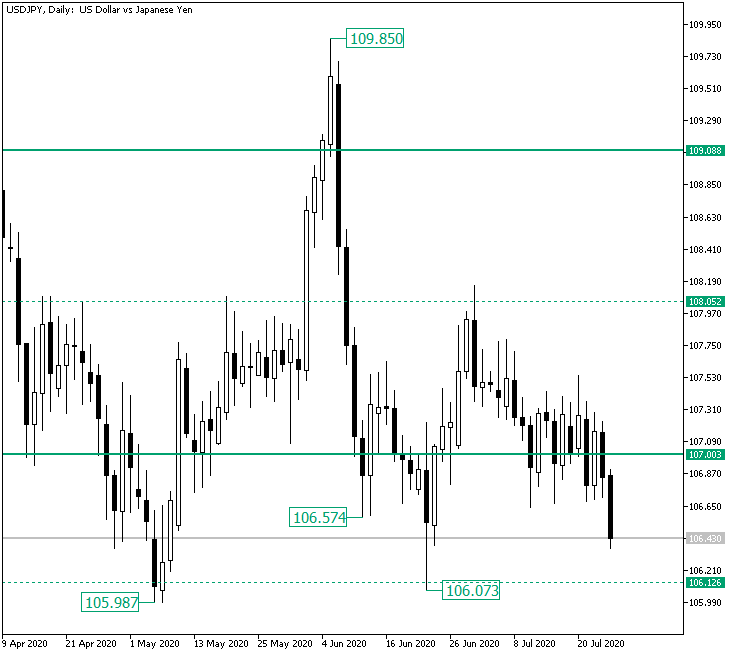

USD/JPY About to Test the 106.12 Level

The United States dollar versus the Japanese yen currency pair seems to have been taken over by the bears. Do the bulls stand a chance at 106.12? Long-term perspective The fall from the 109.85 high extended, in a first instance, until the 106.57 low. From there, the bulls tried to recover, but, even if they were able to close a candle above the level, the bears had the power to send the price to 106.12, printing the 106.07 low. … “USD/JPY About to Test the 106.12 Level”

Euro Falls Then Rallies Based on US Dollar Dynamics and Sentiment

The euro today fell against the US dollar earlier in the session before rallying higher later with its movements primarily driven by the greenback’s price dynamics. The EUR/USD currency pair’s was further encouraged by the positive investor sentiment around the â¬750 billion EU recovery fund, which was agreed on by European leaders at their summit. … “Euro Falls Then Rallies Based on US Dollar Dynamics and Sentiment”

US Dollar Flat As Initial Jobless Claims Rise for First Time Since March

The US dollar is trading flat against its G10 currency rivals on Thursday after the US government reported that initial jobless claims rose for the first time since the start of the coronavirus pandemic. Does this mean the job situation is beginning to deteriorate? Or is this a blip on the radar? Financial markets are hardly reacting to the news in pre-market trading as the leading stock indexes are also relatively unchanged. According to the Department … “US Dollar Flat As Initial Jobless Claims Rise for First Time Since March”

Eurozone PMIs Preview: Return to positive territory may complete bullish week for EUR/USD

Markit’s preliminary PMIs for July are set to top 50, indicating expansion. Germany’s manufacturing sector may be the laggard, but they have surprised in most recent months. EUR/USD has been having a positive week and the rare economic release could boost it. On a recovery path? Economists expect Markit’s Purchasing Managers’ Indexes to return to … “Eurozone PMIs Preview: Return to positive territory may complete bullish week for EUR/USD”

UK Retail Sales Preview: Comeback continues? Yearly figures, headwinds, could keep cable depressed

Economists expect to see the second month of recovery in British consumption in June. Year over year figures may serve as a reminder that expenditure remains depressed. GBP/USD has room to fall, also due to other headwinds. Football is coming home – matches in England’s Premier League were resumed on June 1, potentially adding to … “UK Retail Sales Preview: Comeback continues? Yearly figures, headwinds, could keep cable depressed”

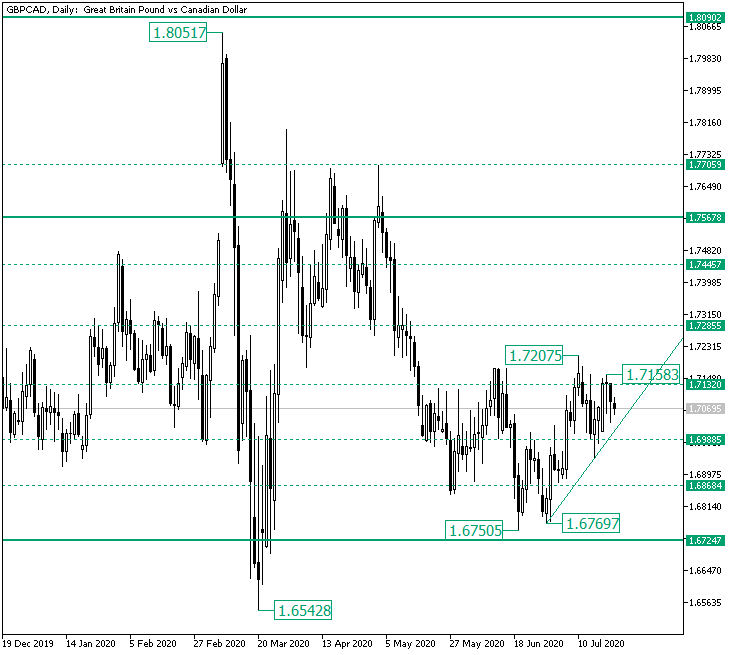

GBP/CAD Undecided Around 1.7100 Area

The Great Britain pound versus the Canadian dollar currency pair seems to have trouble continuing the appreciation. Is this only a pause from the bulls or the bears are preparing their next movement? Long-term perspective After the appreciation from the 1.6542 low stalled at the firm 1.7567 level, the price began a descending movement that got very close to the important 1.6724 support level, printing the low of 1.6750. From there, the bulls tried … “GBP/CAD Undecided Around 1.7100 Area”

Sterling Pound Falls on Brexit Jitters, Later Rallies on Reassurances

The sterling pound today alternated between losses and gains against the US dollar driven mostly by market sentiment given the empty UK dockets. The GBP/USD currency pair later rallied after the British government confirmed that it was committed to sealing a post-Brexit trade deal with the EU. The GBP/USD currency pair today fell to a … “Sterling Pound Falls on Brexit Jitters, Later Rallies on Reassurances”

Canadian Dollar Mixed Amid Higher-Than-Expected Inflation, Strong Retail Sales

The Canadian dollar is trading mixed against its most traded currency rivals midweek. The loonie has been gaining on the greenback on Wednesday as higher-than-expected inflation and strong retail sales data were in the backdrop of the Canadian dollar’s ascent. But falling energy prices capped the currencyâs modest rally. According to Statistics Canada, the consumer price index (CPI) rose by 0.8% in June, up from 0.3% in May. The annualized inflation rate surged … “Canadian Dollar Mixed Amid Higher-Than-Expected Inflation, Strong Retail Sales”

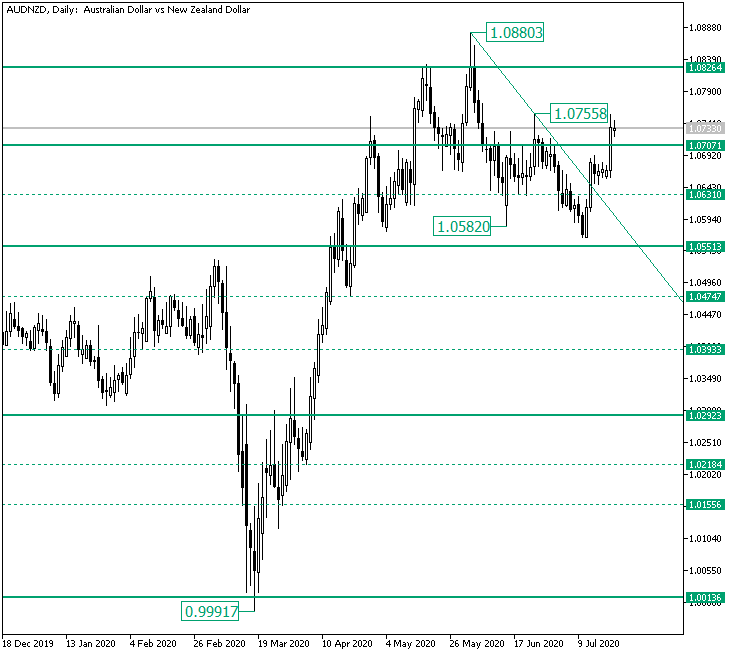

Bulls on AUD/NZD Heading for 1.0826

The Australian versus the New Zealand dollar currency pair seems to be in bullish hands. Do the bears still have a chance? Long-term perspective The rally that started from the 0.9991 low extended to as high as 1.0880. From there, a strong drop came about, bringing the price under the firm 1.0707 level and printing the low of 1.0582. Even after their first run, the bulls were only able to etch the 1.0755 high, which … “Bulls on AUD/NZD Heading for 1.0826”