The Turkish lira is slumping to its lowest level against the US dollar in two months as investors fear that it is poised for another currency crisis. The lira has been steadily rebounding since falling to an all-time low against the greenback, but analysts warn that the fundamentals, from inflation to foreign exchange reserves, do not support its gains. Is another crash going to happen soon? The Turkish government … “Turkish Lira Weakens to Two-Month Low As Investors Fear Another Currency Crisis”

Month: July 2020

ActivTrades Revenue Set to Go Up to Record High in H1 of 2020

We’re almost halfway through the year 2020, and Forex broker ActivTrades is set to be welcoming the second half on a good note after it announced that it has recorded a revenue of £30 million in the first half. This was almost three times the revenue the company recorded in the first half of 2019 … “ActivTrades Revenue Set to Go Up to Record High in H1 of 2020”

How Traders Can Make Use of the Equidistant Channel Drawing Tool?

Trading platforms offer dozens of tools for traders to analyze the charts and consequently conduct a more thorough analysis. The Equidistant channel is one of such tools which can be very handy with working with charts. The channel itself is formed by two parallel lines that maintain the same distance between them. Traders use this … “How Traders Can Make Use of the Equidistant Channel Drawing Tool?”

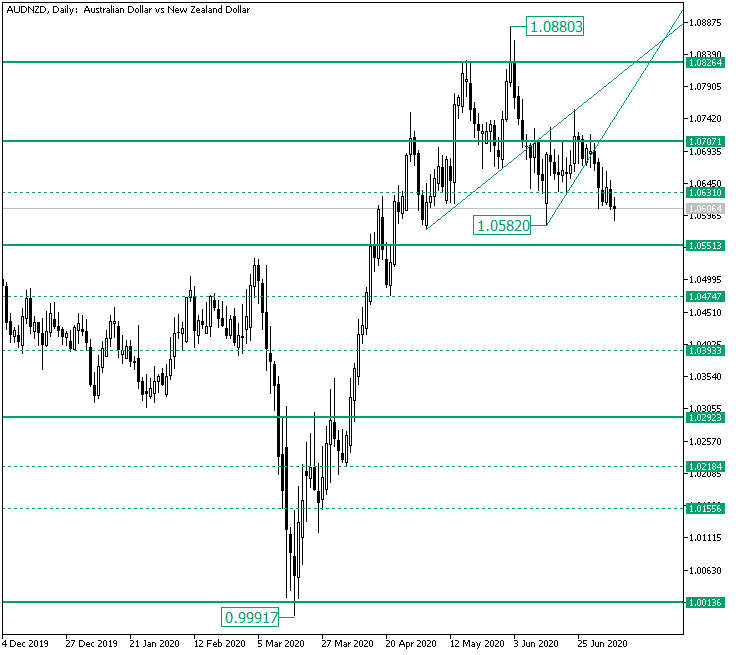

AUD/NZD Getting Closer to 1.0551

The Australian dollar versus the New Zealand dollar currency pair is approaching an important support area. Will the bulls be able to withstand the bearish pressure? Long-term perspective The appreciation that started from the 0.9991 low seems to have ended at the 1.0880 high, as the price confirmed the important resistance level of 1.0826. The confirmation sent the price under the next major support area, 1.0707. Once there, the bears took the opportunity to drive the price … “AUD/NZD Getting Closer to 1.0551”

Euro Crashes on Risk-Off Sentiment, Recoups Losses on Better Mood

The euro today fell against the US dollar during the Asian session, driven by the risk-off market sentiment that saw most Asian equity markets selloff. The EUR/USD currency pair recovered some of its losses during the European session despite the mixed releases from across the euro area. The EUR/USD currency pair today fell from a … “Euro Crashes on Risk-Off Sentiment, Recoups Losses on Better Mood”

Japanese Yen Flat Amid Slumping Household Spending, Yield-Curve Control

The Japanese yen is trading relatively flat against many of its major currency counterparts on Tuesday. The yen has been struggling to find direction so far this week as household spending data disappointed and investors try to weigh the central bankâs decision to embark upon a policy of yield-curve control. Although Japan was able to flatten the coronavirus curve, it has reported a renewed uptick in confirmed cases. Will the worldâs third-largest … “Japanese Yen Flat Amid Slumping Household Spending, Yield-Curve Control”

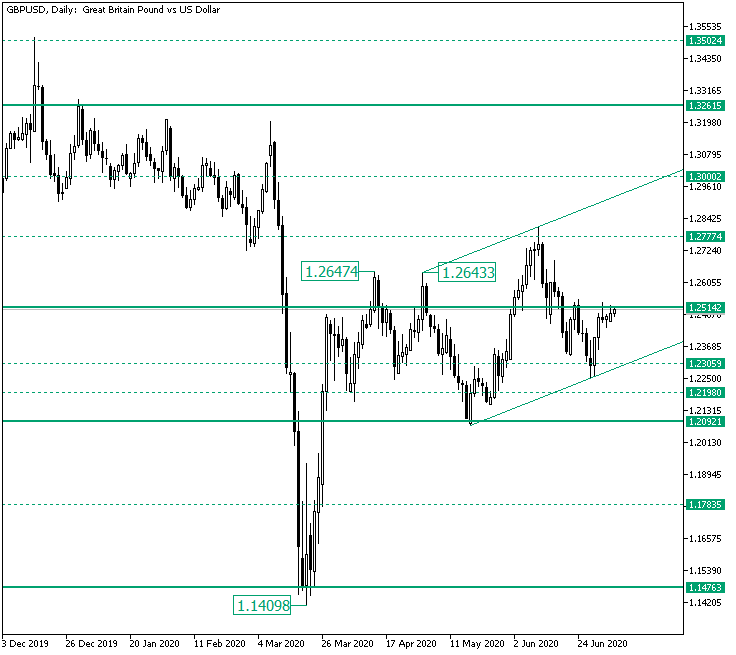

GBP/USD Facing the 1.2514 Resistance

The Great Britain pound versus the United States dollar currency pair made a great recovery, but will the bulls be able to conquer 1.2514 as well? Long-term perspective The rally from the 1.1409 low, which confirmed the 1.1476 important support level, managed to pass the equally important 1.2092 area but was halted by 1.2514, both attempts of passing it failing and printing the 1.2647 and 1.2643 highs, respectively. After retracing to 1.2092 … “GBP/USD Facing the 1.2514 Resistance”

Chinese Yuan Strengthens As Investors Pour Into Stocks, Bank Lending Up

The Chinese yuan is strengthening against many of its currency competitors to start the trading week. But while some economic data are boosting the currency on Monday, reports that investors are pouring into the stock market at the state mediaâs direction is generating all the buzz. China Securities Journal, a state-owned publication, published a front-page editorial in which it encouraged everyone to buy stocks. According to the opinion piece, investors were … “Chinese Yuan Strengthens As Investors Pour Into Stocks, Bank Lending Up”

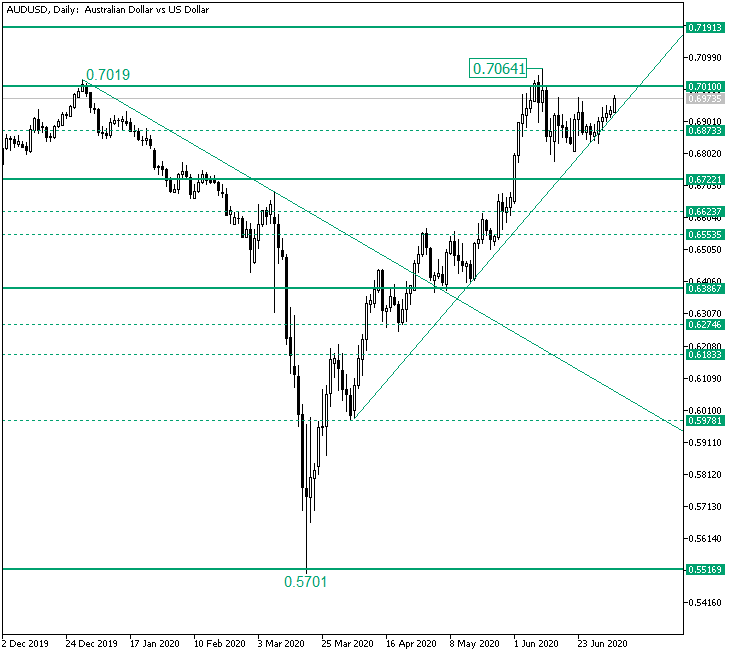

AUD/USD Preparing to Test the 0.7010 Level

The Australian dollar versus the United States dollar currency pair is getting very close to the 0.7010 level. Do the bulls still have enough traction to continue? Long-term perspective The depreciation that started from the 0.7019 high, after the major 0.7010 level was confirmed as resistance, extended until the 0.5701 low. From there a strong rally commenced, one that confirmed the double support made possible by the descending trend and the 0.6386 … “AUD/USD Preparing to Test the 0.7010 Level”

Canadian Dollar Flat As Oil Slumps, Manufacturing Rebounds

The Canadian dollar is trading flat against its G10 currency rivals at the end of the holiday-shortened trading week. The loonie has been gaining against several of its counterparts over the last week, despite an influx of disappointing economic data. With energy prices firmly rebounding and the investors selling the US dollar, could the Canadian dollar have a strong second half? On Friday, the IHS Markit manufacturing purchasing managersâ index climbed to 47.8 … “Canadian Dollar Flat As Oil Slumps, Manufacturing Rebounds”