The Australian dollar rose today. In fact, it was the strongest among most-traded currencies on the Forex market. The Aussie got a boost from positive macroeconomic data, both domestic and Chinese. The Australian Bureau of Statistics reported that retail sales climbed by 16.9% in May on a seasonally adjusted basis. Experts were anticipating the same 16.3% jump as in the previous month. The Australian Industry Group/Housing Industry Association Australian Performance of Construction Index rose from … “Aussie Beats Rivals with Help from Domestic & Chinese Economic Reports”

Month: July 2020

Inverted Head and Shoulders on USD/JPY from 108.05?

The United States dollar versus the Japanese yen currency pair, at first glance, seems to be in bullish hands. But is it so? Long-term perspective The fall that started from the 109.85 high extended, in a primary phase, until the 106.57 firm level, being rejected by its supportive role. However, the bears continued pressuring the price, thus drawing another leg down and etching the 106.07 low. Since 106.07 is very … “Inverted Head and Shoulders on USD/JPY from 108.05?”

Indian Rupee Settles at Three-Month High on Foreign Inflows, Vaccine Hopes

The Indian rupee is settling at its best level against the US dollar in three months as foreign inflows and vaccine hopes elevated the currency. The rupee has been Asiaâs worst-performing currency this year, driven primarily by the coronavirus pandemic and volatility in global financial markets. Could analystsâ forecasts of further appreciation in the second half of 2020 come true? Because the US and other major stock markets have relatively stabilized in recent weeks, … “Indian Rupee Settles at Three-Month High on Foreign Inflows, Vaccine Hopes”

Non-Farm Payrolls Analysis: Good, but as good as it gets, re-closing is rapidly ravage reopening gains

The US economy gained 4.8 million jobs in June, better than expected. Data is from early June when the US economy was reopening at a rapid pace. A raging second wave of coronavirus cases is set to hit employment, including in the long term. “The US never got the virus under control before reopening” – … “Non-Farm Payrolls Analysis: Good, but as good as it gets, re-closing is rapidly ravage reopening gains”

US Dollar Stalls As Economy Creates 4.8 Million Jobs in June, Factory Orders Surge

The US dollar is stalling against many of its G10 currency rivals on Thursday after a strong and better-than-expected June jobs report. The stellar labor reading sparked a rally in the stock market, raising the risk tolerance of traders in equities. After the last couple of weeks of investors being spooked by a resurgence in … “US Dollar Stalls As Economy Creates 4.8 Million Jobs in June, Factory Orders Surge”

Non-Farm Payrolls Cheat Sheet: Three stages of market reaction

Headline Non-Farm Payrolls are set to determine the initial knee-jerk reaction. The political impact of the Unemployment Rate is set to shape the second move ahead of the long weekend. Core unemployment has room to impact stocks when the dust settles. Coronavirus is upending everything – not only the labor market but also the Non-Farm … “Non-Farm Payrolls Cheat Sheet: Three stages of market reaction”

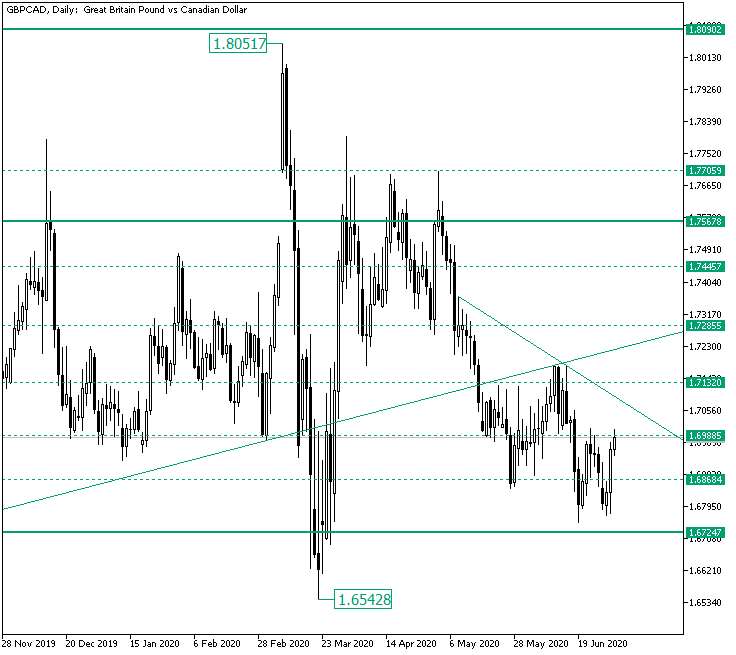

Bulls on GBP/CAD Trying Their Best from 1.6800

The Great Britain pound versus the Canadian dollar currency pair seems not to be willing to go beneath 1.6724. Can the bulls put the double bottom formation to their use? Long-term perspective The depreciation that started after the third unsuccessful bullish attempt to go beyond the firm 1.7567 resistance level back in May extended a hair away from the solid support of 1.6724. To be more exact, the 1.6800 psychological level — not … “Bulls on GBP/CAD Trying Their Best from 1.6800”

ADP Analysis: Low-hanging fruit bounce, not a recovery, S&P 500 rally seems unsustainable

ADP reported an increase of 2.369 million private-sector jobs in June, below expectations. Even after the whopping upward revision for May, job losses are devastating. After staging the best quarter since 1998, another S&P seems unreasonable. When an increase of over two million jobs – and an upward revision worth nearly six million – are … “ADP Analysis: Low-hanging fruit bounce, not a recovery, S&P 500 rally seems unsustainable”

US Elections: Three reasons why Biden’s lead over Trump is far greater than Clinton’s in 2016

There are fewer undecideds in 2020, making Biden’s lead more solid. Biden is leading by around 9% while Clinton maxed out at 7%, only after the convention. The electoral college – which Trump while losing the popular vote – is more aligned with the national map. Fox News’ polls point to a landslide loss for … “US Elections: Three reasons why Biden’s lead over Trump is far greater than Clinton’s in 2016”