Benefiting from the misery of others – there was nothing to support the pound, but the dollar’s weakness proved more influential. Will this trend extend or reverse? An updated view on the US labor market via the all-important Non-Farm Payrolls, the Bank of England’s rate decision, and coronavirus-related news is all of the interest.

This week in GBP/USD: All about dollar weakness

Dollar down – that was the dominating theme in markets, and it had several drivers. The world’s largest economy has been showing more signs of weakness, and politicians have failed to agree on a new relief package – triggering a fiscal-cliff in special federal employment benefits.

US Gross Domestic Product plunged by 32.9% annualized, better than expected but still the worst in history. Perhaps the bigger blow came from continuing claims, which jumped to 17 million in the same week when Non-Farm Payrolls surveys are held.

More: US GDP Analysis: Could have been worse, but will not improve, winners and losers in markets

The Federal Reserve preempted its scheduled meeting by announcing that some special lending schemes will be extended through year-end – showing the bank’s commitment to non-stop support for the economy

The Fed then announced its decision, striking a more dovish tone. Jerome Powell, Chairman of the Federal Reserve, said that high-frequency data is pointing to an economic softening since coronavirus cases began rising in mid-June. While he committed to doing whatever is needed, he was short on specifics, allowing the dollar to edge up.

It seems that Powell and his colleagues prefer Congress to lead – using their spending powers, which the Fed does not possess. Republicans and Democrats were at odds over further stimulus – especially the all-important federal unemployment benefits. Depressed US bond-yields – regardless of YCC – have also been weighing on the dollar.

Coronavirus statistics remained worrying, with daily deaths rising well above 1,100, while total mortalities surpassed 150,000. The determination comes alongside more hopes for a vaccine – Moderna is kicking off its Phase 3 trial, racing against AstraZeneca and the University of Oxford. That may have pushed the safe-haven dollar down – and it had already been unwinding the risk-aversion trade.

The UK COVID-19 situation remains under control, but the number of cases is rising once again and the government slapped restrictions on around. 4.3 million people in northern England.

That increase did not stop Prime Minister Boris Johnson from announcing several measures against European countries were infections are moving up – angering Spain in particular.

EU-UK Brexit talks remain deadlocked, and investors expect a breakthrough only closer to the deadline – the end of the year when the transition period expires.

Sino-British relations have not improved after the UK canceled the extradition treaty with Hong Kong. While the “special relationship” with America remains close – a breakthrough in trade talks is unlikely before next year.

UK events: Bailey is back, Brexit continues

Brexit breakthrough or breakdown of talks? None of the above, most probably. Reports suggest that both the EU and the UK are unlikely to move – nor abandon negotiations – during the summer. Any unlikely development would rock the pound.

The UK’s gradual exit from COVID-19-related restrictions is set to continue, but any flareups – as seen elsewhere – may weigh on sterling.

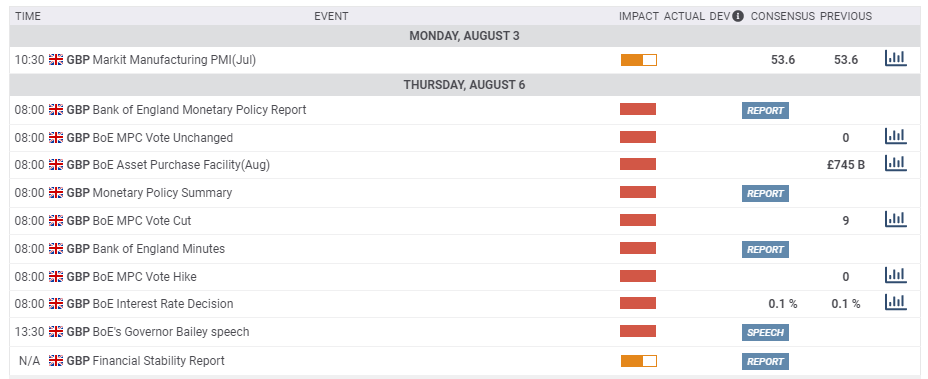

The main event of the week as the Bank of England’s “Super Thursday.” The BOE is set to leave its interest rate unchanged at 0.1% and the Quantitative Easing program at £745 billion. The focus will be on what makes it “super” – the Monetary Policy Report.

Andrew Bailey, Governor of the Bank of England, is set to hold a press conference and provide details on the current economic situation, growth prospects, and what the BOE is and is not ready to do. Some have expressed concerns about the bank’s independence – as it is financing massive fiscal stimulus.

Investors prefer any BOE help that would lower the government’s borrowing costs and support the recovery. With inflation out of sight, any distancing between the bank and the state would be seen unfavorably and could hurt the pound.

Apart from additional QE, investors will want to know where the BOE stands on negative interest rates. Bailey previously said the topic is under “active consideration” – pounding the pound – but later seemed to cool down to the idea. If any of his colleagues vote for a rate cut – or if he hints that option is on the cards – sterling could suffer.

Overall, the pound needs more QE and less talk of sub-zero borrowing costs to rise.

See Bank of England Preview: Three things that will move the pound on “Super Thursday”

Here is the list of UK events from the FXStreet calendar:

US events: Full Non-Farm Payrolls buildup, coronavirus news eyed

Is the coronavirus curve flattening? Cases have stopped rising, but deaths are on a worrying uptrend. Figures coming out from Florida, California, Texas, and other states will probably move markets.

If the statistics worsen, that would adverse for markets – but could also push lawmakers in Washington to strike a deal and provide more help to the struggling economy. Both sides want to be seen as helping the public in an election year.

US politics: Joe Biden, the presumptive Democratic candidate, is set to announce his pick for a running mate during the week, spicing up the race. Recent opinion polls have shown that President Donald Trump has somewhat narrowed the gap, but he remains behind. Markets have yet to respond to the elections.

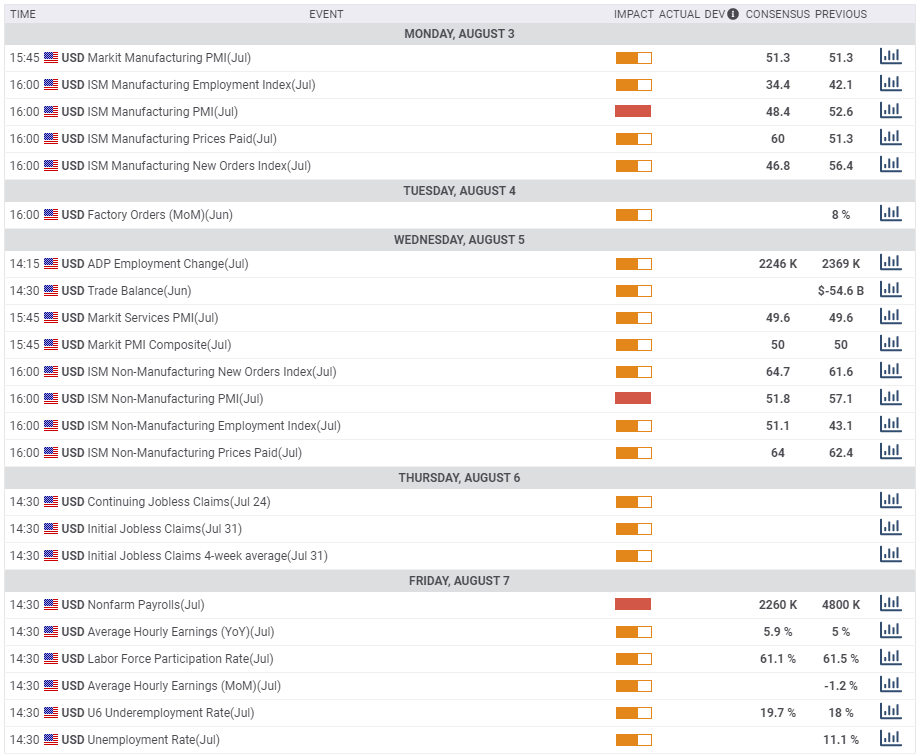

The US economic calendar is packed once again – with a full buildup to Friday’s job figures. The ISM Manufacturing Purchasing Managers’ Index for July provides the first clue with the employment component potentially outperforming the headline figure – the industry is less impacted by the resurgence of the virus.

Wednesday features ADP’s labor market report, which has been useful at pointing to the general trends – but its numbers have often been far from the official ones. America’s largest payroll provider will likely report a more modest increase in positions in July after printing 2.369 million in June.

The ISM Non-Manufacturing PMI has likely fallen in July as the services sector suffered both a loss of business and potential job contraction. The employment component will be of particular interest ahead of Friday’s figures.

While weekly jobless claims figures are for the weeks following the one in which the NFP surveys are held, they provide up to date data about the state of the labor market and have room to move markets.

Finally, the Non-Farm Payrolls report can go either way – a third consecutive month of job growth or a downturn. The chance of repeating June’s 4.8 million increase is meager. The same goes for the unemployment rate, which dropped to 11.1 in the previous month and may now move up.

Wage growth is set to remain elevated but will likely be ignored as it is skewed – many of the position losses were among low earners. On the other hand, the U-6 underemployment rate – aka the “real unemployment rate.”

The high level of uncertainty about July’s figures – the first full month after COVID-19 raised its head in mid-June – implies a strong reaction in markets.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar looks overbought – the Relative Strength Index on the daily chart is above 70, indicating a correction. Cable broke above the 200-day Simple Moving Average and benefits from upside momentum. It also smashed the long-term downtrend resistance line.

Some support awaits at 1.3015, followed by 1.3065, a peak that was hit in February. Lower, 1.2870, which was a cushion back in February. It is followed by 1.2815, June’s peak, and then by 1.2770, a stepping stone on the way up. The next lines so watch are 1.27, 1.2660, and 1.2540.

Resistance is at the recent swing high of 1.3145, followed by levels dating back to earlier in the year – 1.32 and 1.3270. Further above, 1.3390 and 1.3510 come into play.

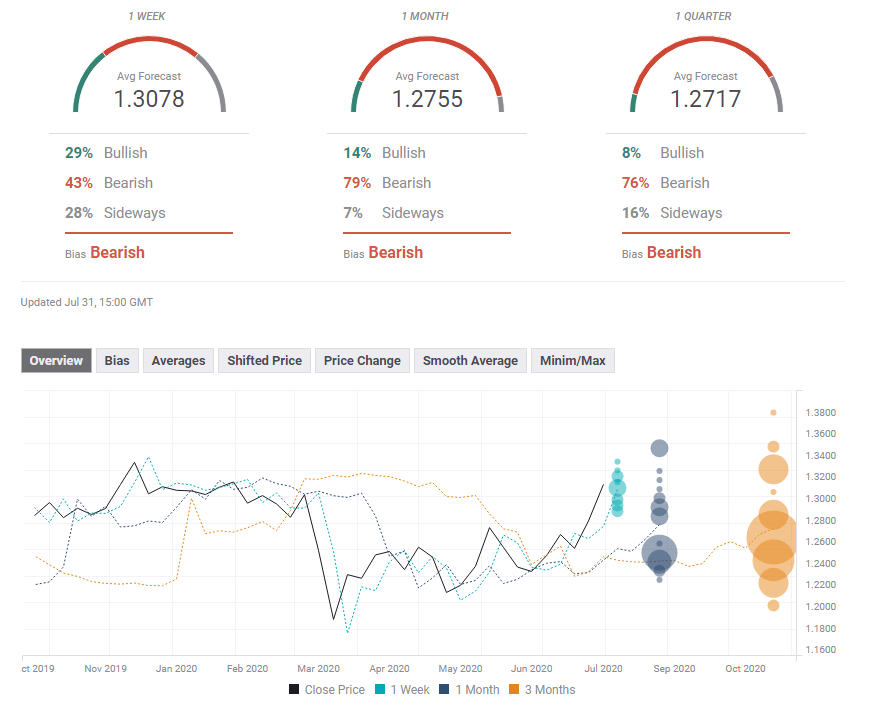

GBP/USD Sentiment

This Schadenfreude – finding pleasure in the suffering of others – may come to its limits due to the rising UK curve, overbought conditions, and other factors.

The FXStreet Forecast Poll is showing a doubtful crowd – experts foresee a substantial drop in the pound, with a minor drop in the short term and a greater one later on. The bearish forecasts come despite an upgrade in the average targets.

Related Reads

Get the 5 most predictable currency pairs