“Big jobs number on Friday” – said President Donald Trump to Fox News and the public ahead of July’s all-important Non-Farm Payrolls report.

It doesn’t look that way – the NFP could be a small number or even negative.

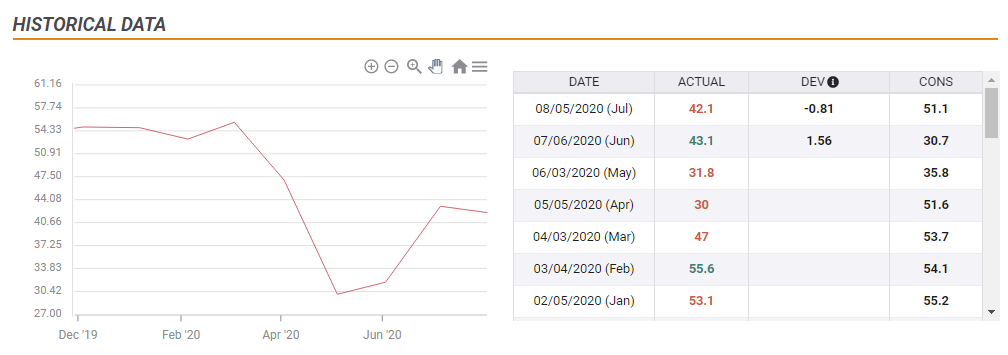

The ISM Non-Manufacturing Purchasing Managers’ Index’s headline figure may resonate with Trump’s trumping up of the US economy – it rose to 58.1 points against a projected fall. However, the employment component in America’s services sector – consisting of around 70% of the economy – is suffering. The gauge fell to 42.1, well below estimates of 51.1, under June’s score of 43.1, and pointing to contraction.

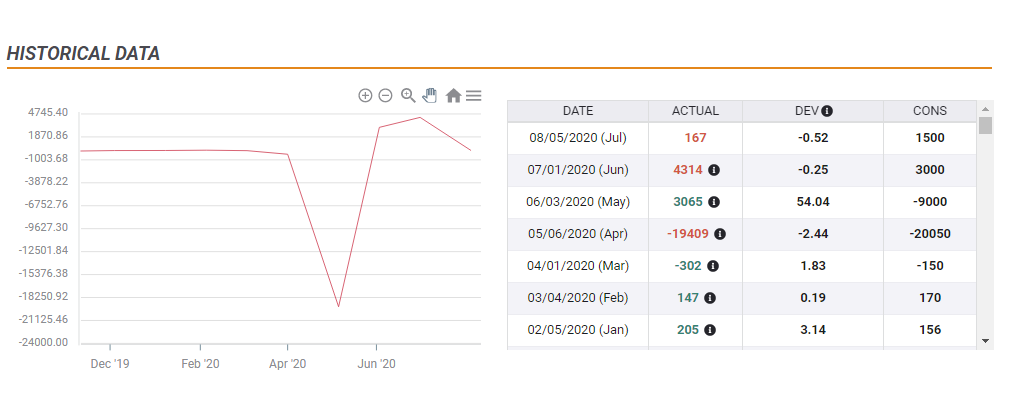

Earlier, ADP, America’s largest payroll provider, reported a meager increase of 167,000 private-sector jobs, substantially below 1.5 million projected. While the firm has been finding it hard to hit the nail on the head – missing the official numbers – it does point to the general trend.

In pre-pandemic times, an increase of 167K would be considered average, but now it points to the stalling of the recovery.

Earlier in the week, the ISM Manufacturing PMI also exceeded estimates but pointed to contraction in employment, similar to the larger services sector.

All in all, the figures published so far are pointing to a stall in the recovery due to the resurgence of coronavirus cases since mid-June.

NFP expectations and markets

Analysts will now be adjusting estimates for Friday’s official Burea of Labor Statistics’ Non-Farm Payrolls. The minority of banks that talked about a loss of positions may turn into a majority, and those foreseeing another multi-million restoration of employment are set to lower their estimates.

The US dollar will likely extend its falls after these numbers and as fresh Non-Farm Payrolls come in. EUR/USD’s flirt with 1.19 may turn into a breakout and GBP/USD may be eyeing 1.32. Gold, which topped $2,000 on Tuesday, could extend its gains.

Even if NFP is positive like ADP’s figure, the chances of a “big number” are falling. In case America’s labor market squeezes after only two positive months, the effect that would exacerbate the dollar’s decline and potentially push gold to even higher ground.

It also has political implications.

See 2020 Elections: Trump is losing his economic edge, for three robust reasons

Get the 5 most predictable currency pairs

US Data Analysis: Big jobs number? Negative NFP looks more likely, trends could extend in gold, dollar