The Bank of England’s “glass-half-full” approach eventually surrendered to fears about the US economy, Sino-American relations, and coronavirus. Apart from these themes, two top-tier UK figures and an update on US consumption are closely watched.

This week in GBP/USD: Bailey gives, Trump takes

BOE boost: The Bank of England painted a rosier than expected picture of the economy in its “Super Thursday” event. The “Old Lady” upgraded 2020 growth forecasts, said high-frequency data is upbeat and played down the chances of negative rates. That sent the pound higher.

See BOE Analysis: Three pound-positive on Super Thursday open door to new highs

While Andrew Bailey, Governor of the Bank of England, vowed to continue supporting the economy, the government hinted it might have to withdraw some of the stimuli. Rishi Sunak, Chancellor of the Exchequer, said that the successful furlough scheme could not go forever.

The program keeps Brits attached to their jobs by paying them most of their salaries but is set to expire in October. Sunak took some of the sting out of sterling.

UK coronavirus cases are edging higher, but flareups remain localized. The Scottish city of Aberdeen joined Leicester, Manchester, and others in slapping restrictions, while Britain also limited entry from additional countries on the continent.

While Brexit talks are going nowhere fast, the government allocated around £355 million to set up a customs border in the Irish Sea – as stipulated by the Withdrawal Agreement but contrary to Prime Minister Boris Johnson’s promises. The PM is coming under increased pressure, potentially limiting his ability to enact reforms.

Siino-American tensions intensified after President Donald Trump – trailing in the polls – slapped restrictions against TikTok and WeChat, two prominent Chinese tech firms. The moves dampened the market mood and sent safe-haven flows into the dollar.

Late in the week, a report suggesting the US will slap sanctions on Carie Lam – Hong Kong’s leader – added fuel to the fire and supported the greenback.

Trump also threatened to intervene with Executive Orders to break the deadlock between Democrats and Republicans on the next relief package. At the time of writing, both sides remain apart while millions of unemployed Americans stopped receiving the federal top-up of $600/week.

Non-Farm Payrolls showed an increase of 1.763 million jobs, better than estimated but pointing to a deceleration in hiring. The unemployment rate stands at 10.2% in July and the underemployment level at 16.5%.

Other programs, help to states and municipalities, health funding, are all on the negotiating table. Markets remain optimistic that politicians would strike a deal in an election year.

The need for additional help stems from the surge in coronavirus since mid-June. The cases and deaths’ curves are showing tentative signs of declining as of early August, yet the damage has been done.

UK events: Coronavirus caution, jobs, and GDP

With coronavirus raising its ugly head in Europe, is Britain also seeing a similar increase? So far, the UK’s recent figures are better, but any increase would raise the chances of a lockdown on London – perhaps the most significant threat to the recovery.

Brexit and US-UK trade talks both carry low expectations for a breakthrough in the near future, allowing for any piece of good news to boost sterling. On the other hand, the Sino-British front has calmed, but if London is dragged by Washington to a fresh fight with Beijing, the pound could suffer.

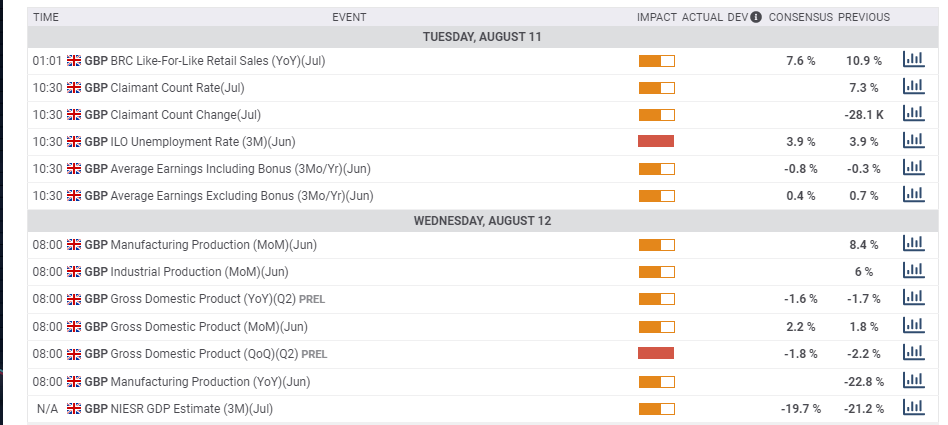

Two top-tier economic indicators await cable traders. Tuesday’s jobs report will likely remain robust – showing the success of the government’s economic response, far better than its record on the health front. The unemployment rate is set to remain at 3.9% in June – exactly where it was in January before coronavirus grabbed the headlines.

The second event is Gross Domestic Product figures for the second quarter. Economists foresee a bounce in June to mitigate the crash already reported for April and May – resulting in a minor decline of 1.8%, similar to -2.2% in the first quarter. That would be excellent news, as other developed countries have suffered more than the UK.

Any disappointment would pressure PM Johnson to prolong emergency policy schemes for longer.

Here is the list of UK events from the FXStreet calendar:

US events: Double-dose of politics, coronavirus, and the consumer

Daily updates from Florida, Texas, California – and national numbers – remain of high interest. It is essential to note that figures tend to fall on Monday due to the “weekend effect.”

While improving statistics may boost the dollar, they may also disincentivize Republicans to opt for multi-trillion support, thus potentially turning good health news into a dire economic development. Both sides expect a deal in the next few days. For investors, a bigger deal is better while protracted talks could be harmful.

The clash between the world’s largest economies will probably garner even greater attention – as American and Chinese trade negotiators meet to take stock of the Phase One deal. Markets have been able to brush through the rhetoric while calm on the commerce front continued.

However, any threat to the accord may already trigger more significant jitters. The upcoming party conventions – key events in the electoral calendar – may push the Trump administration to take bolder steps, especially if he remains behind in the polls.

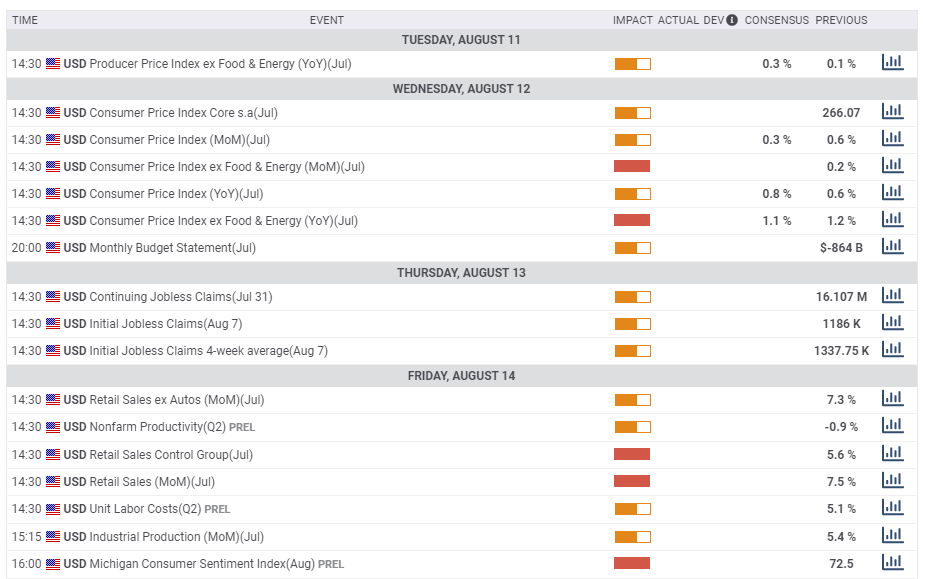

The economic calendar focuses on the consumer, kicking of with inflation figures on Wednesday. The Core Consumer Price Index is set to remain close to 1%, well below the Federal Reserve’s 2% target. Coronavirus has been a deflationary shock.

Weekly jobless claims are of interest on Thursday, and investors will want to see if the previous week’s encouraging figures are a one-off or the beginning of improvement. Weekly initial claims will likely print over one million once again.

Friday features two critical events. Retail sales statistics for July will likely show a slowdown in the recovery – and perhaps a downward turn. Consumption is central to the US economy and any change is critical. Apart from the headline figure, markets will eye the Control Group.

The second significant release is the University of Michigan’s preliminary Consumer Sentiment Index for August. Is the recent downtick in COVID-19 already encouraging consumption? Or is the lack of additional employment benefits weighing on confidence? The forward-looking indicator has the last word of the week.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar has slipped back below the long-term downtrend resistance line after fighting hard to break above it in late July. That is a bearish sign, but there is a sliver lining – the downward move pushes the Relative Strength Index below 70 – exiting overbought conditions. Technically, that is the much-needed correction bulls need to resume the rally.

GBP/USD continues trading above the 50, 100, and 200-day Simple Moving Averages, also implying the potential for the upside – if the downtrend resistance line is recaptured.

Support awaits at 1.2980, which was a swing low in late July. It is followed by 1.2880, a support line from early in the year. Further down, 1.2815, 1.2770, 1.27, 1.2660, and 1.2530 are next.

Resistance is at 1.3170, July’s high, followed by March’s swing high of 1.32. It is followed by 1.3270, 1.3350, and finally the post-elections peak of 1.3510.

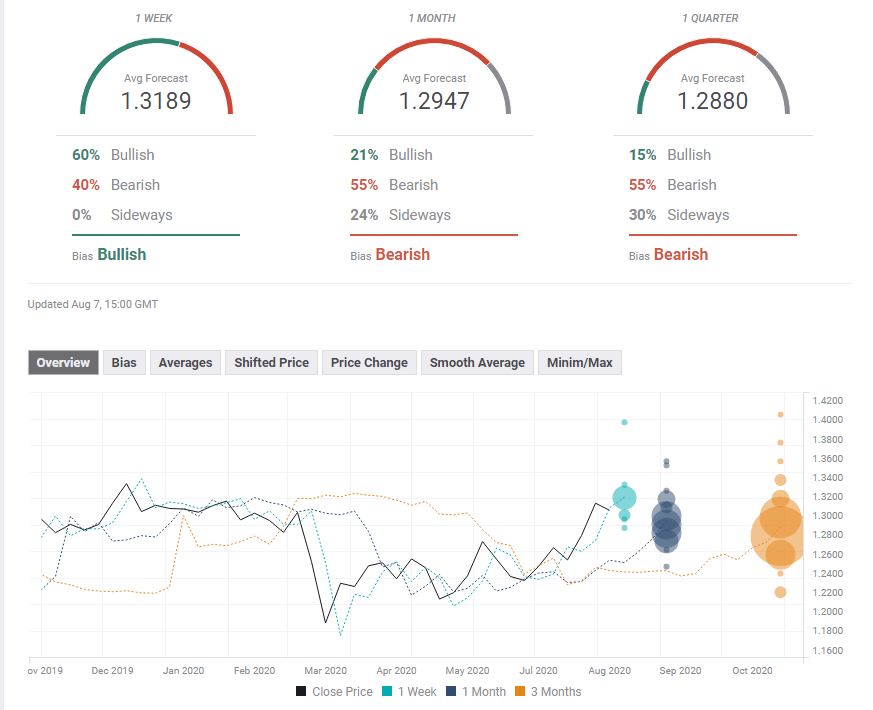

GBP/USD Sentiment

Fears that the UK economy will struggle from here onward, safe-haven flows into the dollar, and further unwinding of overbought conditions may continue weighing on GBP/USD.

The FXStreet Forecast Poll is showing that experts are bullish in the short-term, but see a downward spiral later on, despite upgrading all targets.

Related Reads

Get the 5 most predictable currency pairs