The Canadian dollar today surged against its US peer as the latter eas reeling from yesterday’s speech by the Fed Chair Jerome Powell, which unveiled a new inflation policy. The USD/CAD currency pair today fell for the fourth consecutive session to lows last seen in January as the greenback remained under intense selling pressure. The … “Canadian Dollar Surges Against US Peer, Later falls on GDP Data”

Month: August 2020

Abe’s Departure Analysis: USD/JPY buying opportunity? Abenomics is here to stay

Japanese Prime Minister Shinzo Abe is set to step down after nearly eight years in office. The safe-haven yen reacted with a rise amid uncertainty about the succession. Economic policy is set to remain on course under any replacement, leaving room to recover. The end of an era – that is how several media outlets … “Abe’s Departure Analysis: USD/JPY buying opportunity? Abenomics is here to stay”

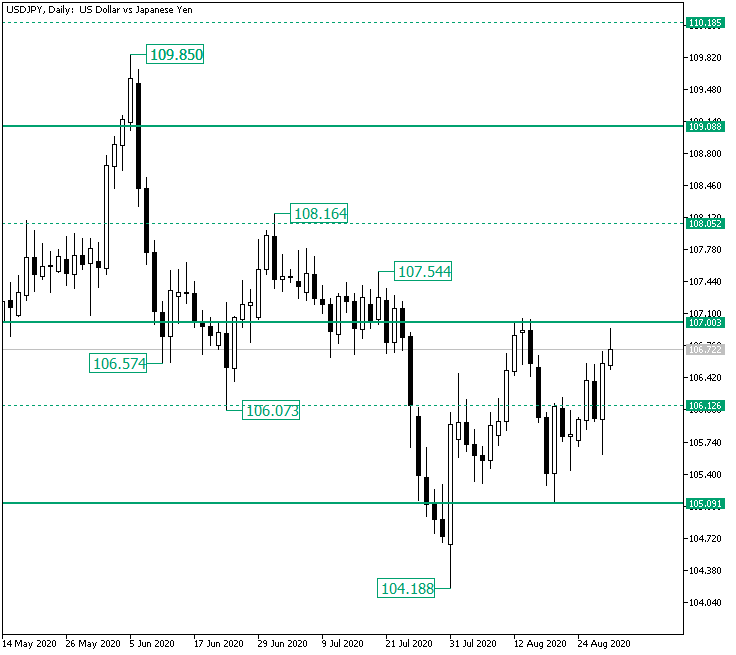

USD/JPY Confronting the 107.00 Resistance Level

The US dollar versus the Japanese yen currency pair seems to be willing to pass the 107.00 level. Will the bears defend it? Long-term perspective The fall from the 109.85 high extended until the 104.18 low. The high is part of a bullish overextension above the firm 109.00 level, while the low an overextension by the bears in relation to the major 105.09 level. The decline from the peak to the bottom passed yet another area of interest, the psychological level … “USD/JPY Confronting the 107.00 Resistance Level”

Euro Swings Between Gains and Losses on Powellâs Speech

The euro today alternated between gains and losses against the US dollar swinging wildly between gains and losses ahead of Jerome Powell speech. The EUR/USD currency pair spiked higher and then crashed lower during the Fed Chair’s speech creating uncertain trading conditions for most traders. The EUR/USD currency pair today spiked to a high of … “Euro Swings Between Gains and Losses on Powellâs Speech”

Powell Quick Analysis: Fed fires on all cylinders, three factors fueling gold stocks, downing dollar

Fed Chair Powell has introduced a new policy framework, allowing for average inflation targeting as expected. Details are lacking, opening the door to inflation running hot. The bank will also prioritize employment over price rises. The Powell Put is alive and kicking – Jerome Powell, Chairman of the Federal Reserve, announced a major dovish paradigm … “Powell Quick Analysis: Fed fires on all cylinders, three factors fueling gold stocks, downing dollar”

US Dollar Slumps As Federal Reserve Announces New Inflation Approach

The US dollar is slumping toward the end of the trading week after the Federal Reserve announced a new approach to inflation that would keep interest rates lower for longer. The greenback is also in the red after initial jobless claims topped one million for the second consecutive week. With inflation almost certain for the next few years, does this spell bad news for the buck? Fed Chair Jerome Powell announced a major … “US Dollar Slumps As Federal Reserve Announces New Inflation Approach”

Powell Speech Cheat Sheet: Three scenarios for the dollar and stocks

Fed Chair Powell is set to announce a change allowing for higher inflation. Providing details about the potential heat up could send the dollar down. Refraining from rocking the boat would boost the greenback. Making Jackson Hole great again – even if the speech is virtual. Jerome Powell, Chairman of the Federal Reserve, will be … “Powell Speech Cheat Sheet: Three scenarios for the dollar and stocks”

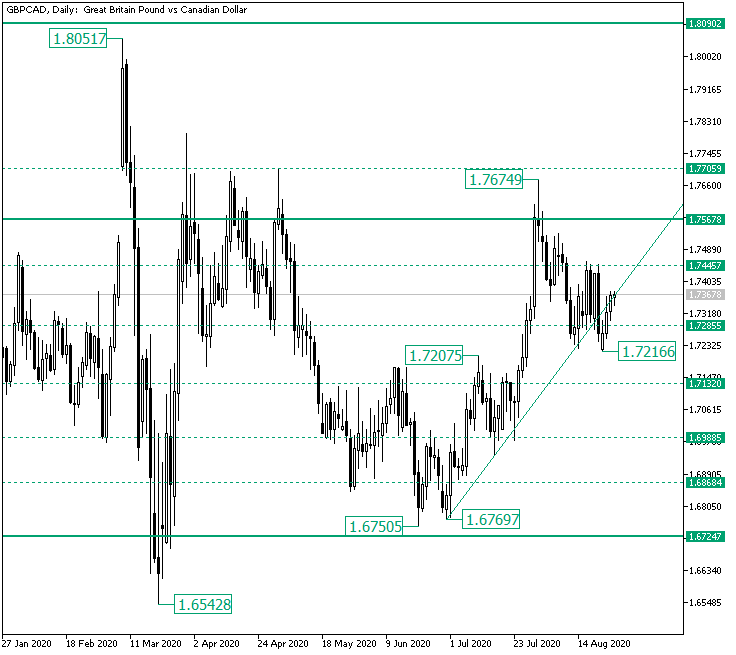

GBP/CAD Recovers from 1.7285

The Great Britain pound versus the Canadian dollar currency pair succeded in recovering after the price went beneath 1.7216. But is this a sustainable rise? Long-term perspective The rally from the 1.6542 low, limited by the 1.7567 resistance level, allowed a fall to take place, one that almost touched the 1.6724 area, but stopped after printing the 1.6750 and 1.6769 lows. From the lows, the bulls attempted another push against the firm … “GBP/CAD Recovers from 1.7285”

South Korean Won Choppy As Investors Fear Potential COVID-19 Lockdown

The South Korean won is trading choppy in the middle of the trading week as investors begin to weigh the possibility of another lockdown related to the coronavirus pandemic. Despite South Korea flattening the curve in March, the nation has been experiencing an uptick in infections for most of August. The country is already in a recession, so another wave of restrictions could exacerbate the downturn. So far, South Korea has more than 18,000 confirmed cases of COVID-19, with … “South Korean Won Choppy As Investors Fear Potential COVID-19 Lockdown”

Greenback Weak, Fails to Get Support from US Durable Goods Orders

The US dollar was very weak today, surprisingly so considering very good domestic macroeconomic data. While the greenback managed to retain some of its gains versus the euro, the US currency fell against many other major rivals. The US Census Bureau reported that durable goods orders climbed by 11.2% in July. That is a far bigger increase than 4.4% predicted by specialists and a higher rate than 7.6% … “Greenback Weak, Fails to Get Support from US Durable Goods Orders”