The Japanese yen was trading either flat or higher versus other most-traded currencies today. Today’s economic data in Japan was good, unlike yesterday’s inflation report. Other news was also generally positive. The Bank of Japan reported that the Services Producer Price Index rose by 1.2% in July, year-on-year, after increasing by 0.9% in June (revised, 0.8% before the revision). Experts were anticipating a mild slowdown to 0.8%. According … “Japanese Yen Flat-to-Higher After Economic Data, Other News”

Month: August 2020

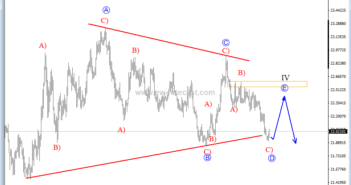

Can USDMXN Break Out Of A Triangle?

Hello traders! USDMXN is trading sideways since the beginning of June and it looks like it is forming a big, bearish Elliott wave triangle in wave IV that can send the price even lower for wave V, but seems like one more intraday wave up is still missing before we may see a continuation to … “Can USDMXN Break Out Of A Triangle?”

NZ Dollar Rises Despite Shrinking Trade Surplus

According to data released today, New Zealand’s trade balance surplus shrank last month. But that did not prevent the New Zealand dollar from rising. In fact, it was the strongest among the most-traded currencies. Statistics New Zealand reported that the trade balance showed a surplus of NZ$282 million in July. It was a sharp drop from the previous month’s revised value of NZ$475 million but it was … “NZ Dollar Rises Despite Shrinking Trade Surplus”

US GDP Preview: Will the corona-quarter look better at second sight? Not necessarily

The first revision to second-quarter GDP is set to show a minor upgrade. Several upside surprises in US figures indicate a better result. On the other hand, coronavirus’ resurgence in June may result in worse data. Confirming the catastrophe, albeit with a marginal upgrade – that is what economists are expecting for the revised Gross … “US GDP Preview: Will the corona-quarter look better at second sight? Not necessarily”

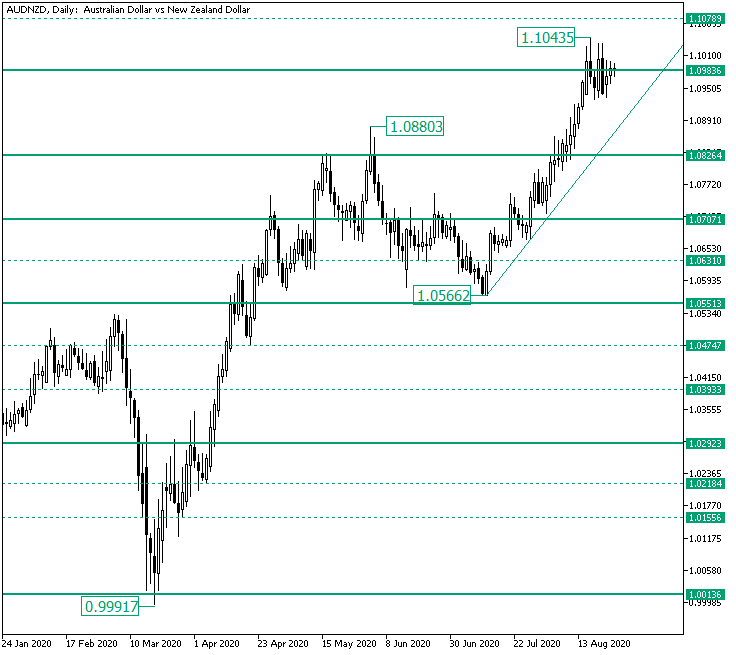

AUD/NZD Consolidates Around 1.0983

The Australian versus the New Zealand dollar currency pair seems to have entered into a consolidation phase. Is this only a pause of the bullish advancement? Long-term perspective The rally from the 0.9991 low extended — in a first phase — until the 1.0880 high. From there, a corrective movement began, one that after finding support a hair away from 1.0551 — and etching the 1.0566 low — fueled a rise that printed the 1.1043 high. Even … “AUD/NZD Consolidates Around 1.0983”

South African Rand Extends Winning Streak As Global Sentiment Improves

The South African rand is extending its winning streak against the US dollar as it continues to find support in global foreign exchange markets. With a fierce risk appetite and general optimism in the broader financial markets, investors are pouring into the rand. As the number of confirmed coronavirus cases comes down and the central bank indicating tightness in monetary policy, the rand may emerge as one of the top emerging market currencies. According to the South … “South African Rand Extends Winning Streak As Global Sentiment Improves”

Euro Rallies Against US Dollar on German GDP and IFO, Later Falls

The euro today rallied higher against the US dollar boosted by positive investor sentiment as the US and China reported progress in the latest round of trade talks. The EUR/USD currency pair later gave up its gains after the release of mixed US data amid a lack of volatility in the Forex market ending up … “Euro Rallies Against US Dollar on German GDP and IFO, Later Falls”

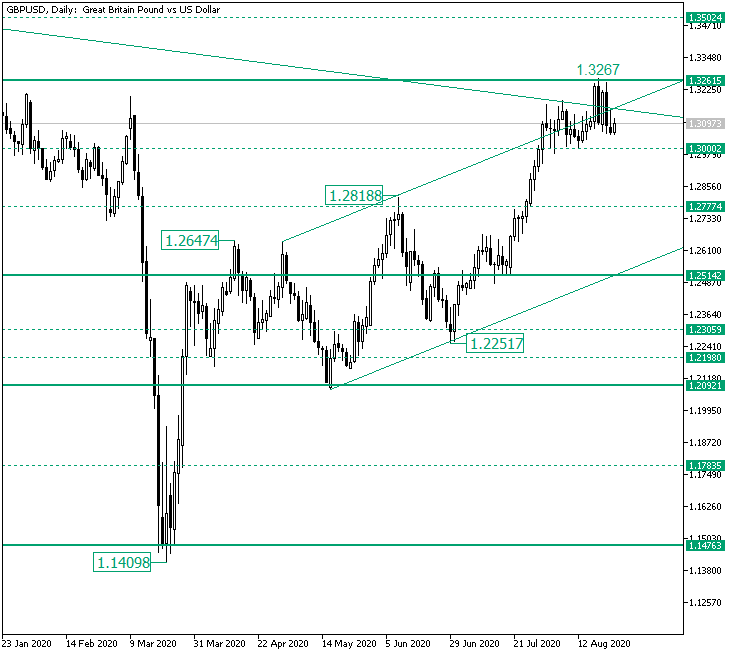

Bulls Might Try a New March Towards 1.3261 on GBP/USD

The Great Britain pound versus the US dollar currency pair, although it was indecisive, seems to be searching to channel its momentum towards a direction. Will this be the continuation of the appreciation? Long-term perspective After the rally from the 1.1409 low to the 1.2647 high, the price began shaping an ascending trend. The new trend performed very well in terms of facilitating the bulls in gaining ground. In fact, the bulls were determined enough so … “Bulls Might Try a New March Towards 1.3261 on GBP/USD”

NZ Dollar Firm amid Positive Market Sentiment, Ignores Historic Drop of Retail Sales Values

The New Zealand dollar traded higher against the vast majority of most-traded currencies today, including other commodity currencies, which themselves were firm thanks to the positive market sentiment. Today’s macroeconomic data released in New Zealand was not very good but that did not prevent the kiwi from rising. Investors were in a positive mood after Financial Times reported that the US government wants to bypass … “NZ Dollar Firm amid Positive Market Sentiment, Ignores Historic Drop of Retail Sales Values”

USD/CNY Drops As PBoC Injects More Liquidity Into Economy

The Chinese yuan is enjoying another session of modest gains to start the trading week, with much of the strength coming at the expense of the US dollar. The yuanâs ascent on Monday is being driven primarily on the central bank injecting more liquidity into the financial system. Could the yuan test 6.8 next? The currencyâs performance may hinge on US-China trade talks as it will be quiet on the data front this week. On Monday, the Peopleâs … “USD/CNY Drops As PBoC Injects More Liquidity Into Economy”