The Sterling pound today rallied against the weak dollar ignoring the uncertainty surrounding the Brexit talks as investor sentiment remained decidedly bullish. The GBP/USD currency pair today extended its rally for the third consecutive day driven by the greenback’s overall weakness and positive UK macro reports. The GBP/USD currency pair today rose from a low … “Sterling Rallies Against Dollar on Brexit Optimism and UK GDP”

Month: September 2020

Canadian Dollar Rises as GDP Continues to Grow, Oil Prices Rise

Commodity currencies were the clear winners today, and the Canadian dollar was among them. It was trading on par with its Australian and New Zealand counterparts but gained against major rivals. Market analysts speculated that such behavior was a result of month-end flows, which drove the US dollar down, though the Canadian currency has its own factors to support it. Statistics Canada reported that gross … “Canadian Dollar Rises as GDP Continues to Grow, Oil Prices Rise”

US Dollar Mixed As GDP Beats Estimates, Fiscal Stimulus Hopes Rise

The US dollar is trading mixed against several currency counterparts midweek as investors focus more on economic data and fiscal stimulus instead of the first 2020 presidential debate between President Donald Trump and former Vice President Joe Biden. With growing confidence in the broader financial market, the greenback could face pressure in October, but electoral uncertainty might cap its decline. According to the US Bureau of Economic Analysis (BEA), … “US Dollar Mixed As GDP Beats Estimates, Fiscal Stimulus Hopes Rise”

Chinese Yuan Jumps on Better-Than-Expected Manufacturing Activity

The Chinese yuan is looking to extend its modest winning streak this week, buoyed by better-than-expected manufacturing and non-manufacturing data. Global financial markets have been waiting for these figures to see how the worldâs second-largest economy is faring in the aftermath of the coronavirus pandemic. While the numbers are positive, they still suggest sluggishness in China. According to the National Bureau of Statistics (NBS), the manufacturing purchasing managersâ index (PMI) climbed to 51.5 … “Chinese Yuan Jumps on Better-Than-Expected Manufacturing Activity”

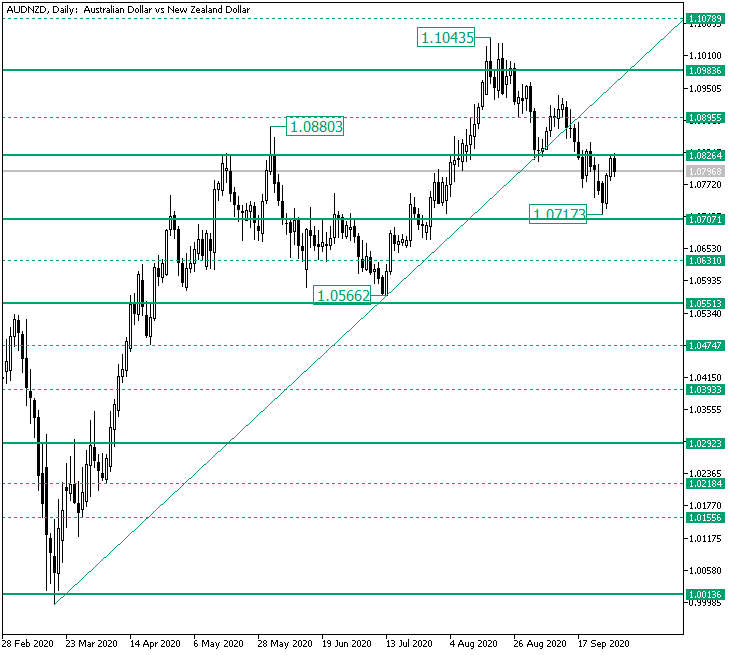

Bulls Attempting Recovery on AUD/NZD from 1.0717?

The Australian versus the New Zealand dollar currency pair seems to be unwilling to go any lower. It’s the bulls behind all this, or a new depreciation is just around the corner? Long-term perspective After the rally that started from the 1.0013 support area and the correction that extends from the 1.0880 high to the 1.0566 low, the price continued until the 1.1043 peak. But as the peak formed above the major 1.0983 level and the following … “Bulls Attempting Recovery on AUD/NZD from 1.0717?”

Euro Rallies to 1-Week Highs Driven by Investor Risk Appetite

The euro today rallied against the US dollar despite the release of mixed macro prints from across the euro area driven by the resurgent investor risk appetite. The EUR/USD currency pair’s rally was also boosted by the greenback’s selloff, which started yesterday amid hopes of a US coronavirus stimulus package. The EUR/USD currency pair today … “Euro Rallies to 1-Week Highs Driven by Investor Risk Appetite”

USD/KRW Unchanged As Data Disappoints Struggling South Korean Economy

The South Korean won is trading sideways against the US dollar on Tuesday as the national economy failed to improve in August as the effects of COVID-19 continue to linger in one of Asia’s biggest economies. With the coronavirus pandemic diminishing in Seoul, could one of Asiaâs worst-performing currencies turn things around in the final quarter of 2020? Industrial output fell 0.7% in August, down from the 1.9% increase in July. The annualized rate dropped 3%, worse than … “USD/KRW Unchanged As Data Disappoints Struggling South Korean Economy”

Presidential Debate Preview: Trump may lose due to his own buildup, market implications

The first presidential debate is set to shake up the elections campaign. President Trump’s playing down of challenger Biden’s skills may turn into a double-edged sword. Markets will move on implications for a new fiscal relief package. “Sleepy Joe” is what President Donald Trump calls his opponent and former Vice-President Joe Biden. Mocking a political … “Presidential Debate Preview: Trump may lose due to his own buildup, market implications”

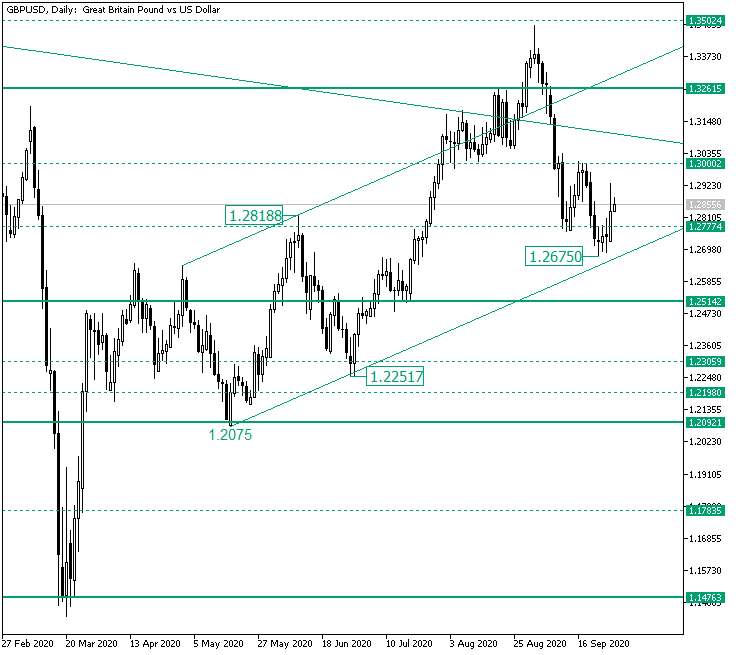

Bulls Back on GBP/USD from 1.2675?

The Great Britain pound versus the US dollar currency pair seems to have shifted the course. Is this the real thing, or it’s just the bears preparing a new depreciation? Long-term perspective After the rally started by the confirmation of 1.1476 as support, the price sprang an ascending movement that stopped near the 1.3502 intermediary level. However, shortly after, the price dropped under the area it had just conquered, an area defined by the 1.3261 level, … “Bulls Back on GBP/USD from 1.2675?”

Australian Dollar Gains on Improving Sentiment, Changing Outlook for Interest Rate Cut

The Australian dollar was extremely strong on Monday, second only to the Great Britain pound. There were two likely reasons for that. The first one was the positive general market sentiment, which was favoring riskier assets. The second one was the changing outlook for the timing of an interest rate cut from the Reserve Bank of Australia. Investors were in a positive mood at the start of the week as the rally in the stock market that has started on Friday … “Australian Dollar Gains on Improving Sentiment, Changing Outlook for Interest Rate Cut”