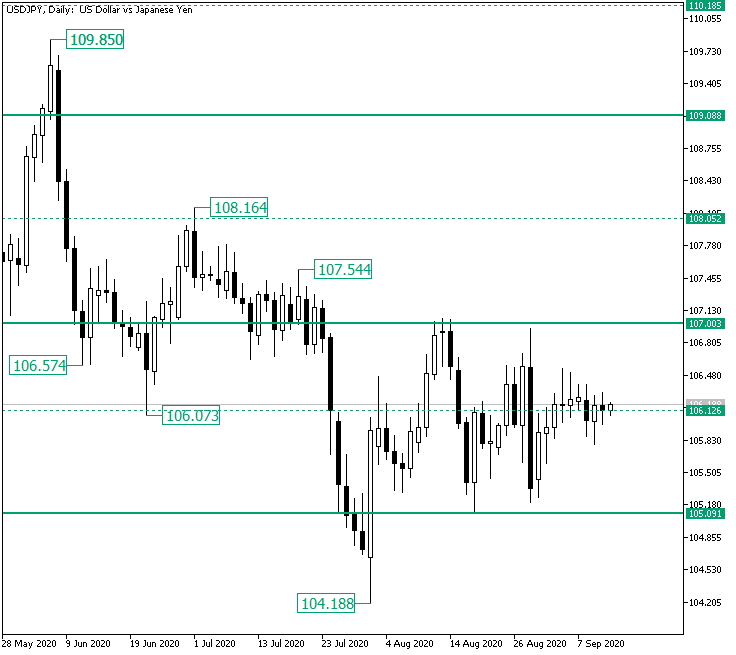

The United States dollar versus the Japanese yen currency pair seems not to be that willing to go south. But are the bulls able to pull it off?

Long-term perspective

The firm drop from the 109.85 high appears to have bottomed at the 105.09 support, after printing the low of 104.18. In other words, the depreciation is now limited by the 107.00 — as resistance — and 105.09, respectively.

Since the price is now in this range, there is a possibility for a shift of direction. Indeed, that looks to be the case, as both the candles of August 19 and 31 strongly retraced. The two lows retraced after almost touching the 105.09 area — 105.00 on the chart. Even more, the latter low appears to be a higher low, therefore attracting bullish interest.

Aside from this, after the candle on September 3 peaked and closed near the 106.12 intermediary level, the bears should have taken the chance. Still, the sole depreciation attempt ended with the candle on September 9, which brought the price back above the 106.12 intermediary level.

Considering the aforementioned variables, the bulls are in the posture to set the tone. So, as long as the oscillations unfold over 106.12, the bulls eye the 107.00 psychological level.

Only if there is a turn of events that renders 106.12 as resistance, then 105.09 may serve as the next target.

Short-term perspective

After falling from the 106.95 high, the price was repelled by the 105.27 intermediary level. This push managed to send the price above the firm 106.02 level, peaking at 106.55.

The following throwback was intercepted by the bears, who tried to push the price under 106.02. But they were able to do so only for a brief moment, as the bulls were quickly back on tracks, fitting the price onto 106.02.

If 106.02 remains support, then 106.77 is in reach. On the flip side, 105.27 might be paid a visit.

Levels to keep an eye on:

D1: 106.12 107.00 105.09

H4: 106.02 106.77 105.27

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.