The US dollar is continuing its winning streak on foreign exchange markets during the Labor Day holiday. The greenback has been staging a rebound over the last several trading sessions after cratering 11% since hitting a peak of 103.00 earlier this year at the height of the coronavirus pandemic. The buck has been rallying on a multitude of factors, including bullish economic data and COVID-19 concerns, but analysts are still maintaining a bearish … “US Dollar Index Tops 93.00 As Bullish Data Supports Greenback”

Month: September 2020

Pound Sinks as Threat of No-Deal Brexit Rises

The Great Britain pound fell against all other most-traded currencies today as the no-deal Brexit looks more and more likely. Better-than-expected housing data released in Britain on Monday did nothing to help the currency. According to reports, the UK government is preparing the internal market bill that will undermine parts of the Withdrawal Agreement reached between the United Kingdom and the European Union. It will complicate negotiations between the UK and the EU and can … “Pound Sinks as Threat of No-Deal Brexit Rises”

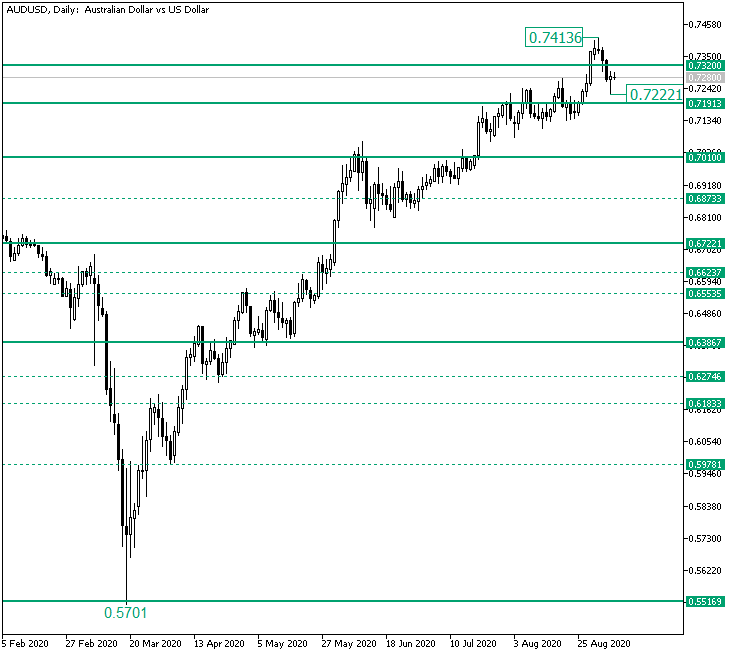

Bulls Challenged from 0.7320 on AUD/USD

The Australian versus the US dollar currency pair slipped under the major 0.7320 level. Are the bears coming back? Long-term perspective The appreciation that started from the 0.5701 low extended until the 0.7413 high. Reaching the high also meant piercing the firm 0.7230 level. So, as the bulls inscribed the price above the level, the expectations were for the level to be validated as support. However, the price slipped sharply under 0.7230, printing the low … “Bulls Challenged from 0.7320 on AUD/USD”

Euro Falls Against US Dollar on Weak Sentiment and Upbeat NFP

The euro today fell against the much stronger US dollar extending the bearish trend that began earlier this week as the greenback strengthened against its peers. The EUR/USD currency pair fell to its daily lows during the American session following the release of the US non-farm payrolls report for August, which was mixed. The EUR/USD … “Euro Falls Against US Dollar on Weak Sentiment and Upbeat NFP”

Canadian Dollar Rallies Against US Peer, Later Falls on Jobs Data

The Canadian dollar today surged against its US peer erasing yesterday’s losses boosted by the rising crude oil prices, which fueled the commodity-linked loonie. The USD/CAD currency pair later recovered and rallied higher as the loonie reacted to Canadian employment data, which was worse than expected. The USD/CAD currency pair today fell from an initial … “Canadian Dollar Rallies Against US Peer, Later Falls on Jobs Data”

US Dollar Gains After Strong August Jobs Report, Rising Treasury Yields

The US dollar is looking to extend its winning streak against multiple currency counterparts to close out the trading week. The greenback is rising on Friday after an impressive jobs report last month sparked confidence that the worldâs largest economy is rebounding in the aftermath of the public health crisis. According to the Bureau of … “US Dollar Gains After Strong August Jobs Report, Rising Treasury Yields”

Great Britain Pound Firm Despite Falling Construction Index, Outlook for Monetary Easing

The Great Britain pound rose today despite the gloomy outlook and an unexpected drop in the construction index. While the sterling has lost its gains versus commodity currencies by now, it continued to trade above the opening level against other most-traded peers. Michael Saunders, External Member of the Monetary Policy Committee at the Bank of England, delivered a speech titled “The Economy and Covid-19: Looking Back and Looking Forward”. In it, he voiced his opinion … “Great Britain Pound Firm Despite Falling Construction Index, Outlook for Monetary Easing”

Australian Dollar Stays Firm Despite Disappointing Retails Sales

The Australian dollar rose against some of its rivals today despite a slightly disappointing retail sales report. The gains were limited, though, as markets were quiet ahead of US nonfarm payrolls due for release later over Friday’s trading session. The Australian Bureau of Statistics reported that retail sales increased by 3.2% in July on a seasonally adjusted basis. Traders were hoping for the same 3.3% rate of increase as in June. The biggest gain … “Australian Dollar Stays Firm Despite Disappointing Retails Sales”

USD/JPY at 106.00. Where to from Here?

The US dollar versus the Japanese yen currency pair seems to be confined between 107.00 and 105.09. Who will make the next movement? Long-term perspective The false break of the major 109.00 resistance level, which peaked at 109.85, extended to as low as 104.18, from where it retraced above the firm 105.09 support level, thus marking yet another false breakout. Initially, the intermediary level of 106.12 seemed to have limited the bullish … “USD/JPY at 106.00. Where to from Here?”

USD/CAD Rises As Initial Jobless Claims Fall to New Pandemic Low

The US dollar is looking to continue its winning streak on Thursday after the federal government reported that the number of Americans filing for first-time unemployment benefits plunged to a new COVID-19 pandemic low. Although the number remains historically high, the trends suggest the labor market is extending its rebound. But while the greenback has cratered in recent months, is the string of gains a signal that the currency is triggering a rally? According … “USD/CAD Rises As Initial Jobless Claims Fall to New Pandemic Low”