The Chinese yuan is continuing its appreciation against the US dollar on Tuesday as better-than-expected manufacturing activity and continued stimulus in the banking system extended the currencyâs winning streak. The yuan has been strengthening against the greenback since the height of the coronavirus pandemic, and it is now testing the 6.8 range. In August, the Caixin/IHS Markit manufacturing purchasing managersâ index (PMI) came in at 53.1, up from 52.8 in July â anything above 50 … “Chinese Yuan Extends Winning Streak As Manufacturing Activity Beats Estimates”

Month: September 2020

ISM Manufacturing PMI Preview: Why only a leap can stop the dollar’s decline

The ISM Manufacturing PMI is set to continue reflecting moderate growth. Dollar selling pressure remains significant after the Fed’s policy shift. Contracting employment could add pressure on the greenback. The industrial sector remains on a recovery path – that what economists expect ISM’s Manufacturing Purchasing Managers’ Index to reflect in its August report. Nevertheless, that may … “ISM Manufacturing PMI Preview: Why only a leap can stop the dollar’s decline”

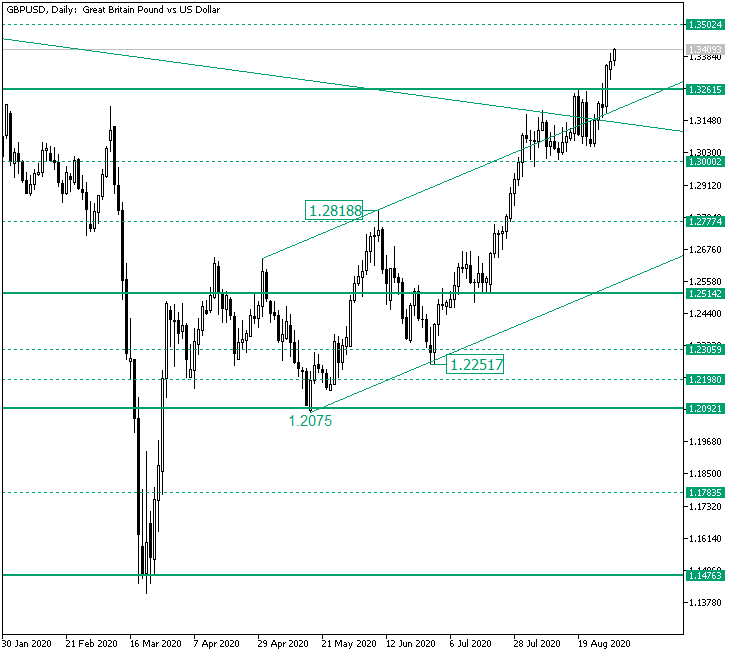

Next Target on GBP/USD: 1.3504?

The Great Britain pound versus the US dollar currency pair managed to overcome an important resistance area. But is this movement sustainable? Long-term perspective After etching the 1.2075 low, thus validating the 1.2092 area as support, the price began an ascending trend that, after piercing two intermediary levels, 1.2777 and 1.3000, respectively, put the bulls in such a good mood that they extended the impulsive swing until the triple resistance … “Next Target on GBP/USD: 1.3504?”