The US dollar is looking for direction against many of its currency rivals on Thursday after the federal government reported that the number of Americans filing for first-time unemployment benefits declined to a pandemic low. The US central bankâs important September policy meeting continues to weigh on the buck, while uncertainty surrounding Congress’ newest stimulus package sparks concern in the broader financial markets. According to the Department of Labor, initial jobless claims came in at 860,000 … “US Dollar Looks for Direction As Jobless Claims Fall to Pandemic Low”

Month: September 2020

Sterling Tanks After BoE Talks About Negative Interest Rates

The Great Britain pound sank today, overtaking the New Zealand dollar as the weakest currency on the Forex market during Thursday’s trading. The sterling dropped after the monetary policy announcement from the Bank of England. While the central bank kept its policy unchanged, the wording of the statement led to the drop of the currency. As was widely expected, the BoE left its monetary policy unchanged, with the benchmark interest rate remaining at 0.10% and the size of the Asset Purchase … “Sterling Tanks After BoE Talks About Negative Interest Rates”

NZ Dollar Among Weakest After GDP Report

The New Zealand dollar was among the weakest currencies on the Forex market today amid the risk-negative sentiment among investors. Domestic macroeconomic data was also extremely bad, though not as bad as pessimistic forecasts. Statistics New Zealand reported that gross domestic product shrank by as much as 12.2% in the June quarter. That was the biggest decline on the record. Yet it was still not as big as the 12.5% decline predicted by economists. … “NZ Dollar Among Weakest After GDP Report”

Retail Sales Analysis: Miserable figures good for gold as fiscal help could come sooner

US Retail Sales missed by rising by only 0.1% in August. The lapse of federal support seems to be taking its toll. Growing chances of fresh relief from Washington could boost gold prices. The economic recovery cannot walk on its own – that is the conclusion from America’s retail sales figures for Aguust. Expenditure grew … “Retail Sales Analysis: Miserable figures good for gold as fiscal help could come sooner”

Fed Analysis: No news is good news for the dollar, at least until Congress moves

The Federal Reserve’s projections reiterate the message of low rates. Growth is forecast to return to pre-pandemic levels only by the end of 2021. The cautious message may boost the dollar, weigh on sensitive stocks. Focus shifts to Congress, where there is fresh hope for a deal. Read my dot-plot, no new rate hikes – … “Fed Analysis: No news is good news for the dollar, at least until Congress moves”

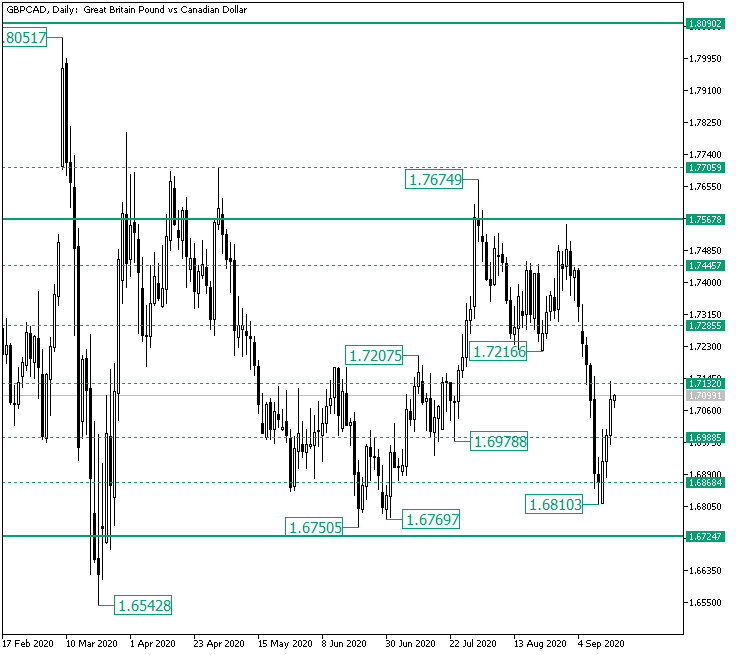

Bulls Taking Over on GBP/CAD from 1.6810?

The Great Britain pound versus the Canadian dollar currency pair shifted direction. Could this be a sustainable rise? Long-term perspective After the double bottom marked by the 1.6750 and 1.6769 lows, respectively, validated the firm 1.6724 support area, the price started a convincing appreciation phase. At first, the rally was limited by the 1.7132 intermediary level, thus printing the 1.7207 high. As a result, a consolidation stage — with 1.6988 as support — took shape. However, … “Bulls Taking Over on GBP/CAD from 1.6810?”

Canadian Dollar Soft Despite Surge in Crude Oil Prices

The Canadian dollar was soft today, falling or staying flat against its most-traded peers. Even the strong rally of crude oil prices was unable to aid the currency. One of the possible reasons for the loonie’s weakness was disappointing domestic inflation data. Statistics Canada reported that the Consumer Price Index fell 0.1% in August, without adjustments for seasonal factors, instead of rising at the same rate as analysts had predicted. With seasonal … “Canadian Dollar Soft Despite Surge in Crude Oil Prices”

Pound Rallies on Brexit Optimism, Later Falls on FOMC Decision

The British pound today rallied higher against the US dollar amid optimism that the UK would not crash out of the EU after Boris Johnson toned down his rhetoric. The GBP/USD currency pair’s rally was also driven by the dollar’s selloff coupled with the upbeat UK inflation data released earlier today, which boosted the pound. … “Pound Rallies on Brexit Optimism, Later Falls on FOMC Decision”

US Dollar Mixed As Federal Reserve Pledges to Keep Interest Rates Low Until 2023

The US dollar is trading mixed against its G10 currency rivals midweek following the Federal Reserve‘s completion of its two-day policy meeting. The central bank left interest rates unchanged, and it pledged to keep rates lower for a few more years to support the economic recovery. With rates hovering near zero until at least 2023, how will this impact the greenback? The Federal Open Market Committee (FOMC) announced … “US Dollar Mixed As Federal Reserve Pledges to Keep Interest Rates Low Until 2023”

Japanese Yen Stable, Gains on US Dollar

The Japanese yen was stable against other most-traded currencies today, even managing to gain on the US dollar, despite the generally positive market sentiment. Traders were more cautious than usual, though, due to the upcoming FOMC monetary policy announcement, resulting in quieter-than-usual trade. Yoshihide Suga, who was serving as Chief Cabinet Secretary, will replace Shinzo Abe as Japan’s prime minister. Abe had step down due … “Japanese Yen Stable, Gains on US Dollar”