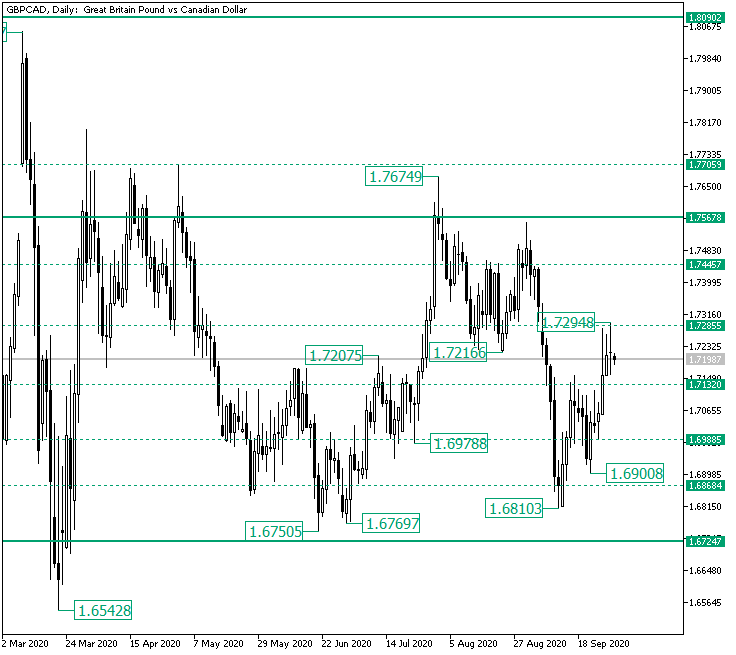

The Great Britain pound versus the Canadian dollar currency pair seems to be having a hard time while attempting to conquer 1.7285.

Long-term perspective

The appreciation that came into being after the double bottom defined by the 1.6705 and 1.6769 lows, respectively, played its part was limited by the 1.6567 firm resistance area, which encouraged the bears to start a fall that would later stop at the zone of the mentioned lows, printing the 1.6810 higher low.

The rise that followed also sits on two lows, the already mentioned 1.6810 and 1.6900. The resulting rally was able to cover more ground, as it stopped at the 1.7285 and defining the 1.7294 high, compared to the 1.7207 high etched lower earlier.

Nevertheless, the determined bears seem to be unwilling to let the bulls gain an inch. So, this could spark yet another fall, one that may spread under the 1.7132 intermediary level.

From beneath 1.7132, the bears could stick to their purpose and send the price to 1.6988, or they could drop the ball before reaching their target, which would give the bulls their chance to regain 1.7132.

However, if — even after this substantial pullback from 1.7285 — the bulls do find support at 1.7132, then they could check 1.7285. Afterward, they could aim for 1.7445.

Short-term perspective

The fall that originated at the 1.7554 peak extended until the 1.6810 low. Along this path, two significant levels were pierced. The lower one, 1.6965, was swiftly recuperated by the bulls. Still, 1.7244 limits any further advancement.

So, if the bulls give it another try and succeed in taking out 1.7244, then they could focus on 1.7337 and 1.7487. This is also true if 1.7094 is validated as support, albeit, in this case, 1.7244 would serve as the first target.

But if 1.7094 is pierced and confirmed as resistance, then the bears can drive the price to 1.6965.

Levels to keep an eye on:

D1: 1.7132 1.6988 1.7285 1.7445

H4: 1.7244 1.7337 1.7487 1.7094 1.6965

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.