The Australian versus the New Zealand dollar currency pair seems to be willing to go towards the north. Do the bulls have the power to do so?

Long-term perspective

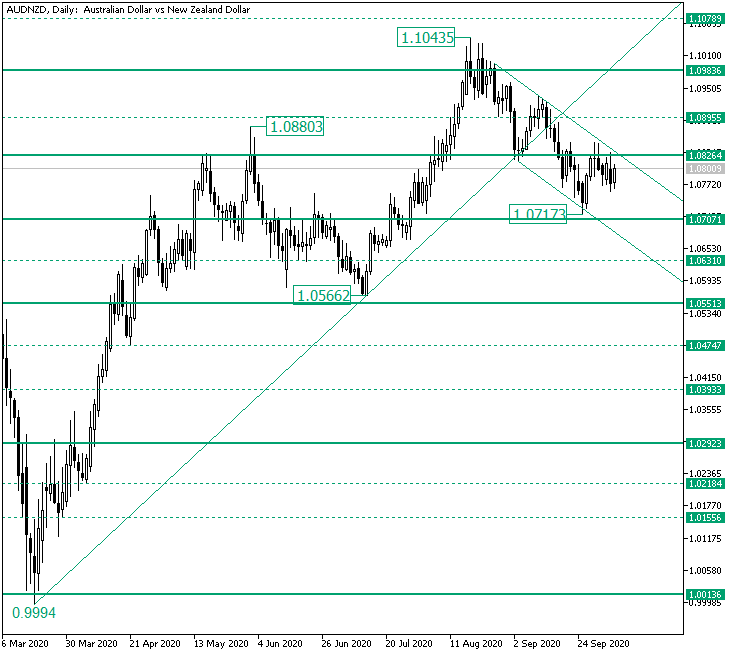

The appreciation from the 0.9994 low extended, after a correction phase bounded by the 1.0880 high and 1.0566 low, respectively, to 1.1043.

Noteworthy is that the 1.1043 high comes outside of the resistance area that the firm level of 1.0983 represents.

And because — after such a departure — the bulls were not able to keep their gains and allowed the price to fall beneath 1.0983, the bears pushed the price much as they could.

The result was that the 1.0895 intermediary level ceded, allowing the drop to reach the previous resistance level of 1.0826.

Even if the bulls did respond in a very determined manner, the bears had their ace, the 1.0895 area, which they used as a resistance to rotate the price.

As a consequence, the fall extended a hair away from the 1.0707 level, defining the 1.0717 low, and noting an angled rectangle in the process.

If the double resistance — made up by 1.0826 and the upper trendline that bounds the rectangle — is validated, then 1.0707 is the first bearish stop, followed by the 1.0631 intermediary level.

On the contrary, if the aforementioned area is validated as support, then the bulls can secure 1.0895, and from there make another attempt towards 1.0983.

Short-term perspective

The fall from 1.0936, after the 1.0921 intermediary level was confirmed as resistance, ebbed to as low as 1.0717.

However, by looking closely, the 1.0717 low — alongside 1.0748 and 1.0759 — an inverted head and shoulders pattern can be determined, with 1.0820 serving as the neck-line.

So, as 1.0778 seems to have been validated as support, 1.0820 is in bullish reach. From there, 1.0866 is the first target, with the rise being able to extend until 1.0921.

But if 1.0820 maintains its role as resistance, then the price could fall back to 1.0778, and then to 1.0741, which is the next bearish objective.

Levels to keep an eye on:

D1: 1.0826 1.0707 1.0631 1.0895 1.0983

H4: 1.0778 1.0820 1.0866 1.0921 1.0741

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.