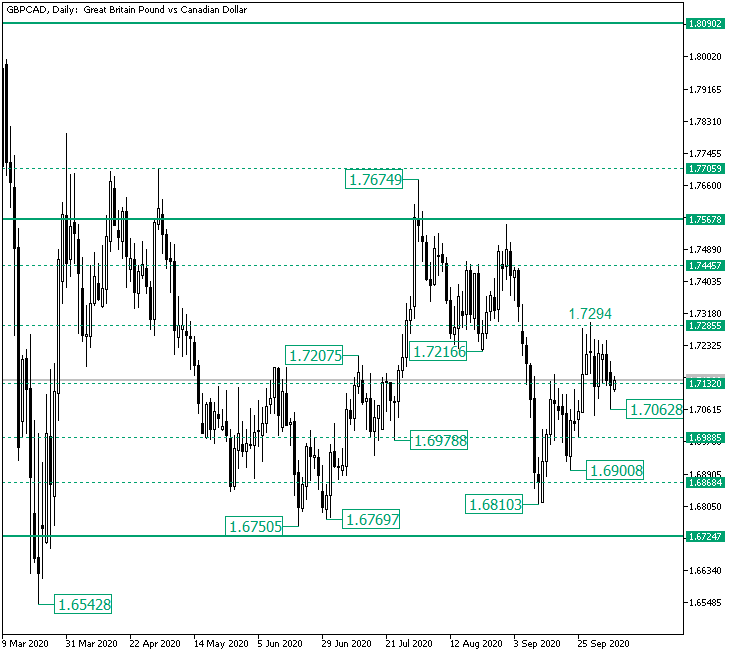

The Great Britain pound versus the Canadian dollar currency pair seems to have found support at 1.7132. Are the bulls ready for a new march?

Long-term perspective

After the retracement that came about with the definition on the chart of the 1.6542 low, the market entered into an extended range trading phase, limited by 1.7567 as resistance and 1.6724 as support.

The last upward pointing movement came into being after the price noted the double bottom highlighted by the 1.6810 and 1.6900 lows, respectively.

The movement extended to as high as 1.7294, after which it unfolded as a side-ways phase confined within the 1.7285 and 1.7132 intermediary levels, respectively.

One thing to point out is the 1.7062 low, which — even if it is very close to the previous one, from a price perspective — is a higher low and is part of the false piercing of 1.7132.

In other words, the bears attempted a depreciation, but the bulls played them out, unmounting their plans.

If the bulls are able to keep up the good work and keep the price above 1.7132, then they could challenge 1.7283 yet again, which if it cedes, opens the door to 1.7445.

However, if the bears persist and do achieve to regain control, then 1.6988 is the main target.

Short-term perspective

From the 1.6810 low, the price is in an ascending trend, as the series of higher lows and higher highs indicates.

The last trending phase coined the 1.7294 high, after which allowed a trading phase to materialize.

So, as long as the oscillations confined to 1.7244 and 1.7094 continue, the bulls have their chance to extend the uptrend.

In the light of the above, if 1.7244 becomes support, then 1.7337, followed by 1.7487, are bullish objectives. On the flip side, 1.6965 may expect a bearish visit if 1.7094 turns resistance.

Levels to keep an eye on:

D1: 1.7132 1.7285 1.7445 1.6988

H4: 1.7244 1.7094 1.7337 1.7487 1.6965

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.