Two steps forward, one step back – in both Brexit and US fiscal stimulus talk has left GBP/USD marginally lower in a week full of contradictory reports. Coronavirus and elections headlines are set to have a growing impact, yet several economic figures could also steal the show.

This week in GBP/USD: Kicking two cans down the road

Brexit, far away, so close? The EU and the UK seemed to have made progress on a deal on future relations, including on state aid and fisheries’ controversial issues. However, talks were also on the brink of collapse, and headlines whipsawed the pound.

The bloc’s leaders agreed to continue talks without intensifying them – asking Britain to make concessions. While the UK replied with “surprise” and “disappointment,” officials also acknowledged progress.

Late in the week, Prime Minister Boris Johnson said Britain should get ready for a no-deal exit in January, sending the pound down. However, he also added that “if there is a fundamental change to the EU’s position, we are willing to listen” – leaving room to talk. Both sides demand concessions from the other, and talks may continue.

Fiscal stimulus: On the other side of the pond, Treasury Secretary Steven Mnuchin and House Speaker Nancy Pelosi were making minor progress. The latest is that Democrats insist on $2.2 trillion while the White House is ready to raise the offer above $1.8 trillion.

Mnuchin was pushed forward by President Donald Trump tweeted “go big” – but Senate Republicans are focused on the Supreme Court and want a minimal deal worth only $500 billion, at least ahead of the elections. With the clock ticking down to November 3, the chances of an accord look slim.

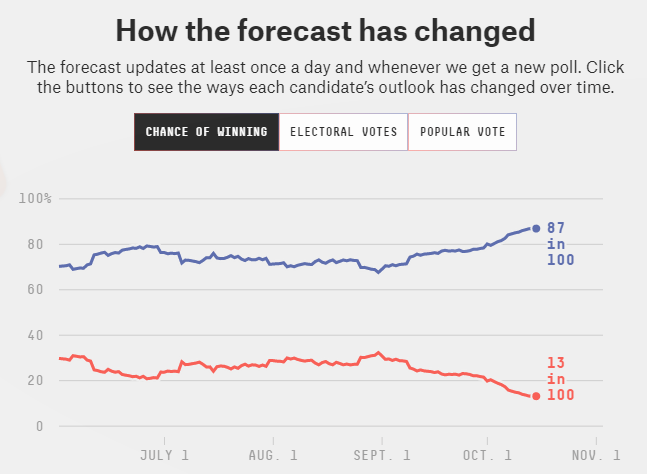

Former Vice-President Joe Biden continues commanding a substantial lead over Trump in national and state polls, consolidating his post-debate gains. According to RealClearPolitics, the challenger has a 9.4% advantage over the incumbent, some 3.4% more than Clinton had at the same time in 2016, and fewer undecided voters.

The FiveThirtyEight model gives Biden an 87% chance of winning, while The Economist shows 91%. The main theme on the agenda is COVID-19, where Trump is criticized for mishandling the disease, which also affected him.

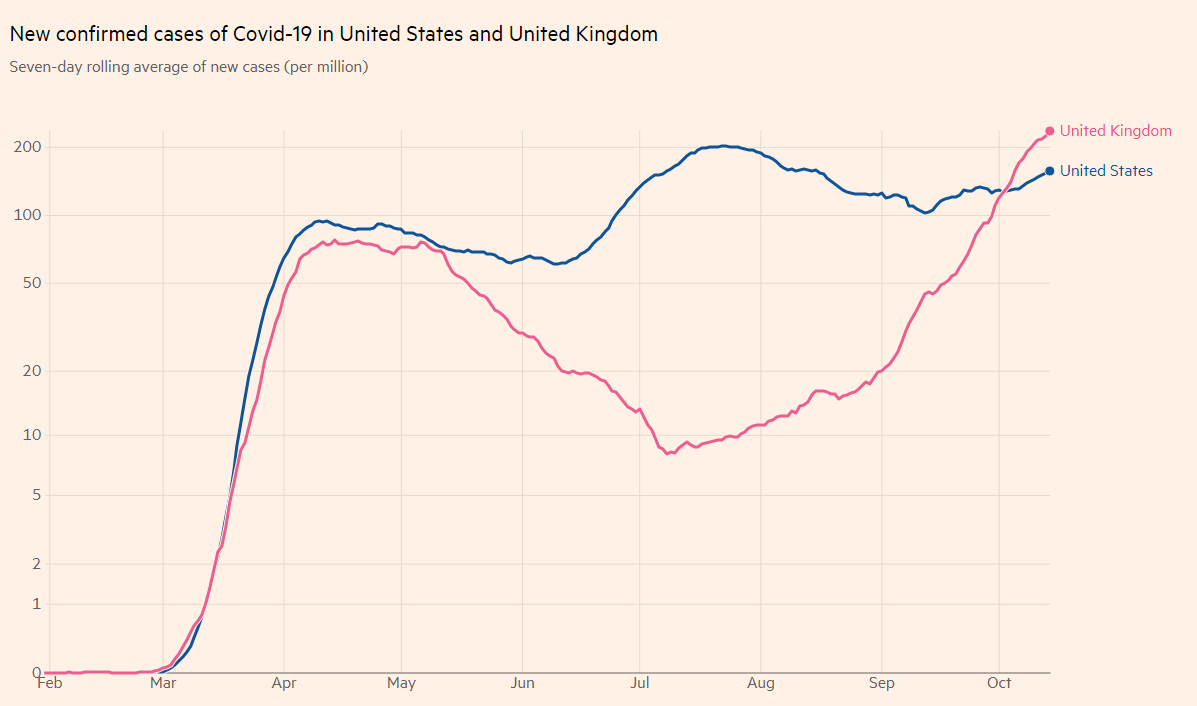

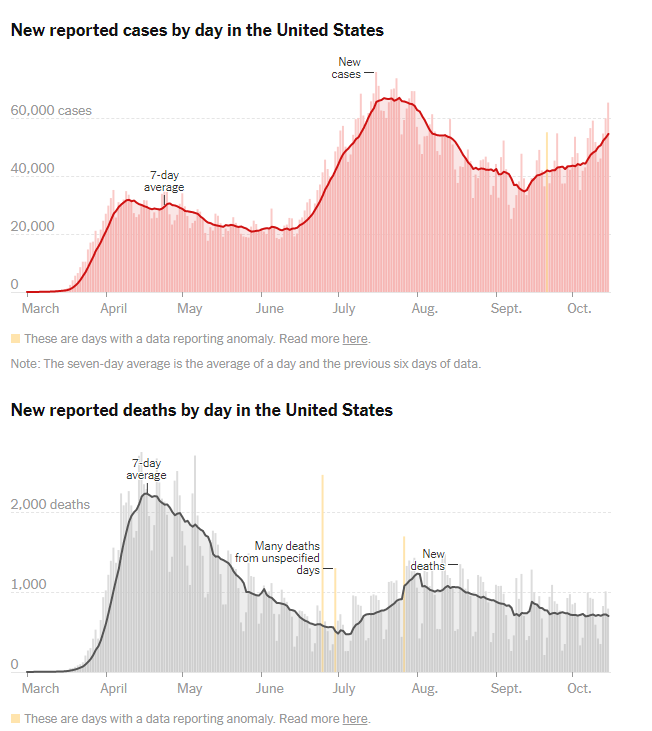

Coronavirus cases are on the rise in the US, but they are advancing at a faster clip in the UK. London entered Tier Two of the restrictions while Liverpool is at Tier Three. Grievances about mistreating the north have surfaced in Manchester, where mayor Andy Burnham lamented his city’s lack of funds.

Confidence and trust in the government are falling, which may hobble the efforts to bring the disease back under control, adding to pressure on the pound.

Source: FT

Economic data played second fiddle to political developments, yet worth mentioning. The UK Unemployment Rate rose to 4.5% in August – worse than expected, but still low. Wage growth in August and jobless claims in September both exceeded estimates. The impact of the government’s reduced furlough scheme is still awaited.

In the US, initial weekly jobless claims disappointed with an increase to 898,000, but that was skewed by a bump in California data, which had not reported figures in the previous week.

US Retail Sales smashed estimates with an increase of 1.9% in September. Core measures such as the control group also surprised to the upside – showing the strength of the US consumer and also diminishing appetite for further stimulus.

UK events: COVID-19, data, and less Brexit

Brexit deliberations continue in the background, with any headlines about progress set to push sterling higher, while disagreements could pound the pound.

The next deadline is the end of the month – as previously agreed between the PM and Ursula von der Leyen, the European Commission’s President. However, this can-kicking exercise could be extended until the only hard stop – year-end, when the transition expires.

On the other hand, coronavirus statistics and decisions about lockdowns may take center stage. Several scientists suggest announcing a nationwide “circuit-breaker” lockdown. The idea would be to slam the statistics quickly to lower levels. Such a move would also be politically advantageous – putting to rest regional grievances.

However, a second shuttering would deal a blow to the economy that is far from recovering. Moreover, there is a risk that lack of obedience and other factors would result in a slow decrease of cases, potentially leading to the extension of such a lockdown.

If Johnson announces a “circuit-breaking” move, it could break down the pound. Keeping lockdowns local – and especially keeping London out of Tier Three – would allow some breathing space for sterling.

Several members of the Bank of England, including Governor Andrew Bailey, will speak during the week. Markets are currently dismissing the probability of a negative interest rate, but if lockdowns are coming, the BOE may accelerate preparations for such a move, weighing on the pound.

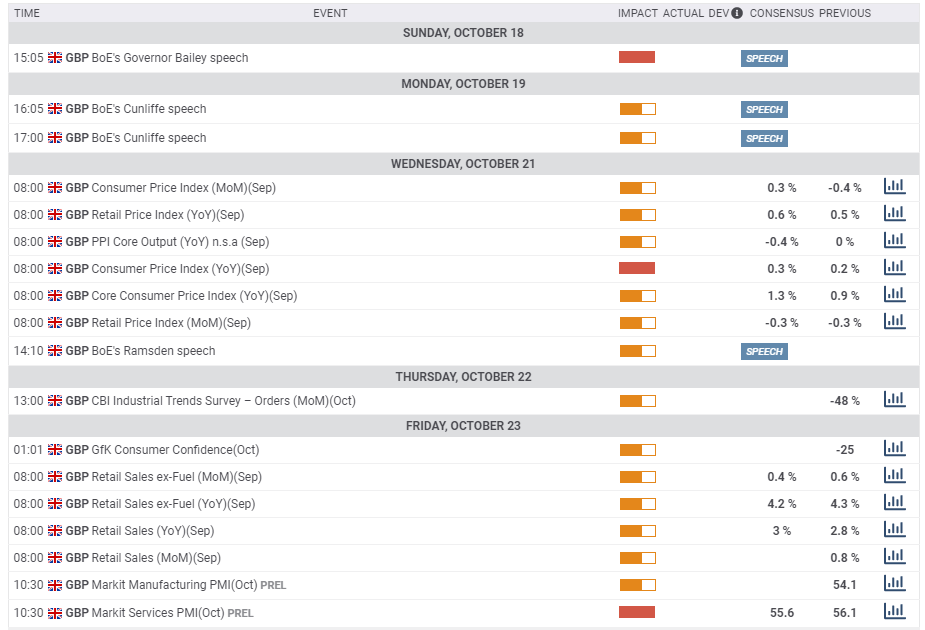

For September, inflation figures are set to show a recovery from 0.9% to 1.3% in the headline Consumer Price Index. If CPI nears 2%, it would ease pressure from the BOE and could boost the pound.

Retail Sales are set to show a moderate increase of 0.4% in September, lower than August’s 0.6% rise. It is essential to note that consumption has fully bounced back from the downfall seen in the spring.

Markit’s preliminary purchasing managers’ indexes for October are projected to show a minor decrease in confidence, albeit still pointing to growth – above 50 points. Any decline below that threshold could weigh on the pound.

Here is the list of UK events from the FXStreet calendar:

US events: Trump’s last chance

The election campaign is entering high gear with the second and last presidential debate between Trump and Biden. Trailing in the polls, the president will likely be attacking his challenger in harsher terms and may look for a surprise or a miracle.

FiveThirtyEight’s model gives Biden an 87% chance of winning, while The Economist gives the former Vice-President a 91% probability of ousting Trump.

Source: FiveThirtyEight

The debate is held on Thursday, 12 days ahead of the only poll that matters, and as millions have already sent their mail-in ballots or voted early. Nevertheless, an upbeat performance by Trump could shake the race.

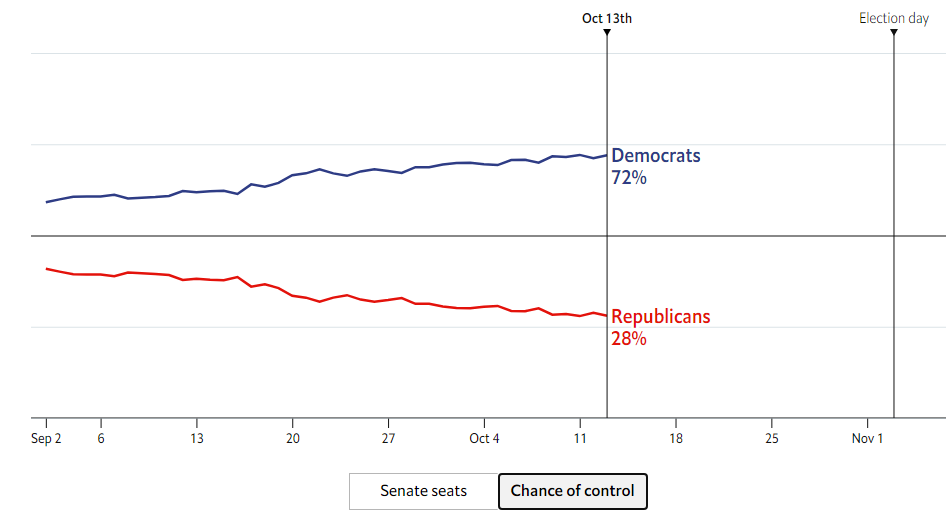

Without any material change, markets may shift their attention to the Senate race, much closer. If Democrats take control of the upper house, they could quickly pass a generous stimulus bill that markets want. That may boost stocks and weigh on the dollar. Conversely, if Trump and Republicans recover, the safe-haven greenback could rise.

The Economist gives Dems a 72% chance of winning the Senate, while FiveThirtyEight puts the odds at 73%.

Source: The Economist

Doubts about polls stemmed from 2016 when more undecided voters eventually broke 2:1 in favor of Trump. Moreover, surveys in states missed by large margins, also underestimating support for the then businessman.

In 2020, there are fewer undecideds, more high-quality state polls – and polling firms probably learned the lessons from that year, taking education as a factor in their demographic allocations. Moreover, it is essential to remember that in 2012, surveys underestimated support for then-president Barack Obama.

Overall, markets are relatively cautious due to the 2016 recency bias and see the race as closer. However, polls can be wrong either way or could be absolutely correct.

Fiscal stimulus talks will likely continue, but with every day that passes toward the vote, the chances are diminishing. A miracle deal could boost stocks and weigh on the dollar, while a breakup of talks is likely to cause only a shortlived advance in the greenback.

Investors may begin paying attention to rising US COVID-19 cases, which have been under the radar due to the focus on politics and the quicker spike in Europe. Mortalities have been stable in recent weeks, but that may change as infections advance. Concerns over hospitalizations and deaths could weigh on sentiment.

Source: New York Times

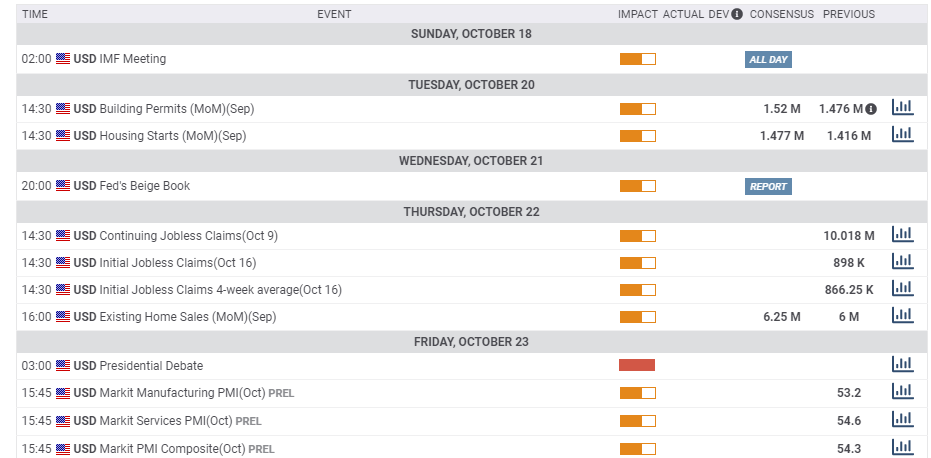

Other events will likely overshadow economic indicators, yet markets will likely watch jobless claims for any indication if the recent spike was a one-off or the start of a worrying trend. A fall back toward 800,000 would be encouraging. Markit’s PMIs, housing figures, and the Federal Reserve’s Beige Book are also of interest.

Here the upcoming top US events this week:

GBP/USD Technical Analysis

Pound/dollar failed to hold above the 50-day Simple Moving Average, and the daily chart’s momentum also remains lackluster. On the other hand, the currency pair is trading above 100 and 200 SMAs.

All in all, the picture is mixed.

Support awaits at 1.2860, which provided support in mid-October and also played a role beforehand. Further down, 1.28 capped recovery attempts in mid-September. It is followed by the 200-day SMA, which hits the price around 1.2705. Further down, 1.2665 is September’s trough and the lowest since July.

Resistance awaits at 1.30, which is not only a round number, but it also capped cable twice in recent weeks. October’s high of 1.3085 is another considerable resistance line. Further above, 1.3195 and 1.3270 await the pair.

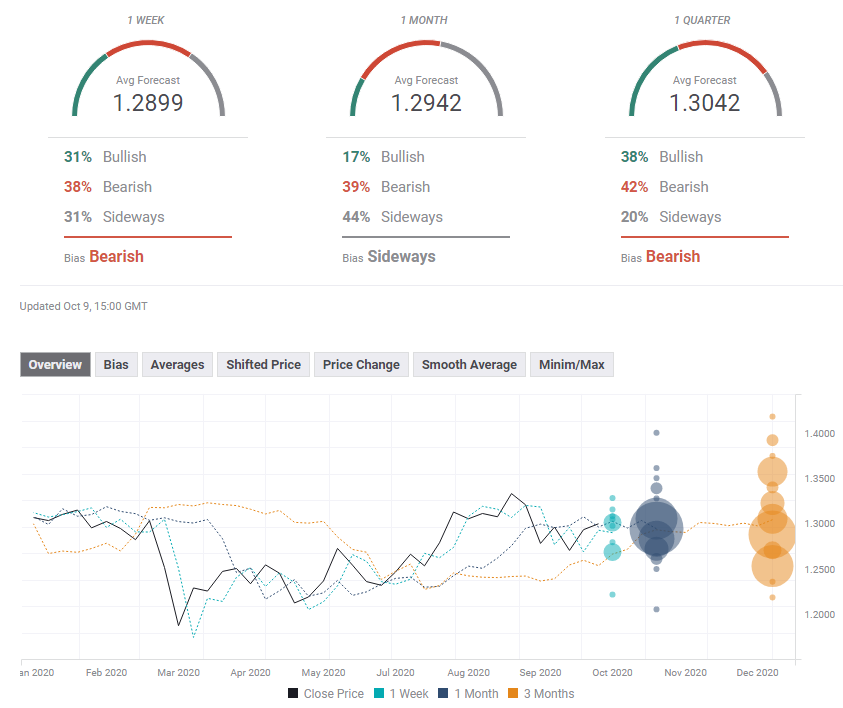

GBP/USD Sentiment

An ugly presidential debate and rising coronavirus cases on both sides of the pond could weigh on GBP/USD – even if there is a positive twist in the Brexit saga.

The FXStreet Forecast Poll is showing that experts are skeptical of the recent rise and see a drop in the upcoming week. Later on, moderate increases are on the cards. While the short-term forecast has been downgraded, the long-term one has edged higher.

Related Reads

Get the 5 most predictable currency pairs