After the rally to 1.7285, would the level cede in front of the bullish momentum or serve as the perfect spot for the bears to short the market at a very good price?

Long-term perspective

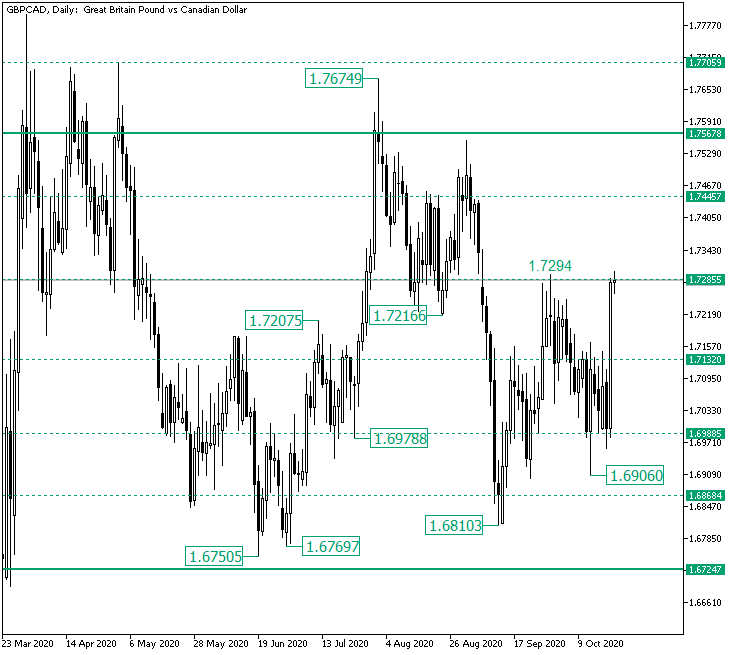

After the price validated the major level of 1.6724 as support, it managed to rise until the important 1.7567 area. But as the intermediary level of 1.7705 limited further bullish advancement, the result was a decline well under 1.7567.

As a result, the price almost retouched the 1.6724 level. However, the double bottom defined by the 1.6750 and 1.6769 lows, respectively, aided in the renewal of the bullish enthusiasm.

This drove the price once more until the 1.7567 area. Yet again, the bears were determined to halt any rally that comes close to the 1.7705 intermediary level, thus printing the 1.7674 high.

As expected, a new fall towards 1.6724 materialized. After the 1.6810 low was printed, the bulls refreshed their attempts. This time, the bears limited their movements at the 1.7285 level, printing the 1.7284 high.

Still, the bulls refused to dive too much and used 1.6988 as a springboard to send the price back to 1.7285.

If 1.7285 remains resistance, then a new fall could occur, targeting 1.7132 and then 1.6988.

But if the bulls can keep the momentum — and they have the chance, given the higher lows — then 1.7445 is their first objective, followed by 1.7567.

Short-term perspective

The price rallied from the important support of 1.6965, piercing the 1.7095 intermediary level and getting above 1.7244.

If the bulls are able to keep their gains above 1.7244, then they could visit 1.7337. However, if 1.7244 turns resistance, then 1.7094 is the first bearish stop, while 1.6965 is the second.

Levels to keep an eye on:

D1: 1.7285 1.7132 1.6988 1.7445 1.7567

H4: 1.7244 1.7337 1.7094 1.6965

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.