The United States dollar versus the Japanese yen currency pair, at this moment, may very well be treasured by both bulls and bears. However, only one party is to be right.

Long-term perspective

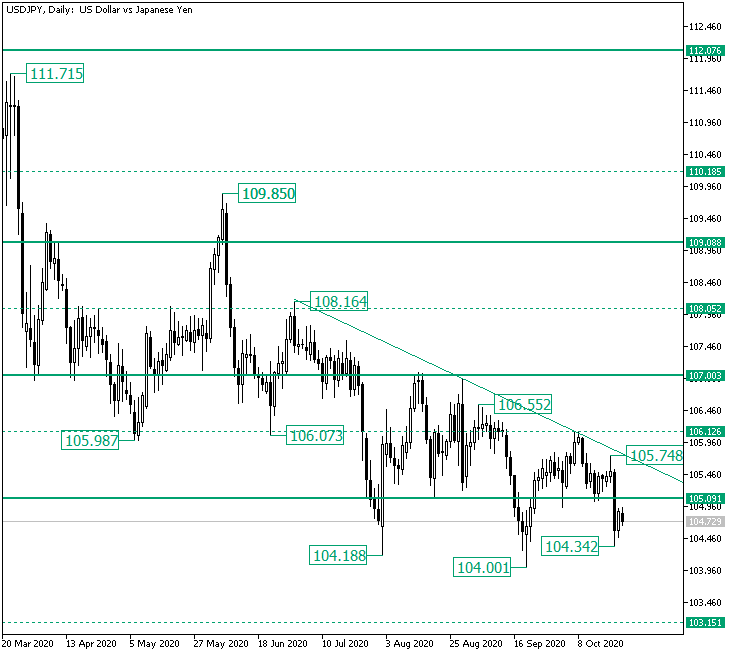

The fall from the 111.71 high extended — in a first phase — until the 105.98 low, from where a new appreciation crystalized, pinning the 109.85 high.

The fall from 109.85 continued the endeavor of the first one thus — after defining the 108.16 high — printing the low of 104.18.

From 104.18, the price, yet again, retraced until the 107.00 psychological level.

As a result, from this firm area, the bears loaded their positions, sending the price beneath another solid support level, 105.09, and noting the 104.00 low.

The retracement that followed was limited by the double resistance etched by the descending trendline that starts from the 108.16 high and the 106.12 intermediate level.

As expected, a new drop came into being, sending the price once more under the firm 105.09 level.

But as the bears’ thrust might have been more than they could handle, as after reaching the 104.34 low, the price started heading north.

Now, on one side, the bears could argue that they pierced 105.09 and — as a natural occurrence — the price is now marking a throwback that sees to validate 105.09 as resistance.

However, the other side, that is — of course — the bulls, considers the 104.18 and 104.34 lows, respectively, as the shoulders of an inverted complex head and shoulders, with the low of 104.00 being the head.

So, 105.09 is the key level. If the bears are victorious, then 103.15 is the next stop. On the flip side, the bulls eye the 106.12 level, followed by 107.00.

Short-term perspective

The rise from the 104.00 low topped at 106.10 — not before correcting from the 105.80 high until the 104.94 low. From the peak, the price ebbed until the 105.27 level, even oscillating under it for a short while.

From 105.27, the pair climbed until the 105.74 tip, from where a very determined bearish movement sent the price to the 104.34 low, falsely piercing the firm 104.44 level.

So, as a corrective phase within the descending channel — marked by the lines that start from the 106.10 high and 104.94 low, respectively — seems to be already set in motion, two possible scenarios emerge.

The first one is the one in which the 104.92 low serves as resistance. The result would be a range trading phase that, sooner or later, may pierce 104.44 support, heading towards 103.09.

The second one is a retracement that goes all the way to the double resistance made possible by the upper line of the descending channel and the 105.27 intermediary level, aiming towards 104.44 and the same 103.09 later on.

Levels to keep an eye on:

D1: 105.09 103.15 106.12 107.00

H4: 104.44 103.09 105.27 the low of 104.94

If you have any questions, comments, or opinions regarding the US Dollar, feel free to post them using the commentary form below.