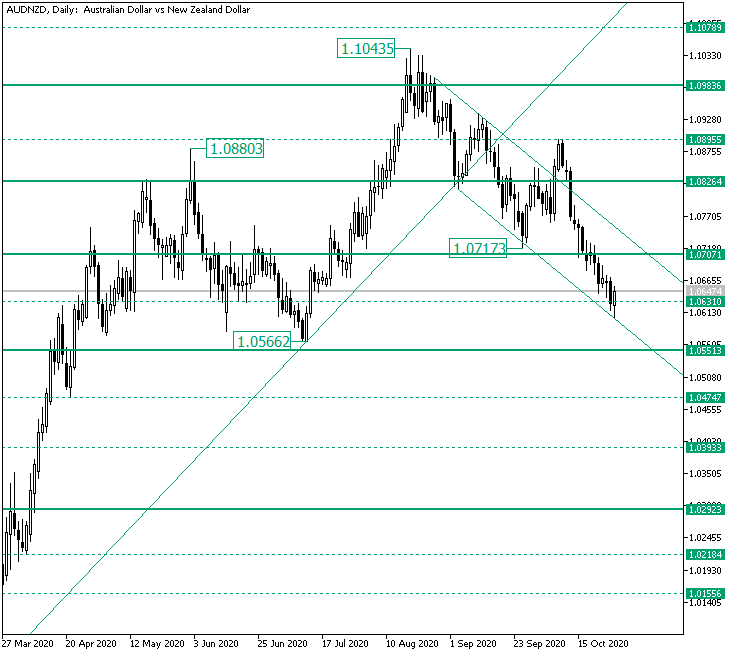

The Australian versus the New Zealand dollar currency pair ebbed until the 1.0631 level. Could this level be the one that starts a correction?

Long-term perspective

After validating the support of 1.0013 — not highlighted on the chart — the price climbed until the 1.1043 high.

In doing so, towards the end of the movement, it pierced two significant levels. The first one is 1.0826, which previously — see the 1.0880 high — served as a firm resistance, but which this time was passed with relative ease.

However, the second, 1.0983, limited the bullish advancement, causing a false piercing that the 1.1043 high is part of. As a result, the price dropped until the 1.0826 level. Initially, the bulls had the edge, as they seemed to validate it as support and depart from it.

But the 1.0895 intermediary level halted the bullish advancement, spelling the drop that sent the price beneath 1.0826 and at the 1.0717 low.

Even if the bulls attempted a comeback, the dice were cast, as they were not able to keep their gains above 1.0826.

Like so, the price reached the double support crafted by the lower line of the descending channel and the 1.0631 intermediary level.

One scenario is the one in which the price corrects in an attempt to validate the double resistance noted by the upper line of the descending channel and the 1.0707 level.

The second scenario postulates for the simple continuation of the drop, with 1.0631 becoming resistance and targeting the 1.0551 level.

Short-term perspective

From the 1.0893 high, the price started a sustained fall, reaching the 1.0621 level.

If the price corrects until the 1.0681 intermediary level, then a range trading phase may set be in place, with 1.0621 serving as support.

However, 1.0621 being converted to resistance is also a possibility, a case in which 1.0573 becomes the next objective.

Levels to keep an eye on:

D1: 1.0707 1.0631 1.0551

H4: 1.0681 1.0621 1.0583

If you have any questions, comments, or opinions regarding the Technical Analysis, feel free to post them using the commentary form below.