The Chinese yuan is trading flat against the US dollar, but it has topped 8.0 against the euro to kick off the trading week. The yuan is coming off its best quarter in more than a decade as analysts warn think the yuan could become the next safe-haven currency amid volatility. Can the yuan test 6.6 in the final quarter of 2020? The broader financial market has been surprised by the yuan’s appreciation … “Chinese Yuan Flat After Having Best Quarter in a Decade”

Month: October 2020

AUD/USD Under 0.7191. Have the Bulls Met Resistance?

The Australian versus the US dollar currency pair slipped under the 0.7193 level and looks like it has difficulties in regaining it. Could this be a bearish sign? Long-term perspective The appreciation that started from the 0.5701 low advanced until the 0.7413 high. However, after falling beneath 0.7320, the price began a descending movement, as the bullish attempt to validate 0.7191 as support failed. The bullish missed effort left the bears with … “AUD/USD Under 0.7191. Have the Bulls Met Resistance?”

Euro Falls Against Dollar on Risk-Off Mood, Non-Farm Payrolls

The euro today fell against the dollar reversing all of yesterday’s gains driven by the risk-off market sentiment after US President Donald Trump tested positive for COVID-19. The EUR/USD currency pair’s decline was further fueled by the weak inflation data from the euro area, which could derail the bloc’s economic recovery. The EUR/USD currency pair … “Euro Falls Against Dollar on Risk-Off Mood, Non-Farm Payrolls”

GBP/USD: Will Boris break the Brexit deadlock? Volatility set to explode

GBP/USD has been torn between hope and despair in both Brexit and US fiscal talks. Politics, rising coronavirus cases, and the Fed minutes stand out in October’s first full week. Early October’s daily chart is painting a mixed picture. The FX Poll shows experts are bullish on all timeframes. Optimism on Brexit with pessimism on … “GBP/USD: Will Boris break the Brexit deadlock? Volatility set to explode”

NFP Analysis: Stocks set to fall as sub 8% jobless rate lowers chances for stimulus

The US gained 661,000 jobs in September, weaker than expected, but the jobless rate fell to 7.9%. Markets are focused on fiscal stimulus and the political headline lowers the chances of a deal. Trump’s positive coronavirus test is grabbing the headlines and also limits the scope for further relief. Positive for COVID-19 – the new … “NFP Analysis: Stocks set to fall as sub 8% jobless rate lowers chances for stimulus”

Sterling Pound Rallies As Boris Johnson Acts to Save Brexit Talks

The Sterling pound today rallied against the dollar after the British Prime Minister intervened to try and save the Brexit talks, which seem to be falling apart. The GBP/USD today rallied higher despite the lack of macro releases from the UK docket as the positive Brexit developments boosted investor sentiment towards the pound. The GBP/USD … “Sterling Pound Rallies As Boris Johnson Acts to Save Brexit Talks”

US Dollar Rises Amid September Jobs Report, Trump Testing Positive for COVID-19

The US dollar is holding its gains to finish the trading week as investors get spooked by a worse-than-expected September jobs report. But the main headline maker is that President Donald Trump and the First Lady tested positive for COVID-19. This was the curveball tossed into the broader financial market with a month to go until the 2020 election. How will the buck react in the coming days? According to the Bureau of Labor Statistics (BLS), … “US Dollar Rises Amid September Jobs Report, Trump Testing Positive for COVID-19”

Trump’s coronavirus adds uncertainty in three ways, stocks have more room to fall

President Donald Trump’s contraction of COVID-19 raises questions about fiscal stimulus talks. Sympathy could strengthen the incumbent’s position, narrowing his gap with rival Biden and tightening the race. Questions about the Vice President’s Pence’s leadership could rise. The October surprise is here – President Donald Trump and his wife Melania tested positive for COVID-19. The … “Trump’s coronavirus adds uncertainty in three ways, stocks have more room to fall”

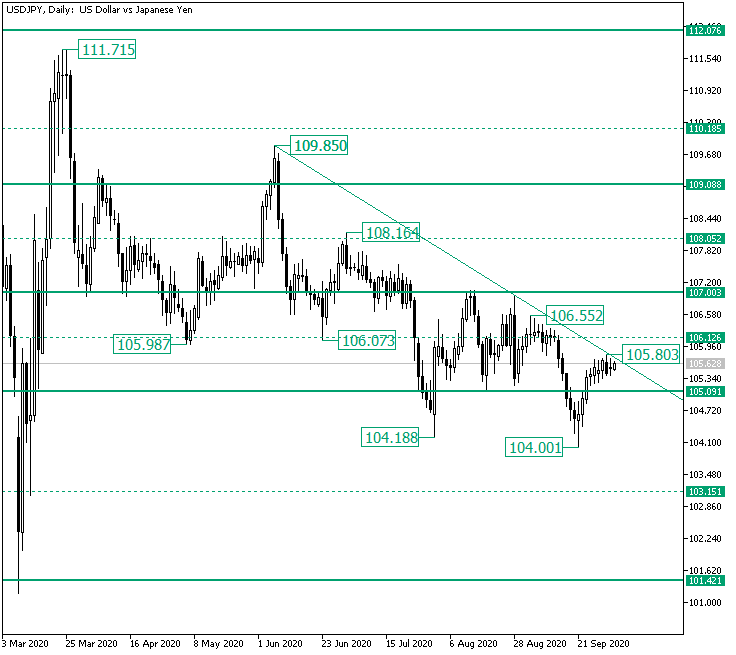

Possible Leg Down on USD/JPY from the 105.80 High?

The US dollar versus the Japanese yen currency pair seems to be lacking traction to reach 106.12. Are the bears just around the corner? Long-term perspective The depreciation from the 111.71 high lead to a more or less sideways movement which, from the 109.85 lower high, ebbed and crafted the low of 104.18. From the 104.18 low, a new side sideways movement started, one contained by the 107.00 and 105.09 levels, respectively. After the support was … “Possible Leg Down on USD/JPY from the 105.80 High?”

Euro Rallies Against Dollar on Elevated Sentiment, Falls Then Rises

The euro today rallied against the US dollar twice followed by quick retracements despite the upbeat investor risk appetite that boosted risk assets. The EUR/USD currency pair today rallied then gave up all its gains before rallying again as the bulls and bears fought for control amid mixed euro area macro prints. The EUR/USD currency … “Euro Rallies Against Dollar on Elevated Sentiment, Falls Then Rises”