EUR/USD managed to print some sort of stability after the big fall from the highs. However, the reason for the fall could continue weighing heavily on the common currency.

The team at ING discusses the pair, parity and the US GDP Now model:

Here is their view, courtesy of eFXnews:

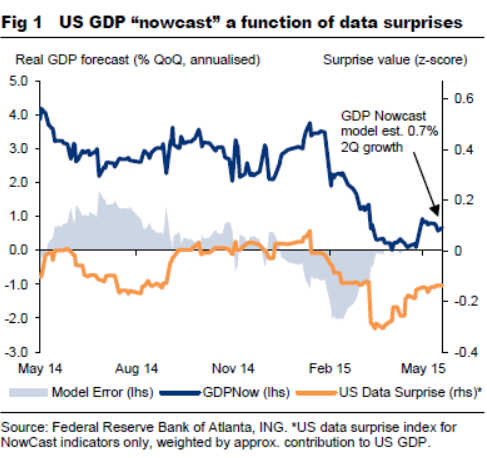

“With the initial estimate for 2Q US GDP not scheduled for release until 30 July (one day after the July FOMC meeting), we may well need to rely on an array of indicators to form an accurate depiction of the US economy and hence the outlook for monetary policy.

As such, the Atlanta Fed’s GDPNow model – which provides a real-time estimate for the current quarter GDP figure based on the results of key monthly indicators – has been gaining some popularity…Based on the string of 2Q data releases so far, the GDPNow model suggests that we shouldn’t be too hopeful of a considerable rebound in the current quarter, with the latest update on 19 May “nowcasting” a figure near 0.7% QoQ annualised growth.

While the latest “nowcast” only points to a meagre 0.7% growth in 2Q15, our analysis suggests that there is still scope for the rest of the data releases covering the months of May and June to positively contribute to growth. Given the increased sensitivity of USD crosses to relative data surprises, the currency would certainly benefit from a string of positive 2Q data releases, with added scope for gains in light of the (i) recent trimming of long USD positions, (ii) dovish market pricing of Fed rate hikes and (iii) softer expectations for US data prints. Moreover, the ECB’s plan to frontload QE purchases ahead of the mid-July drop in market liquidity is likely to keep EUR/USD anchored around current levels and therefore buys some time for US data outcomes to turn the corner. This is a significant development in the context of our EUR/USD 6M parity call.”

Viraj Patel – ING

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.