Dollar/CAD and also EUR/USD experienced interesting technical moves in the past week. What does the road ahead have for them?

The team at Bank of America Merrill Lynch provides some insight:

Here is their view, courtesy of eFXnews:

USD/CAD is testing pivotal long-term support at the 1.1909/1.1915 area, notes Bank of America Merrill Lynch.

“While this is a very late stage decline, this support zone is unlikely to hold for long, given the weakened state of the USD,” BofA argues.

“Indeed, a break below 1.1909 clears the way for a test of the 200d at 1.1764 before renewed base,” BofA projects.

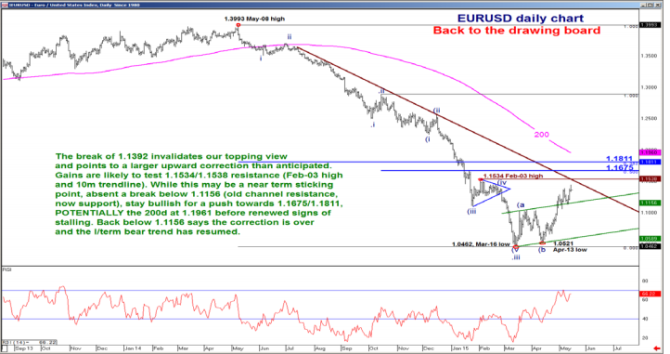

Turning to EUR/USD, BofA thinks that it’s time to get back to the drawing board with fresh thoughts after exiting its short EUR/USD on the overnight push above 1.1392.

“This break points to a larger upward correction than anticipated and further gains for a test of 1.1534/1.1538 resistance (Feb-03 high and 10m trendline),” BofA argues.

“While this may be a near-term sticking point, absent a break below 1.1156 (old channel resistance, now support), stay bullish for a push towards 1.1675/1.1811, potentially the 200d at 1.1961 before renewed signs of stalling,” BofA advises.

“Back below 1.1156 says the correction is over,” BofA adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.