The past week has not been a good week for USD bulls, and more specifically EUR/USD bears.

Is all lost? The team at BNP Paribas gives 4 reasons to keep the faith:

Here is their view, courtesy of eFXnews:

“Against expectations, the FOMC announcement this week was less of a marketmoving event than the earlier release of the very weak US Q1 GDP data.

The resulting USD weakness has taken us out of our short EURUSD spot recommendation from 25 March.We do not think the current USD weakness represents the start of a new trend, and restate our bullish USD view over the coming months for the following key reasons:

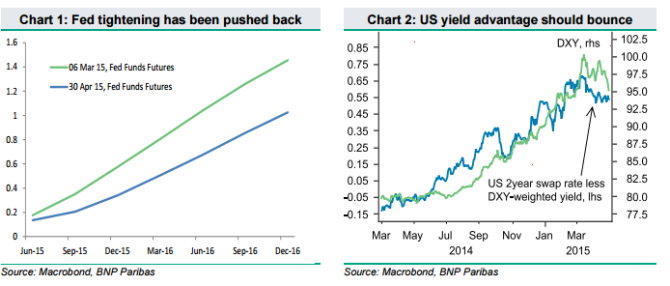

1- Unchanged Fed tightening expectations – the FOMC statement does not change our economists’ view for Fed tightening in September.

2- US growth will rebound in Q2 – the factors suppressing Q1 GDP are likely to prove temporary.

3- US front-end yields will rise – if data improve in line with our expectations, US 2-year yields will rise. The USD yield advantage will widen again.

4- FX positioning is not crowded – USD long exposure has this week fallen to its lowest level for 2015 at +13 (on our scale of -50 to +50). If the above three points prove correct, there is considerable potential for a rebound.”

Steven Saywell – BNP Paribas

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.