It’s not only the elections that could make a mess out of cable, but also seasonality. The US dollar has a tendency to rise in May while GBP has a tendency to slide during this month.

The team at ANZ examines seasonality for various currencies:

Here is their view, courtesy of eFXnews:

“Our seasonality analysis shows that the month of May has tended to favour the USD generally with the DXY up in 9 out of the last 15 years for an average return of +0.5%.

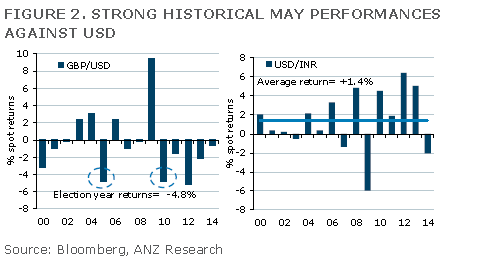

Amongst the G10, GBP shows the greatest tendency to depreciate against the USD (11 out of the last 15 years), though the average percent spot move shorting GBP is only 0.5%.

The upcoming UK elections on 7 May might exacerbate this seasonality move. During the last two elections in May 2005 and 2010, the GBP depreciated by 4.8%. If history is any guide, the GBP could be in for a big fall.

Among the Asian currencies, ignoring the pegged currencies of VND and HKD, we find that INR shows a strong tendency to depreciate against the USD. USD/INR has risen in 11 out of the last 15 years for an average gain of 1.4%. We believe this effect is due to May typically having the most number of auspicious days for Indian weddings, which results in a rise in gold demand and other associated spending.

We note that INR weakness is even more pronounced against CAD, with CAD/INR rising in 13 out of the 15 years with an average gain of 2.1%. CAD also performs strongly against the AUD, with CAD/AUD rising 13 times in the last 15 years for an average spot gain of 1.7%. THB/JPY has a tendency to fall in the month as well.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.