What’s the bigger picture regarding euro/dollar? It’s not only technical levels and fundamentals, but also flows.

The team at Dankse takes a look at everything moving EUR/USD and reaches a conclusion about the next move:

Here is their view, courtesy of eFXnews:

Growth. Economic data has surprised on the upside in the eurozone in recent months, whereas the opposite has been the case for the US. We think this pattern is about to reverse however and look for strong private consumption in the US in Q2. Notably, we expect eurozone inflation to bottom out in Q2 and a marked pick-up thereafter.

Flows. Relative current accounts still favour the EUR. On IMM data, the market remains significantly short EUR, leaving the cross vulnerable to short covering. European equity outperformance is set to depress the EUR as foreign investors are likely to hedge returns.

Valuation. PPP is around 1.23, suggesting the cross is undervalued. Our short-term models suggest 1.13 as ‘fair’.

Risks. The Fed hesitating on rate hikes due to USD strength.

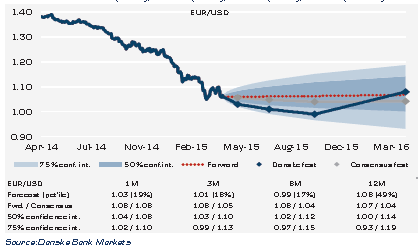

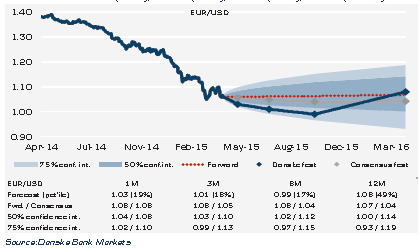

Forecast: 1.03 (1M), 1.01 (3M), 0.99 (6M), 1.08 (12M).

Conclusion. We expect a lower EUR/USD on a 6M horizon, as the effects of ECB QE and the warm-up before Fed policy normalisation continue to weigh. However, the EUR weakness now playing out, lower oil prices and improved credit conditions should pave the way for EUR strength further out. Coupled with our view that a repricing of the Fed will happen mainly ahead of a first hike over the summer, the potential for upside to US rates is limited beyond 6M in our view. Indeed, the start of a Fed hiking cycle should not in itself steer USD stronger. At the same time, a significant pick-up in euro-zone inflation would make EUR markets aware that the ECB will have to exit QE at some point. We see the cross below parity in 6M before moving higher back towards 1.08 in 12M.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.