The Canadian dollar has been trading in range, in quite a wide one. The next big thing for the loonie is the rate decision?

How will it react? Can USD/CAD reach 1.30? Here is the view from Barclays:

Here is their view, courtesy of eFXnews:

Currency investors should consider staying long USD/CAD and keep buying on dips into the Bank of Canada (BoC) policy meeting this week, advises Barclays Capital in its weekly FX pick to clients. The trade is macro-technical driven.

On the macro front, Barclays’ rationale is as follows.

“The BoC is expected to stay on hold at Wednesday’s meeting with the market consensus and the OIS curve indicating no change. In recent comments, Governor Poloz has acknowledged the weakness in Q1 and so the fact that the data have reflected this is not news to the BoC. However, with the MPR also expected next week, the BoC’s forecasts will get a lot of attention. We have highlighted in the past that the full effect of the oil price shock is yet to be reflected in the BoC’s forecasts (lower growth and inflation profiles) or their forecasts already indicate their intention to cut rates significantly,” Barclays clarifies.

“Either way, with less than 1 rate cut priced over the next year, we think there remains significant scope for re-pricing (we expect at least 50bp over the coming six months). A rate cut at this week’s meeting remains an outside risk and we stay long USDCAD spot,” Barclays adds.

On the technical front, Barclays’ rationale is as follows:

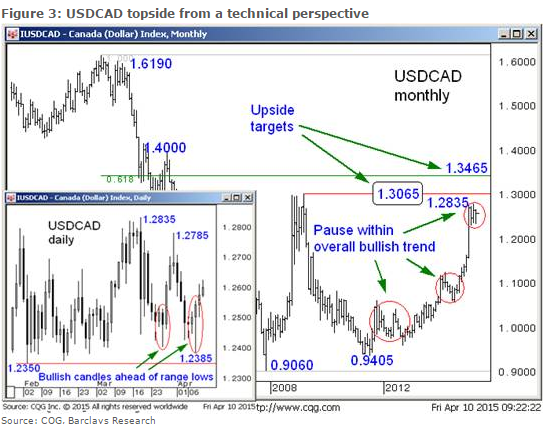

“Our bullish technical view for USDCAD was encouraged by the recent development of basing candles on the daily plot. We expect buying interest ahead of the 1.2350 range lows to underpin a move higher in range towards the 1.2835 year-to-date highs,” Barclays projects.

“A move above 1.2835 would confirm further upside. Our greater targets are near 1.3065, the 2009 range highs and then further out towards 1.3465,” Barclays adds.

In line with this view, Barclays maintains a long USD/CAD position in its portfolio from 1.2460 targeting 1.3050.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.