The US dollar is no longer sweeping the board, and actually losing out to some currencies. The changes are far from being even.

Credit Suisse analyzes the situation and explains what’s next for the greenback:

Here is their view, courtesy of eFXnews:

Last week’s FOMC meeting decision saw the “patience” language removed but at the same time a major downgrade in the Fed’s US growth and inflation expectations.

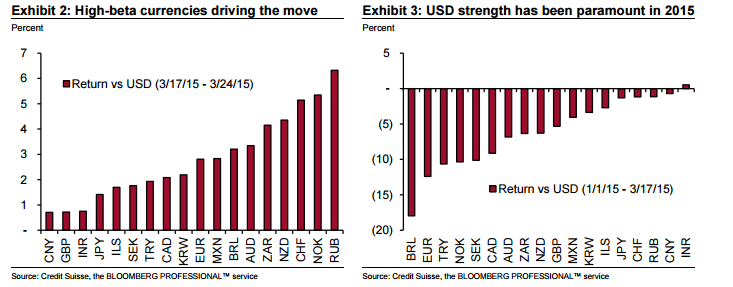

“The role of USD strength as a contributing factor to those downgrades was highlighted too, and provided the market the excuse needed to undergo a thorough positioning clear-out. As might be expected, higher-beta currencies like NZD, RUB and BRL that respond best to lower US rates have been leading the charge,” notes Credit Suisse.

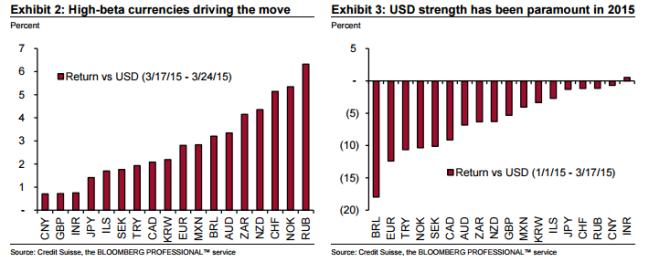

“After all, this was the first clear sign in 2015 that perhaps the Fed will not be entirely passive in a global “currency wars” environment. Arguably this was long overdue anyway given the mostly linear nature of USD gains this year up to last week,” CS adds.

Where does CS stand on this? What’s next?

“After all, we have been consistent USD bulls for many months, both in terms of forecasts and trade recommendations…But we are still not prepared to change the underlying pro-USD nature of our trade recommendations nor our 3m and 12m USD forecasts,” CS argues.

In addition, CS still bases its longer-term views in G10 space on the following USD-positive assumptions:

1- Asset purchase programs in the euro area and in Japan are likely to disrupt the domestic investor bias, diverting capital investment towards foreign-currency-denominated securities.

2- The recent renewed weakness in oil prices reinforces the negative terms of trade impact on commodity exporters such as AUD, CAD and NZD.

3- Price action has partially validated our views, as the USD rebounded very quickly from Wednesday’s post FOMC drop.

“Although it has since softened somewhat, the market has yet to reach the extremes of USD weakness seen last week in key pairs like EURUSD. We would probably need to see a move beyond 1.1300 in that pair – i.e., a material breach of pre-March lows – before it is time to reconsider the underlying USD strength trend,” CS argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.