So, the euro is recovering, isn’t it? Well, perhaps not for too long. The general downtrend seems to be intact.

The team at Dankse explain why more losses are awaiting EUR/USD:

Here is their view, courtesy of eFXnews:

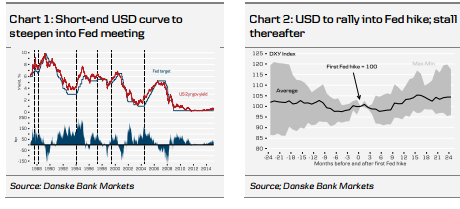

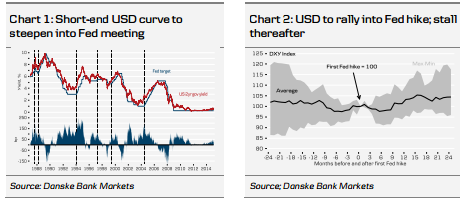

“We have been forecasting EUR/USD to fall in H1 and bounce in H2. That is still our base case. The strong US February non-farm payrolls figure supports our call that the Fed will hike in June; this has yet to be priced in, driving further USD strength. We are bullish on European GDP growth, forecasting it to rise to 1.5% in 2015. However, this is unlikely to help the EUR before the ECB has been successful in fighting deflation. We expect diverging inflation and monetary policy will drive EUR/USD lower over the coming 3-6 months. We are reviewing our EUR/USD forecasts in light of recent developments.

Clearly, short EUR/USD positioning has increased in recent days following the collapse in spot, but we do not see positioning as hindering more EUR/USD losses.

Technically, the break below the 61.8% Fibonacci retracement of the move from 0.8228 to 1.6040, at 1.1212, opens the door for further losses ahead of 1.0071.

Psychologically, parity at 1.00 attracts.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.