EUR/USD is falling relentlessly breaking low support and still not finding a bottom.

We are aware of the forces moving the pair on the headlines front. But what’s going on behind the scenes? The team at BNP Paribas explains:

Here is their view, courtesy of eFXnews:

BNP Paribas Global Head of Rates Strategy is drawing attention to the sharp rise in market measures of inflation expectations, especially in the US and the eurozone over the past few weeks.

This development, according to BNPP, is important for the currency (FX) world via its impact on real yield differentials.

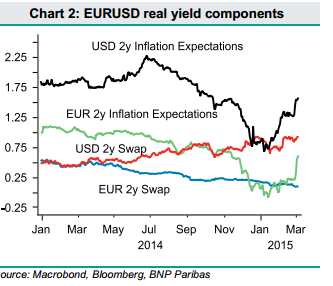

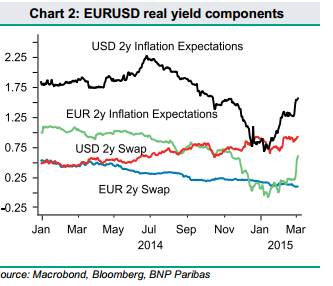

“We believe that real yield differentials will move against the EUR and in favour of the USD during 2015, thus further weakening EURUSD. A breakdown of the real yield components reveals that rising inflation expectations in both the US and the eurozone are the key drivers of 2y real yields. At the same time, nominal yields in the two regions have diverged, as eurozone 2y rates hit new lows. This divergence likely reveals the different market implications of higher inflation in the US vs the eurozone,” BNPP clarifies.

“Low inflation is a key barrier to the pending FOMC rate hike. The removal of this barrier is likely to cause the market to bring forward expectations for Fed tightening, thus supporting the USD. In contrast, the ECB has committed to QE through at least September 2016,” BNPP notes.

“Amid this environment, rising inflation expectations merely have the effect of taking real yields more negative, thus weakening the EUR,” BNPP adds.

All in all, BNPP argues that the combination of these two factors (rising US yields and EZ inflation expectations) is ‘the prescribed cocktail that will push the EURUSD even weaker‘.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.