After another strong jobs report from the US expectations have risen for a removal of forward guidance: no more patience from the Fed regarding rates.

But how can that affect the dollar? Robin Brooks, George Cole and Michael Cahill analyze, and see room for more:

Here is their view, courtesy of eFXnews:

“One reason we adopted a Dollar-bullish stance last year is that we expected Fed forward guidance to fade as the recovery progressed.

Since then, the shift from “considerable time” to “patient” and recent Congressional testimony by Chair Yellen, which talked about a meeting-by-meeting decision on lift-off, have continued to dilute forward guidance, and this month is likely to see a further shift towards data dependence.

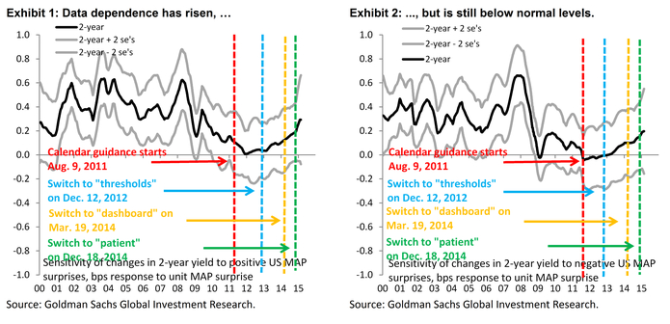

Based on the sensitivity of 2-year US yields to data surprises, we think the front end is about two-thirds of the way back to pricing full data dependence, in line with the most recent Macro Rates Analyst, which argues that US rate volatility, including in the front end, has more room to rise.

There is therefore still room for the risk-premium in front-end rates to go up, regardless of whether the Fed hikes in June, September or later (our US economists continue to expect September).

Based on past Fed meetings that downgraded forward guidance, this should translate into Dollar strength around the upcoming FOMC meeting of 2-3%.“

Robin Brooks, George Cole and Michael Cahill – Goldman Sachs

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.