All commodity currencies were crushed under the strength of the greenback following the excellent NFP. But not all commodities are equal.

The team at Credit Agricole explains the different situations in both CAD and NZD:

Here is their view, courtesy of eFXnews:

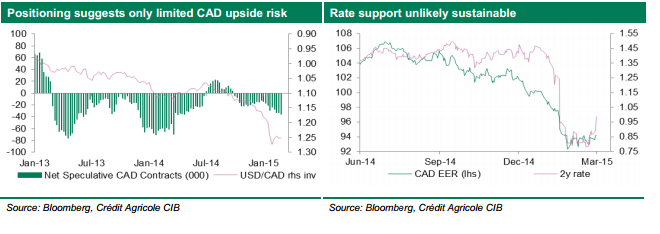

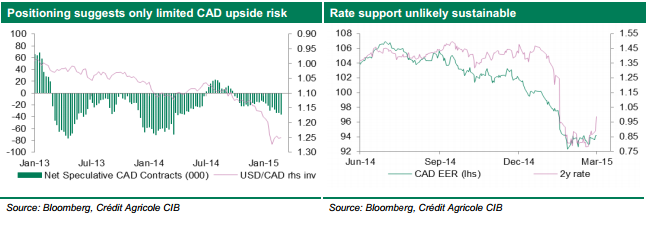

Both the Bank of Canada’s less dovish monetary policy stance and stabilising commodity price developments mean the CAD has been well supported for most of the week. According to the central bank the risks around its inflation profile are now more balanced, while inflation is now close to their assumptions. However, given still muted domestic conditions inflation is likely to remain subject to downside risk. This is especially true as labour market conditions have remained unstable.

From that angle next week’s main focus turns to February employment data. Still muted business confidence suggests that the corporate sector is unlikely to become more active in terms of hiring. This is especially true as uncertainty with respect to commodities remains high on the back of unstable conditions in Asia.

As a result of the above outlined conditions we do not exclude that investors’ BoC easing expectations have risen anew to the detriment of the CAD. Accordingly we remain long USD/CAD. Further room of diverging Fed-BoC monetary policy expectations should prove supportive.

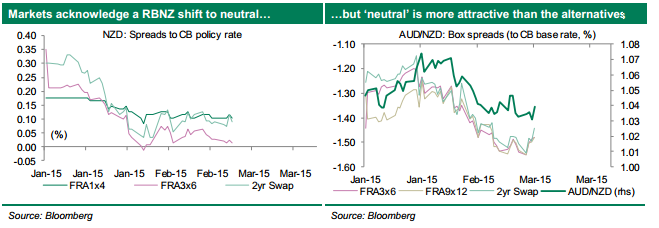

Yet another step in its prudential mandate, the RBNZ is considering raising capital adequacy provisions on residential investment loans. Assuming this provisioning plan goes through (it should), the impact will prove mildly contractionary on New Zealand’s credit (and hence monetary) multipliers given the popularity of property investment.

Having already moved to a neutral stance following four consecutive tightenings, this latest step seems to have been interpreted as heralding more RBNZ flexibility with respect to the OCR ahead of next week’s meeting. That interpretation, however, over steps the mark in our opinion. The RBNZ is merely trying to more accurately address New Zealand’s property imbalances given that the government shows little appetite of risking the politically unpopular introduction of capital gains tax or even stamp duty (Australia has both).

As such latest RBNZ news has little implication for the OCR in the near-term, arguing that the overnight NZD sell-off is probably an over-reaction. In a world increasingly devoid of yield, NZD should therefore remain attractive and we remain short AUD/NZD.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.