What’s next for the US dollar against the yen, Canadian dollar and the euro?

Here are some technical setups from Bank of America Merrill Lynch:

Here is their view, courtesy of eFXnews:

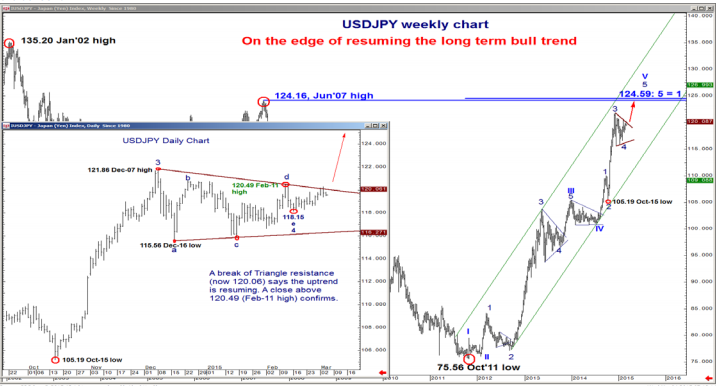

USD/JPY is on the verge of completing its 3m range trade and resuming its long term bull trend for 120.49, notes Bank of America Merrill Lynch.

“A break of Triangle resistance (now 120.06) is the 1st sign that the bull trend is resuming, while a close above 120.49 confirms. Our upside target is 124.16/124.59,” BofA projects.

“Below 118.15 points to continues range trading, while it will take a break of 116.27/115.56 to indicate a turn in the l/term bull tren,” BofA argues.

Turning to USD/CAD, BofA notes that while the pair has proven frustrating of late, the setup remains bullish as it is in the process of completing its 1m range trade.

“A break of 1.2610 says the uptrend is resuming, while a close above 1.2665 confirm a resumption of the bull trend for 1.3035,” BofA projects.

“USD/CAD bulls should add to longs on a break of 1.2610 and again on a close above 1.2665. This view runs into trouble below 1.2367 and is INVALIDATED below 1.2352,” BofA argues.

Finally in EUR/USD, BofA thinks that its breakout below the 1.1098 Jan-25 low, targets the Sep’03 low at 1.0765 and eventually below.

“Bounces should be limited to the old Feb range lows at 1.1270.” BofA advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.