The British pound has been on the rise across the board, thanks to a few positive developments, including the BOE’s Inflation Report.

The team at BNP Paribas says that sterling is set to sparle, provides charts and targets.

Here is their view, courtesy of eFXnews:

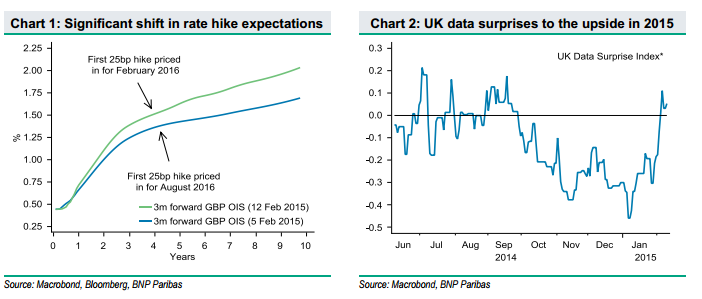

With the recent BoE Inflation report was more upbeat than expected, market expectations for the BoE have shifted, notes BNP Paribas.

“The market has significantly re-priced its expectation for the first rate hike to February 2016 from August 2016, and is now in line with our economists’ expectations…BoE policy surprises will be particularly important going forward. The updated BoE projections put inflation at 2% y/y at the two-year mark and above 2% (2.2%) at the three-year,” BNPP clarifies.

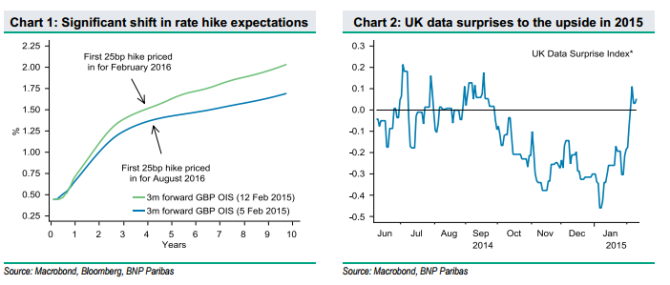

“Upbeat UK data has been, and will continue to be, a consistent theme. December UK manufacturing output surprised to the upside and a strong UK January purchasing managers’ index indicated ongoing robust performance of the UK’s manufacturing sector. The upcoming swathe of data – January inflation data, the January labour market report, BoE minutes and retail sales – will be important as a gauge for the UK economy at the start of 2015,” BNPP projects

In line with this view, BNPP maintains a long USD exposure via short EUR/GBP position, targeting a move to 0.73.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.