EUR/USD is somewhat stuck in narrower ranges, especially when comparing to recent volatility.

What’s next for the pair? The team at Goldman Sachs examines the charts from an Elliott Wave Perspective:

Here is their view, courtesy of eFXnews:

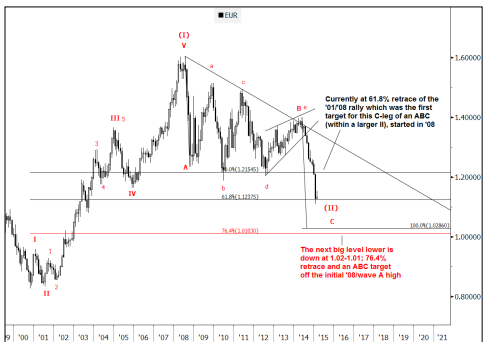

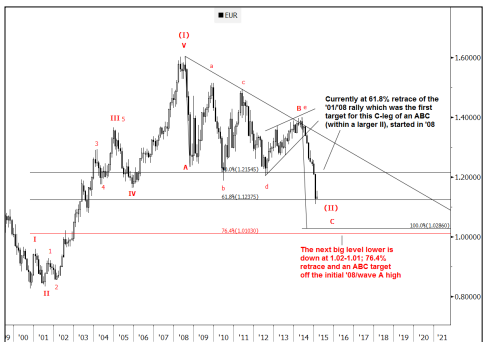

EUR/USD price-action from the Jan. 26th low looks like a complete ABC pattern which is characteristically corrective, notes Goldman Sachs.

“It also tested and held the 21-dma for four consecutive days without breaking the pivot (this now stands at 1.1488). Furthermore, daily oscillators are back near the lowered range highs and looking like they may turn back lower,” GS adds.

As such, GS now sees the next big support to break is 1.1237 (61.8% of the ‘00/’08 rally).

“If at any point this level breaks, there is a decent gap below it that runs down to ~1.0286- 1.0103. This area encompasses an ABC equality target off the initial Jul./Oct. ‘08 drop and 76.4% retrace from ‘00,” GS projects.

“There is a risk that the move since May ‘14 already satisfies the target for an ABC that started in ‘08. From an Elliott wave perspective, it’s plausible (but not necessary) that the low could already be in place. Still, at the absence of any real basing patterns it seems best to remain with the trend until further signal develops,” GS argues.

“Bottom line, focus should be centered on 1.1237 going into the next few weeks,” GS concludes.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.