Both AUD and CAD managed to overcome recent blows and stage recoveries. Is this sustainable? Not so fast.

The team at SocGen sees both commodity currencies weakening, and sets targets:

Here is their view, courtesy of eFXnews:

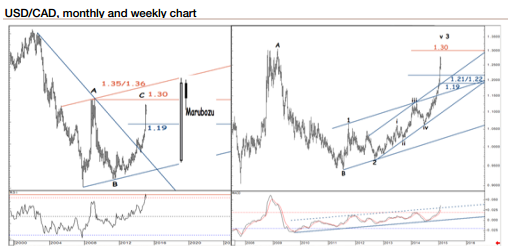

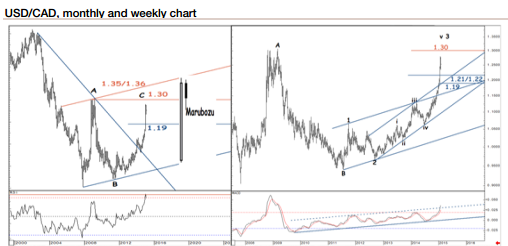

USD/CAD in resuming its move higher and still en-route to test March 2009 highs of 1.30, notes SocGen.

“Monthly RSI is testing a multiyear graphical ceiling. The weekly indicator is breaking an ascending channel limit suggesting positive momentum will continue. Short-term pullbacks, should be cushioned at 1.21/1.22, the 23.6% from 2011 lows,” SocGen argues.

“The pair ultimately should continue the uptrend towards 1.30 and even probably towards 1.35/1.36, the weekly channel limit,” SocGen projects.

Turning to AUD/USD, SocGen notes that it has confirmed a head and shoulders pattern in the monthly charts, and the downtrend accelerated when the pair broke below the descending channel.

“The monthly indicator is also breaking a critical support, confirming the decline,” SocgGen argues.

“With daily RSI diverging positively, a shortterm bounce cannot be ruled out towards 0.80/0.8050. A definite close below 0.7590 will mean an extension in the downtrend towards 0.72, the multi decade channel support,” SocGen adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.