The recent setback for the US dollar may be temporary, and just an opportunity to pile up on more USD longs.

What do you think? The team at Credit Suisse do not see the Fed making a big enough change to change the course of the greenback:

Here is their view, courtesy of eFXnews:

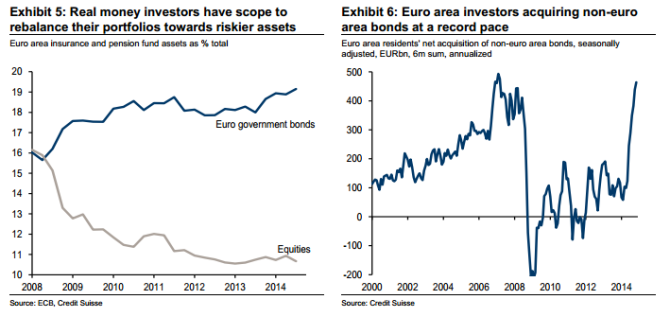

“…From a longer-term perspective, we would recommend taking advantage of USD pullbacks following the Fed to add to or re-establish underlying USD long positions. As Exhibits 5 & 6 shows, real money flows out of Europe are likely to be out of bonds / EUR and into risky assets / foreign currency for some time yet as structural shifts in global flows proceed.

In our view, the broader path for EURUSD remains well defined. Meanwhile, although oil prices are stabilizing, weakness in copper prices are just one signal that the wider set of pressures on commodity prices are still proceeded. This bodes ill for the likes of CAD and AUD.

As for other European currencies like SEK and GBP, we remain skeptical as to how much decoupling from the EUR can be achieved while disinflationary forces remain alive and well in Europe beyond the euro area too.

It will take a very material surprise from the Fed to change our minds at this relatively early stage of the bigger-picture secular USD strength story.”

& For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.