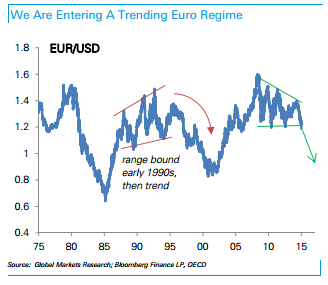

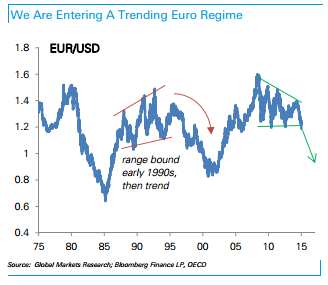

EUR/USD hit a double bottom and is holding on for now, but this may be only temporary. The specter of QE could push the single currency lower and make it “Draghed and Beaten”, says the team at Deutsche Bank, but this is certainly not the only reasons.

Here are three reasons for a further downfall in EUR/USD, with a low round number as a target:

Here is their view, courtesy of eFXnews:

Back in mid-December, Deutsche Bank advised its clients to re-sell EUR/USD targeting a move to 1.15. Today, DB is out with another note advising clients to stay short EUR/USD and to consider opening new structural positions with an extended target to 1.10.

Here are the major 3 ingredients of this trade as outlined by DB:

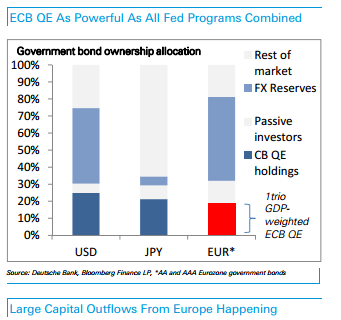

1- ECB Quantitative Easing Incredibly Powerful. “Plenty of other central banks have done quantitative easing. But no other has engaged in QE under negative rates. The reason this matters is that the portfolio rebalancing effects of QE under negative yields are nonlinear, and therefore far more powerful: when the depo rate went negative in June investors shifted away from cash to the closest equivalent.A euro of QE from the ECB is worth far more than the Fed or BoJ,” DB argues.

2- Renewed European Political Uncertainty Here to Stay. “Not only are monetary policy settings conducive to outflows (unlike the 2010-13 period), but political uncertainty is returning. This will be an additional hindrance to a return of portfolio investment and a headwind to business confidence as the year unfolds. The Greek election on January 25th is the nearest event risk, where our baseline expectation is that a SYRIZAled government emerges,” DB clarifies.

3- US basic balance turning: “At a time when the European ingredients for euro weakness are falling into place, so are the American ones for dollar strength. The timing of the first rate hike in the US remains uncertain, but with the market pricing October, this remains at the dovish end of the Fed baseline. The dollar has a well-documented pattern of strengthening in the months prior to the first Fed rate hike (see our September Blueprint), but the sources of support are broadening out,” DB adds.

Conclusion: Sell EUR/USD targeting 1.10. “The ingredients have fallen into place for a persistent trend in EUR/USD this year. The flow situation has deteriorated more quickly than we had assumed last year,” DB concludes.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.